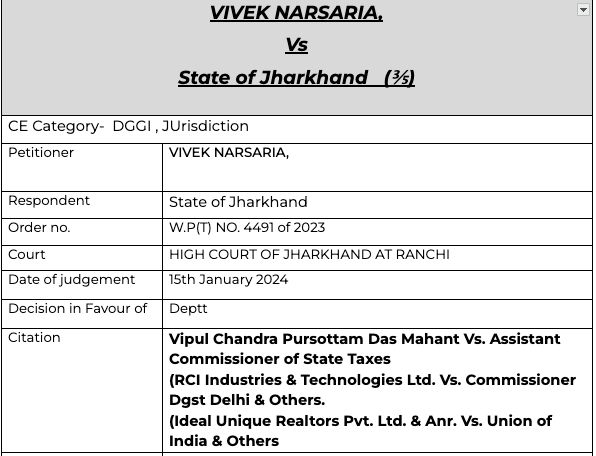

DGGI doesn’t enjoy the special power as State GST officers- Jharkhand high court

Does the DGGI officers enjoy the same power as the State authorities-

This is one of the important judgment for the cross empowerment and rights of DGGI officers. Here the multiple proceedings were tarted on the applicant. he deposited some amount and also reversed the ITC. Let us have a look on its facts and observations by the honourable high court.

(The author can be reached at shaifaly.ca@gmail.com)

Plea of applicant-

The applicant pleaded for the below-

(a) For issuance of an appropriate writ, order or direction, holding and declaring that in terms of Section 6 of the Central Goods and Services Tax Act, 2017 read with Section 6 of the Jharkhand State Goods and Services Tax Act, 2017 as also the provision of Integrated Goods and Services Act, 2017, read with clarifications issued from time to time, the authority once initiated the proceedings commencing from enquiry/ search and seizure, is empowered to complete the entire process of investigation and complete the modalities, in the case in hand State Goods and Services Tax and not by the Preventive Wing of Central Goods & Services Tax or by the Directorate General of Goods & Services Tax Intelligence

(b) Consequent upon holding and declaring that the initiation and conclusion by the prior authority is the rule of law, hence, the notices issued subsequently viz., (Annexure-3, Annexure-4, Annexure-5, Annexure7, Annexure-8, Annexure-10, Annexure-12 Series & Annexure-14) issued by the two different Wings of Central Goods & Services Tax be quashed and set aside and the State GST be allowed to carry the further proceedings

Facts

The brief facts of the case lie in a very narrow campus. The Petitioner is the proprietor of M/s. Manish Trading Company, Lalgutwa, Ranchi, having GSTIN No. 20AHUPN9856C2ZZ and is carrying on the business of trading of Iron & Steels and Cements, since 2017-18. As per the averments made in the writ petition, the purchases and sales are duly reflected in the GST returns furnished by the Petitioner and the outward tax liability is adjusted against the Input Tax Credit available to the Petitioner.

On 16.03.2023, an inspection was carried out by the Intelligence Bureau of the State Goods & Service Tax, and in terms thereof GST INS-01 has been issued and after the inspection is concluded, the GST Officers fixed the date for furnishing books of accounts. As per the Petitioner an amount of Rs.34.00 lakhs from the Cash ledger of the Petitioner and Rs.06.00 lakhs from the proprietorship firm of his wife were made to deposit.

While the proceedings had been initiated by the State Goods & Services Tax Department, the Petitioner was served with a notice dated 10.04.2023 by the Preventive Branch of Central Goods & Services Tax, Ranchi with a direction to reverse the Input Tax Credit along with interest and penalty on account of alleged purchases from the non-existent entity.

since the petitioner has received summons from 3 Departments of GST, the petitioner has approached this Court, seeking a declaration that the authority who has initiated the proceedings prior in point of time, shall be the only authority to carry out the proceedings. In order to buttress the argument, the petitioner has relied upon Notification No. 39/2017-Central Tax dated 13.10.2017 and the Clarification bearing D.O.F. No. CBEC/20/43/01/2017- GST(Pt.) dated 5.10.2018,

Observations-

Having heard the arguments advanced by respective parties and having perused the documents brought on record and the statements & averments made in the respective Counter Affidavits and materials available on record, we find that bare perusal of section 6 of the Act, especially Section 6(2)(b), when read with the Clarification dated 05.10.2018, further read with Clarification dated 22.06.2020, when read together, it clearly denotes and implies that it is a chain of a particular event happening under the Act and every & any enquiry/investigation carried out at the behest of any of the Department are interrelated. Even if, we accept the submission of the Respondent No. 5 that the proceedings initiated by the Respondent No. 5 is on the basis of an information received from Noida; in that event also, we are at loss to say that the DGGI is raising a question about credibility and competence of the State GST Authorities, in carrying out the investigation concerning wrong/inadmissible availment of Input Tax Credit, inasmuch as, the officers of the DGGI does not enjoy any special power or privilege in comparison with the officers of the State GST Authorities.

We are little hesitant to accept such argument, inasmuch as, the State Authorities has also initiated the same very proceeding for wrong/illegal availment of Input Tax Credit. Undeniably, the proceedings at the instance of State Authorities or the Preventive Wing or the DGGI is at initial stage and the proceedings on the basis of ‘Search & Seizure’ by the State Authorities, is prior in point of time. Hence, Section 6(2)(b) read with clarification dated 05.10.2018, adds to the issues raised by the petitioner herein and manifestly crystalizes that since all the proceedings are interrelated, the State Authorities should continue with the proceedings.

The issue since has also been raised with attachment of bank account, which we failed to understand as to what had become so emergent that prior to any determination or finding of any irregular/inadmissible/wrong availment of Input Tax Credit, the bank account had to be attached, which appears to be an ‘arm twisting method’ to make the petitioner succumb to the particular authority, which cannot be the dictum of the Act and we deprecate the same.

We are therefore of the opinion that the Preventive Wing of the CGST and DGGI Wing of the CGST, shall forward all their investigation carried out as against the petitioner and inter-related transaction to the State Authorities, who shall continue with the proceedings from the same stage.

Consequently, we therefore direct the Respondent No. 4 & 5 to make over the entire investigations carried till date to Respondent No. 3, who shall carry out further proceedings as against the petitioner in accordance with law.

Read/download the original copy-

f-Jharkhand-Jharkhand-High-Court

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.