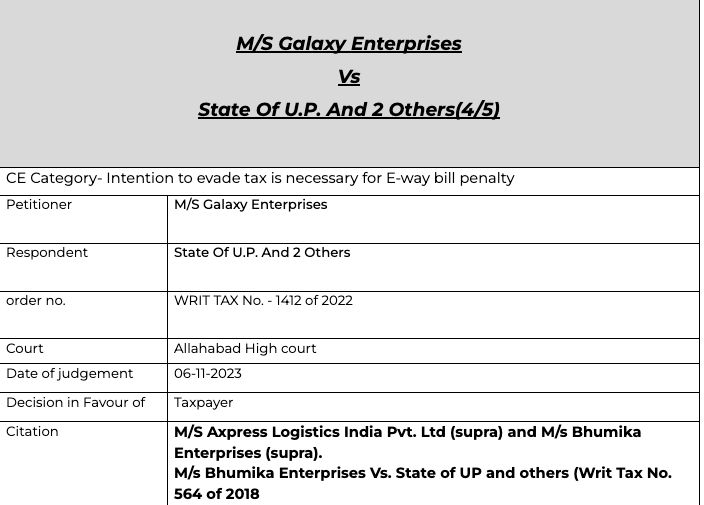

No Penalty if the documents are produced before passing the order

Comment

There were differences in various documents but that was corrected by the taxpayer. In case the correct documents are presented before the authorized before passing the order then it should be accepted by the authorities.

Details of the case

Citation

M/S Axpress Logistics India Pvt. Ltd (supra) and M/s Bhumika Enterprises (supra). M/s Bhumika Enterprises Vs. State of UP and others (Writ Tax No. 564 of 2018)

Pleading

By means of this writ petition, the petitioner is assailing the order dated 27.1.2022 passed by Assistant Commissioner, Mobile Squad, State Goods and Services Tax, Khataunil Unit Muzaffarnagar, respondent no. 3 and the order dated 2.7.2022 passed by Additional Commissioner, Grade -2 (Appeal), State Goods and Services Tax Muzaffarnagar, respondent no. 2.

Facts

Brief facts of the case as stated, are that the petitioner is a proprietorship concerned having GSTIN No. 09AAPFG6376E1ZY and engaged in the business of manufacturing and sale of laminated papers. In the normal course of business, the goods were loaded on Truck no. RJ 01 GC 4269 for dispatch from Muzaffarnagar to Rajasthan along with tax invoices, E-way Bills and GR. During transit, the goods were intercepted on 25.1.2022 and Form GST MOV-2 was issued by respondent no. 3 after recording the statement of the truck driver and after physical verification Form GST MOV-04 was issued on the ground that the goods were found to be different than mentioned in accompanying documents. Thereafter a show cause notice was issued in Form GST MOV-07 on 27.1.2022. The petitioner submitted reply and being not satisfied with the same, penalty was imposed by order dated 27.1.2022. Thereafter the petitioner filed an appeal against the said order, which was also dismissed by impugned order dated 2.7.2022. Hence the present writ petition.

Learned counsel for the petitioner has submitted that it is admitted that the goods were moving along with tax invoice no. 139 dated 25.1.2022 along with eway bill but before physical verification or issuance of show cause notice or passing the detention as well as seizure order, another tax invoice no. 140 dated 25.1.2022 along with e-way bill was produced rectifying the mistake but still notice was issued and penalty order was passed

Observation

Once the documents were produced before passing of the detention / seizure order, the authorities ought not to have proceeded further as held by the the Division Bench judgement of this Court in the case of M/S Axpress Logistics India Pvt. Ltd (supra) and M/s Bhumika Enterprises (supra). Since the Division Bench has specifically decided the said issue in an identical matter way-back in the year 2018, the impugned order is not justified as the documents have already been produced before passing of the detention as well as seizure order. 12. In view of the facts as stated above, the writ petition succeeds and is allowed. The impugned orders are set aside. The matter is remanded to the first appellate authority, who shall pass a fresh order in accordance with law, expeditiously, preferably within a period of two months from the date of producing a certified copy of this order.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.