Amended Section 44 of CGST Act: Annual return in GST(Updated Till on July 2024)

Table of Contents

Section 44 of the CGST Act as amended by the Finance Act 2023

Note: Section 44 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

TEXT on the Section 44 of the CGST Act:

44. Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person shall furnish an annual return which may include a self-certified reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year, with the audited annual financial statement for every financial year electronically, within such time and in such form and in such manner as may be prescribed

Provided that the Commissioner may, on the recommendations of the Council, by notification, exempt any class of registered persons from filing annual return under this section:

Related Topic:

Amended Section 16(4) to de-link ITC on Debit Note with Invoice fails to get stamping of Gujarat AAR

Provided further that nothing contained in this section shall apply to any department of the Central Government or a State Government or a local authority, whose books of account are subject to audit by the Comptroller and Auditor- General of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force.”.

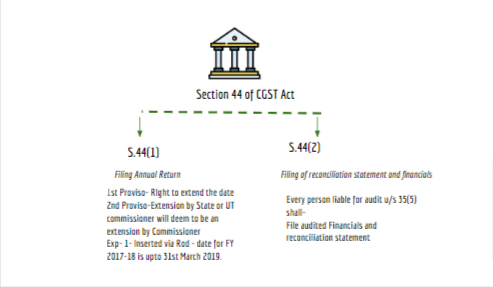

“(1) Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and manner as may be prescribed on or before the thirty-first day of December following the end of such financial year.

Provided that the Commissioner may, on the recommendations of the Council and for reasons to be recorded in writing, by notification, extend the time limit for furnishing the annual return for such class of registered persons as may be specified therein:

Provided further that any extension of time limit notified by the Commissioner of State tax or the Commissioner of Union territory tax shall be deemed to be notified by the Commissioner.

Explanation.- For the purposes of this section, it is hereby declared that the annual return for the period from the 1st July 2017 to the 31st March 2018 shall be furnished on or before the 31st March, 2019.130th June, 2019.231st August, 2019.Note(3) 30th November 2019.Note (4)

[ *1 Inserted via Order No. 1/2018-Central Tax,

* 2 Inserted via Order No.03/2018-Central Tax

*3 Inserted via order No. 6/2019-Central Tax

*4 Inserted via Order No. 7/2019-Central Tax]

(2) Every registered person who is required to get his accounts audited in accordance with the provisions of sub-section (5) of section 35 shall furnish, electronically, the annual return under sub-section (1) along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement, and such other particulars as may be prescribed”

(As given in CGST Act)

chart of the section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.