Only production of invoice and payment proof are not enough for ITC (Pdf Attach)

Cases covered:

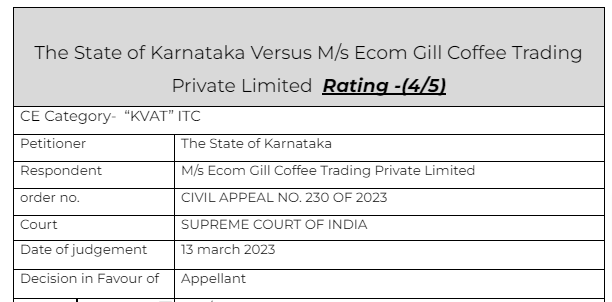

The State of Karnataka Versus M/s Ecom Gill Coffee Trading Private Limited

Citations:

1. M/s. Bhagadia Brothers Vs.Additional Commissioner of Commercial Taxes,

2. Madhav Steel Corporation Vs. State of Gujarat

3. Shreeji Impex Vs. State of Gujarat,

4. Bank Vs. Saraswati Abharansala

5. On Quest Merchandising India Pvt. Ltd. v. Government of NCT of Delhi

Facts of the cases:

In the current case the ITC was disallowed by the assessing officer. As per section 70 of KVAT the burden of proof for ITC is on the recipient.

The taxpayer provided the invoices and proof of the payment. The taxpayer approached the Appeal. In first level appeal his case was rejected and disallowance of ITC was upheld.

In the next level of appeal the order was rejected.

The department approached the high court. In high court also the decision of the second appeal was upheld.

Now the case was filed with the honorable supreme court via an SLP.

Observations & Judgement of the court:

As observed hereinabove, over and above the invoices and the particulars of payment, the purchasing dealer has to produce further material like the name and address of the selling dealer, details of the vehicle which has delivered the goods, payment of freight charges, acknowledgement of taking delivery of goods including actual physical movement of the goods, alleged to have been purchased from the concerned dealers.

so far as the reliance placed upon Rules 27 and 29 of the Karnataka Value Added Tax Rules, 2005 and the submission on behalf of the purchasing dealers that under the provisions of the Rules 2005, more particularly under Rules 27 & 29, the only requirement is to issue the tax invoice and to produce the same and there is no other requirement is concerned, the aforesaid has no substance. Rule 27 cast an obligation on the dealers to issue tax invoice and the particulars of the tax invoice are provided under Rule 29. Merely because the tax invoice as per Rule 27 and Rule 29 might have been produced, that by itself cannot be said to be proving the actual physical movement of the goods, which is required to be proved, as observed hereinabove. Producing the invoices as per Rules 27 and 29 of the Rules 2005 can be said to be proving one of the documents, but not all the documents to discharge the burden to prove the genuineness of the transactions as per section 70 of the KVAT Act, 2003.

Thus the decision of both high court and second appeal were rejected and disallowance of ITC was upheld.

Read & Download the Full The State of Karnataka Versus M/s Ecom Gill Coffee Trading Private Limited

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.