No need to file certified copy of appeal

Comment

The appeal was filed online in this case. But the TP couldnt file the certified hard copy. The honourable court dropped the order rejecting the appeals declaring them time barred. It was clarified by the court that if the appeal is successfully filed on the portal there is no requirement of hard copy.

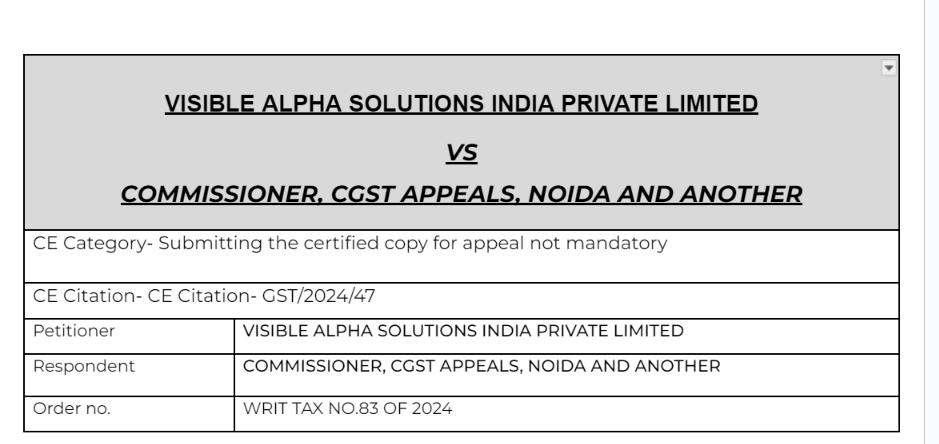

Details of the case

Citation

Sec 107 and rule 108 of CGST Rules

Pleading

This is a writ petition under Article 226 of the Constitution of India wherein the petitioner is aggrieved by the order dated October 18, 2023 passed by the respondent No.1/Commissioner, CGST (Appeals), NOIDA rejecting the two appeals filed by the petitioner on the ground that the same were time barred, as the self-certified copy of the decision or order was not made available within time as per proviso to Rule 108 of the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as “the Rules”).

Facts

Learned counsel appearing on behalf of the petitioner has referred to Rule 108 of the Rules to indicate that when the appeal is filed electronically and uploaded on the common portal in FORM GST APL-01, there is no requirement to file self-certified copy of the decision. Both the proviso to Rule 108 of the Rules apply only in the case when the appeal is not uploaded on common portal. Rule 108 of the Rules is delineated below for clarification:

Observation

Upon a perusal of the impugned order, it clearly appears that the appeal was electronically filed within the time permitted, that is, three months as per Section 107 of the Central Goods and Services Tax Act, 2017. Furthermore, the first and second proviso to Rule 108 of the Rules would not apply, as is clear from the literal interpretation of the first proviso itself. 5. In light of the above, the impugned order dated October 18, 2023 is quashed and set aside with a direction upon the appellate authority to de novo hear the appeals filed by the petitioner and pass a reasoned order on merits within a period of three months from date

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.