Clause by clause analysis of GSTR-9

Introduction:

The purpose of this article is to provide comprehensive analysis of GSTR-9. It starts with discussion on basic legal provisions. Then it provides some “Important aspects of GSTR-9” . It further discusses the structure of GSTR-9 and then takes up clause by clause analysis. At the inception of every table structure of table and summary of sources of information in that table is discussed. Clause by clause analysis is accompanied by reference to relevant clause followed by official instruction on that clause and then comments.

Legal Provisions for GSTR-9

Legal requirement of filing Annual return hereafter called GSTR-9 is governed by section 35(5) and section 44(1) of CGST Act. Section 44(1) of CGST Act read with Rule 80(1) of CGST Rules requires that every Registered person other than – an Input Service Distributor, – a person paying tax under section 51 (TDS) or section 52 (TCS), – a casual taxable person and – a non-resident taxable person, Shall furnish an annual return for every financial year electronically in Form GSTR-9 through the common portal (www.gst.gov.in) either directly or through facilitation center on or before the thirty-first day of December following the end of such financial year.

9A GSTR-9A is Annual return for a supplier who was under composition scheme as per section 10 of CGST Act anytime during the relevant financial year.

9B Person paying tax under section 52 (TCS) is required to file GSTR-9B but since, provision of section 52 is applicable from 01st October 2018 only, they are not required to file GSTR-9B for the year 2017-18.

9C Further, as per section 35(5) of CGST Act, every registered person whose turnover during a financial year exceeds the prescribed limit (Rs. 2 cr.) shall get his accounts audited by a chartered accountant accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement (GSTR-9C) under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed. Reconciliation statement – GSTR-9C is reconciliation of data as per books of accounts and data as reported in GSTR-9.

Switch to/from Composition Scheme during 2017-18 In such case, registered person shall be required to file GSTR-9A for the period he was registered as composition taxpayer and for the remaining financial year, he shall be required to file GSTR-9. Hence, he shall be required to file both the Annual Return GSTR-9A and GSTR-9.

Download full presentation from here.

Multiple GSTIN if a Taxpayer has obtained multiple GST Registrations whether in one state or more than one state, it shall be treated as a distinct person in respect of each such registration as per section 25(4) of CGST Act. Hence, GSTR-9 is required to be filed separately for each such GSTIN.

How to file GST-9 online:

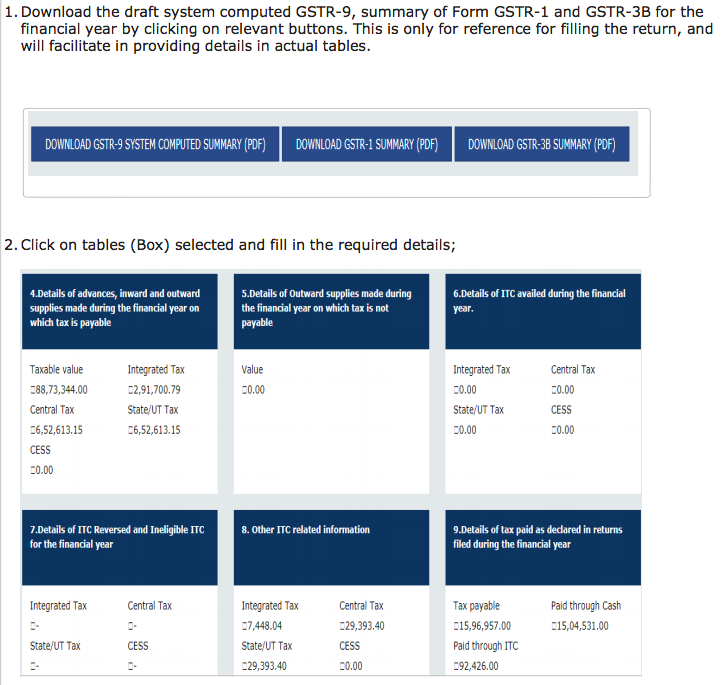

GSTR-9 can be filed online. It can also be prepared on Offline Tool and then uploaded on the Portal and filed.[Help menu Instruction No.1] 1

Steps to prepare GSTR-9 return online

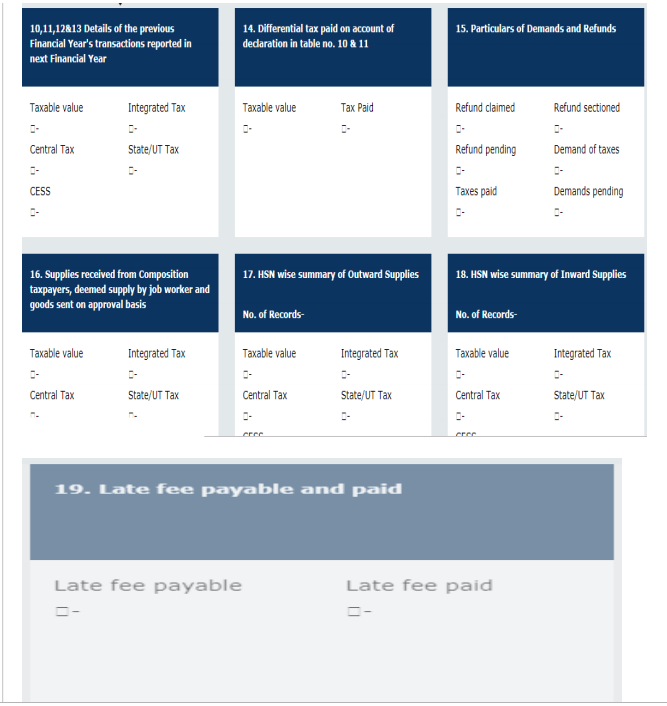

3.Summary of added details would be available on the relevant box;

4.Click on „Preview‟ button to view summary in PDF or Excel format; and

5.After adding and confirming the details, follow filing process: 1.Click on ‘Compute Liabilities’; for computation of Late fee, if any;

6.’Proceed to File’ button would be enabled once late fee is calculated by system;

7.Click on “Proceed to File” to pay liabilities and file the return ; Additional details can be added even after clicking on „Compute Liabilities‟ or „Proceed to file‟ button. However, in that case, you would be required to follow steps 1 to 3 again to file the return ;

8. Click on „Download Filed GSTR-9 (pdf)‟ button to view summary of filed details in PDF

The fields, where the system computed values would be modified by more/less than 20%, shall be highlighted in ‘Red’ for reference and attention.

Annual return in form GSTR-9 is required to be filed by every taxpayer registered as normal taxpayer during the relevant financial year [Help Menu]

Dealers cancelled after 31-03-2018 need to file GSTR 9 ?

In case you are required to file GSTR-9C (Reconciliation statement and Certification); shall be enabled on the dashboard post filing of GSTR-9.

9. Annual return in Form GSTR-9 once filed cannot be revised. Computation of ITC based on GSTR-2A was auto-populated by the System based on GSTR-1 filed by your corresponding suppliers upto 28/02/2019. Next update of ITC based on GSTR-2A will happen soon. If you have some missing credits in GSTR-2A, you may like to wait till next update. 10.

10. Annual Return is not based on annual accounts. Information shall be reflected only for July to March 2018 and not for April to March 2018 [Instruction No. 2 of GSTR-9]

11. It is mandatory to file all your FORM GSTR-1 and FORM GSTR-3B for the FY 2017- 18 before filing this return. [Instruction No.2 and Help Menu Instruction No. 4] Missing items reflected in accounts but not reflected in GSTR-1 and GSTR-3B shall be reflected as line items in GSTR-9C or as un reconciled items and not to be reflected in GSTR-9.

12.Additional Tax liability not discharged through GSTR 3B can be paid through DRC-03.

a. Taxpayers shall select “Annual return” in Drop down for DRC-03.

b. Payment to be made only through electronic cash ledger. [Instruction No.9]GSTR-9 is not meant to be a curated statement for which GSTR-9C is devised.

Taxpayers cannot claim input tax credit unclaimed during FY 2017-18 through this return. [Instruction No.3] Information regarding outward supplies has been sourced from GSTR-1 and information regarding ITC has been sourced from GSTR 3B. 17. 18. Late fee for filing GSTR-9 can be paid through GSTR-9 19. GSTR -9 is based on principle of GIGO (Garbage in Garbage Out) [Page 88 of Technical guide by ICAI]

• Not made any outward supply (commonly known as sale); AND

• Not received any inward supplies (commonly known as purchase) of goods/services; AND

• No liability of any kind; AND

• Not claimed any Credit during the Financial Year; AND

Not received any order creating demand; AND •

Not claimed any refund. during the Financial Year

Auto population (Non Editable ) in GSTR-9 is there regarding: Other fields need a lot of adjustments for being pushed into GSTR-9. 22. a) System computed GSTR-9 as PDF is available for reference. b) Consolidated Summaries of GSTR-1 and GSTR 3B shall are also available GSTR -9 field shall be auto populated to the extent possible based on GSTR 3B and GSTR-1 except Table 6A, 8A, and payment entries in Table 9.

Adjustment sheets need to be prepared for preparing GSTR-9 from GSTR-1 and GSTR-3B and should be maintained for 72 months from the due date of furnishing of return for the year pertaining to such accounts. 11. GSTR-1 & GSTR-3B each for July to March 2018 and GSTR-1 & GSTR 3B each for April to September 2018 are required to prepare GSTR-9, which means at least 30 documents are required to start preparing GSTR-9.

12. April 2018 to Sept. 2018 returns are required because there may be some bills which have been entered in April 2018 to Sept. 2018 Returns.GSTR-3B and GSTR-1 should be brought in alignment before going for GSTR-9. If there is no alignment say GSTR-1 figure is higher than 3B, and also matches with figure as per books, it can not be brought in alignment through GSTR-9 and shall appear as un reconciliation difference in GSTR-9C. If GSTR-3B figure is higher for outward supplies which means that higher taxes have been paid then , then again it shall appear as un reconciled difference in GSTR 9C.

13. GSTR-9 is applicable to registered persons irrespective of their turnover except certain categories specifically excluded under law i.e. ISD, TDS deductors, NRTP, CTP.

14. In case of E Commerce operators covered by section 52, though GSTR-9 is applicable but provisions shall apply from 01-10-2018. For Composition taxable persons GSTR 9A is applicable.

15. In case of E Commerce operators covered by section 9(5) i.e. aggregators, GSTR 9 shall be applicable because they stand in shoes of supplies as per section 9(5)

16. Penalty for non filing of GSTR-9 is Rs. 100/- + 100/- per day. Maximum penalty is 0.25% of turnover in state. It is not 0.25% + 0.25% of turnover.

17. GSTR-9 requires to provide information of supplies made “during” the financial year. In case of belated filing of return or return for March filed during 2018-19, the words should be read as “made for the financial year”.*Page 88 of Technical guide+

18. Table 4, 5, 10,11 ,16,17,18 of GSTR 9 require furnishing of information regarding taxable value. Here invoice value not to be provided although in corresponding tables of GSTR-9, from where information is sourced require “total value” as well as “taxable value”. Provisions of Rule 35 to be complied in this regard.

Rule 35. Value of supply inclusive of integrated tax, central tax, State tax, Union territory tax.- Where the value of supply is inclusive of integrated tax or, as the case may be, central tax, State tax, Union territory tax, the tax amount shall be determined in the following manner, namely,- Tax amount = (Value inclusive of taxes X tax rate in % of IGST or, as the case may be, CGST, SGST or UTGST) ÷ (100+ sum of tax rates, as applicable, in %)

Information required in GSTR-1 and GSTR-3B but not required in GSTR-9 : Supplies made to Composition tax payers as 3.2(b) of GSTR-3B have been clubbed in 4B of GSTR-9 and not separately disclosed. a) Supplies made to UIN holders as per 3.2(c) of GSTR-3B have been clubbed in 4B of GSTR-9 and not required to be separately disclosed. b) Receipt of Exempted, NIL rated and Non GST supplies required to be reflected in Table 5 of GSTR 3B is not required to be reflected in GSTR-9. c) Information regarding taxes paid through TDS and TCS are required to be reflected in Para 6.2 of GSTR-3B, which is not there in GSTR-9 because the provisions have come into effect only from 01-10-2018. d) GSTR 3B GSTR-1 Information regarding documents issued during the tax period required to be reflected in Table 13 of GSTR-9 is not required to be reflected in GSTR-9

If you already have a premium membership, Sign In.

CA Vinamar Gupta

CA Vinamar Gupta

Amritsar, India