Even if part B of E-way is not filled, penalty is not leviable- Allahabad HC

No E-way bill penalty-

The court quashed the E-way bill penalty levied in this case. It is a settled fact now that unless there is an evasion of tax the penalty u/s 129(3) is not leviable.

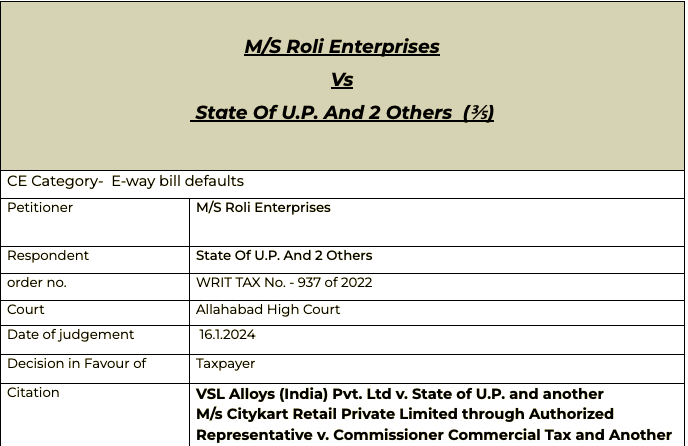

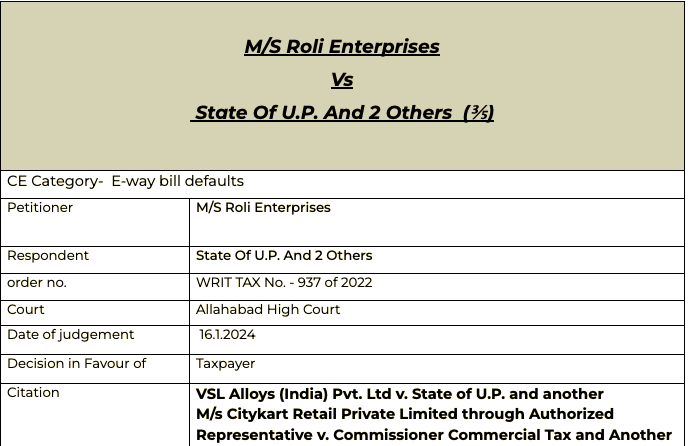

M/s Roli enterprises Vs State of UP – GST E-way bill penalty u/s 129

Pleading

This is a writ petition under Article 226 of the Constitution of India wherein the petitioner is aggrieved by an order dated November 10, 2020 passed under Section 129(3) of the Uttar Pradesh Goods and Services Tax Act, 2017 (hereinafter referred to as “the Act”) levying penalty upon the petitioner and the subsequent appellate order dated January 10, 2022 dismissing the appeal filed by the petitioner.

Facts

Upon perusal of the record, it appears that the only controversy involved in the present petition is with regard to non filling up of Part ‘B’ of the e-Way Bill. The undisputed facts are that firstly the bilty in fact had the details of the truck that was carrying the goods; secondly, the goods were not in variance with the invoice; and thirdly, the Department has not been able to indicate any kind of intention of the petitioner to evade tax.

Mr. Shubham Agarwal, learned counsel for the petitioner has relied upon two judgments of this Court in VSL Alloys (India) Pvt. Ltd v. State of U.P. and another reported in 2018 NTN [Vol.67]-1 and M/s Citykart Retail Private Limited through Authorized Representative v. Commissioner Commercial Tax and Another reported in 2023 U.P.T.C. [Vol.113]-173 to buttress his argument that non filling up of Part ‘B’ of the e-Way Bill by itself without any intention to evade tax cannot lead to imposition of penalty under Section 129(3) of the Act.

Observation

In the present case, the facts are quite similar to one in M/s Citykart Retail Pvt. Ltd.’s case (supra) and I see no reason why this Court should take a different view of the matter, as the invoice itself contained the details of the truck and the error committed by the petitioner was of a technical nature only and without any intention to evade tax. Once this fact has been substantiated, there was no requirement to levy penalty under Section 129(3) of the Act. 8. In light of the above, the orders dated November 10, 2020 and January 10, 2022 are quashed and set aside. The petition is allowed. Consequential reliefs to follow. The respondents are directed to return the security to the petitioner within six weeks.

Comment

There was no intention to evade tax. That’s is the most important part. Even if there is any discrepancy but intention to evade tax is not proven, The penalty is not leviable.

Download the read the judgment- M/s Roli enterprises Vs State of UP

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.