Writ rejected as appellant need to reply Adjudicating authority first

Comment

Writ was rejected by the court. The appellant was asked to first make reply to the adjudicating authority.

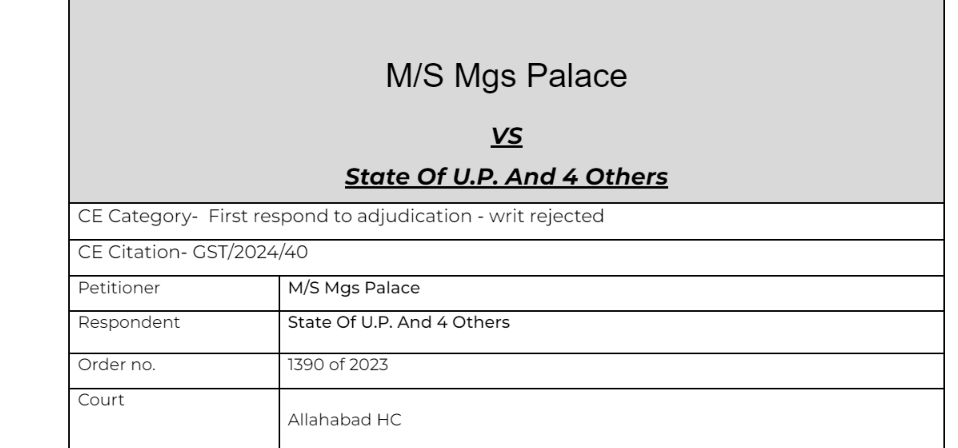

Details of the case

Pleading

Challenge has been raised to the adjudication notice issued under Section 73 of the Uttar Pradesh Goods and Services Tax Act, 2017 dated 19.05.2023. Submission is, though the impugned notice was preceded by the notice issued under Section 61(1) of the Act dated 19.05.2023, respondent no. 2 has failed to consider the reply furnished by the petitioner dated 1.09.2023.

Facts

Submission is, though the impugned notice was preceded by the notice issued under Section 61(1) of the Act dated 19.05.2023, respondent no. 2 has failed to consider the reply furnished by the petitioner dated 1.09.2023. 4. Upon instructions received, learned Standing Counsel has informed that the petitioner had submitted his reply through offline mode. It is also admitted to the petitioner that against transaction value of Rs. 11,50,000/- referred to in the notice dated 19.05.2023, the petitioner had originally disclosed transaction value of Rs. 5,91,000/-. Further disclosure has been made of transaction worth Rs. 5,00,000/- upon receipt of notice dated 19.05.2023. 5. In such facts, it cannot be prematurely concluded that there is no dispute that may require adjudication. 6. The satisfaction required to be recorded in terms of Section 61(3) of the Act is primarily subjective. Unless inherent lack of jurisdiction or complete absence of relevant material is alleged and established, no interference may be warranted in exercise of extraordinary jurisdiction of this court under Article 226 of the Constitution of India.

Observation

Accordingly, the writ petition is dismissed leaving it open to the petitioner to respond to the adjudication notice which shall be dealt with and decided on its own merits without being prejudiced by the observation made in this order.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.