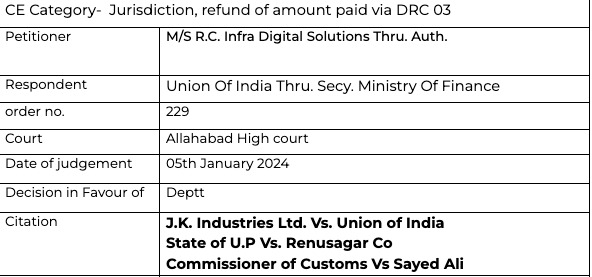

Interesting read- DGSI have the jurisdiction under GST? See what is take of Allahabad High court

DGGI,DGSI- Do they have the power of a Proper officer in GST?

Here the issue was related to the power of DGGI, DGSI to do the search at the premises of the taxpayer. The anti evasion wing already conducted the enquiry for the same issue. Is it a case of parallel proceedings? Also a sum of Rs. 40 lac was deposited by the assessee via DRC 03. He claimed that it was made deposited by coercion. He claimed the refund of that amount.

Author can be reached at shaifaly.ca@gmail.com

Here the court elaborated on all these issues.

Facts –

The petitioner is a partnership firm registered under Goods and Services Tax having GSTIN 09AAYFR5496BIZH and is engaged in the business of work contract services. The Additional Director General, Directorate General of Goods and Services Tax Intelligence (hereinafter referred as ‘DGSI’), who had reasons to believe that documents related to search were secreted at the premises of the petitioner, authorized Intelligence Officers (arrayed as respondent Nos. 5 to 8) to conduct inspection/ search at the premises of the petitioner on 06.06.2023 under Section 67 of the CGST Act, 2017.

The petitioner pleaded for the following –

1- The petitioner challenged the Notification No. 14/2017- Central Tax dated 01.07.2017 primarily on the ground of it being ultra-vires to the power of the Central Government.

2- A further challenge has been laid to the jurisdiction of the Additional Director General of Goods and Services

Tax Intelligence in authorizing the other Intelligence Officer to carry out inspection/search proceedings at the premises of the petitioner under Section 67 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as ‘CGST Act, 2017’).

3- A consequential challenge has also been made by the petitioner to the issuance of summons dated 06.06.2023 and 14.06.2023 issued by the Intelligence Officer under Section 70 of the CGST Act, 2017 as it has been alleged to have been issued without authority of law. Other issue of an amount of Rs. 40 Lakhs having been deposited under coercion has been raised by the petitioner in the instant petition.

It has been submitted by the petitioner that the Central Government has usurped the power of Commissioner in Board by investing the powers with DGSI vide the said impugned notification No. 14/2017- Central Tax. According to him, the Central Government has no power to delegate the power exercisable by the Central Tax Officer to DGSI which has been specifically entrusted upon the Commissioner in Board by the statute and has in that regard also quoted Sections 167 and 168 (2) of the CGST Act, 2017 to argue that the Commissioner in Board may by notification direct any power exercisable by any authority, however, the same power is not available to the Central Government and merely by notifying DGSI as officer of Central Tax would not automatically invest them with the power to perform the function of proper officer. Thus, according to him,powers can be invested with DGSI by issuance of notification by the Commissioner in Board under Section 167 of the CGST Act, 2017 or by specifically delegating the power of proper officer by issuance of a circular akin to the circular No. 3/3/2017- GST dated 05.07.2017.

According to the petitioner, the DGSI Officers cannot exercise their jurisdiction to conduct any proceeding on the same subject matter which is already being conducted by the Anti Evasion Wing of GST Department.

Observation-

A conjoint reading of Notification No. 14/2017 dated 01.07.2017 and Circular No. 3/3/2017-GST dated 05.07.2017 sufficiently contemplates the assigning of powers to DGSI officers by the Board. Let’s take an example, as per the circular of 05.07.2017, a Superintendent of Central Tax has been assigned the power to function as is mentioned in Sub-section (1) of section 70 and a reading of Notification 14/2017 leads us to conclude as mentioned in serial No. 8 that a senior Intelligence officer, Goods and Service Tax Intelligence or Superintendent, Goods and Service Tax or Superintendent, Audit has been notified to be appointed under section 3 of the GST Act as a central Tax officer and is invested with all the powers under the central Goods and Service Tax Act, 201, throughout the territory of India, as are exercisable by the central Tax officers of the rank of “superintendent”. In any case, this court does not find any force in holding that such technical nuances to be fatal for the Notification or to the functions performed by various DGGI officers. The jurisprudence on the implications of invocation of a wrong provision suggests that as long as an authority has power, which is traceable to a source, the mere fact that source of power is not indicated or wrongly indicated in an instrument does not render the instrument invalid.

Read(Download the copy of judgment)

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.