Presumptive Taxation

Presumptive Taxation

What Is Presumptive

- Dictionary meaning: “the act of believing that something is true without having any proof”

- Real purport of Presumptive taxation

- Nand Lal Popli vs. DCIT, ITA 1161-62/Chd/2013, dt. 14.06.2016

- The first important term here is ‘deemed to be’, which proves that in such cases there is no income to the extent of such percentage, however, to that extent, income is deemed. It is undisputed that ‘deemed’ means presuming the existence of something which actually is not. Therefore, it quite clear that though for the purpose of levy of income tax 8% or more may be considered as income, actually this is not the actual income of the assessee. This is also the purport of all provisions relating to presumptive taxation.

Introduction

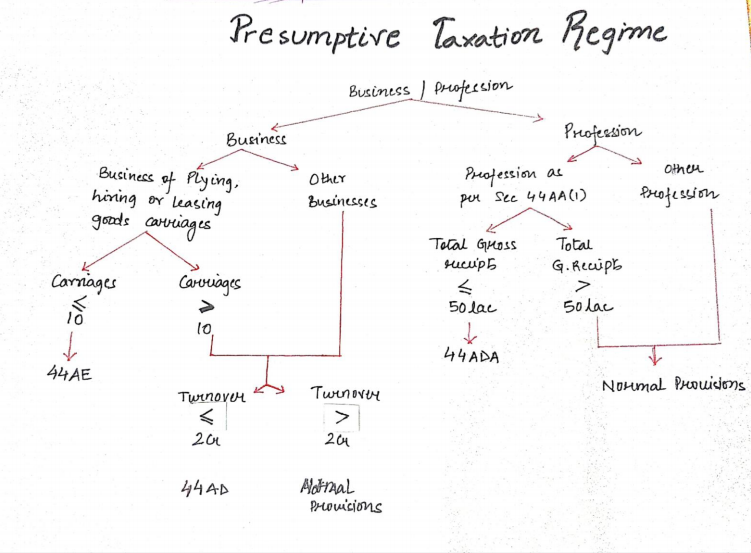

Relevant Provisions

- Section 44AA

- Section 44AB

- Section 44AD

- Section 44AE

- Section 44ADA

SECTION 44AA: Maintenance of accounts by certain persons carrying on profession or business.

- (1) Every person carrying on legal, medical, engineering or architectural profession or the profession of accountancy or technical consultancy or interior decoration or any other profession as is notified by the Board in the Official Gazette shall keep and maintain such books of account and other documents as may enable the Assessing Officer to compute his total income in accordance with the provisions of this Act.

Related Topic:

Calculation Under Section 44AE under Presumptive Taxation

ISSUES:

- 44ADA(4): no books to be maintained if total income does not exceed the maximum amount chargeable to tax

Notified Professions

- Legal

- Medical

- Engineering

- Accountancy

- Architecture

- Technical Consultancy

- Advertisement

- Company Secretary- Notification dt. 25.09.1992

- Information Technology- 04.05.2001

- Authorised Representative

- Film Artiste-

(2) Every person carrying on business or profession not being a profession referred to in sub-section (1) shall,-

(i)

(ii)

(iii)

(iv)

keep and maintain such books of account and other documents as may enable the Assessing Officer to compute his total income in accordance with the provisions of this Act.

(i) if his income from business or profession exceeds one lakh twenty thousand rupees or his total sales, turnover or gross receipts, as the case may be, in business or profession exceed or exceeds ten lakh rupees in any one of the three years immediately preceding the previous year; or

ii) where the business or profession is newly set up in any previous year if his income from business or profession is likely to exceed one lakh twenty thousand rupees or his total sales, turnover or gross receipts, as the case may be, in business or profession are or is likely to exceed ten lakh rupees, during such previous year; or

(iii) where the profits and gains from the business are deemed to be the profits and gains of the assessee under section 44AE or section 44BB or section 44BBB, as the case may be, and the assessee has claimed his income to be lower than the profits or gains so deemed to be the profits and gains of his business, as the case may be, during such previous year; or Issues:

In cases of 44AE, 44BB, and 44BBB- if claiming lesser income, books to be maintained even if income does not cross threshold- section 44AE(7)

(iv) where the provisions of sub-section (4) of section 44AD are applicable in his case and his income exceeds the maximum amount which is not chargeable to income-tax in any previous year,

Issues:

- No requirement of maintaining books if opted for 44AD

- To keep books of accounts if claim less then income presumed under section 44AD

- If subsection (4) applicable, books to be maintained, only if income exceeds the threshold limit

Provided that in the case of a person being an individual or a Hindu undivided family, the provisions of clause (i) and clause (ii) shall have an effect, as if for the words “one lakh twenty thousand rupees”, the words “two lakh fifty thousand rupees” had been substituted:

Provided further that in the case of a person being an individual or a Hindu undivided family, the provisions of clause (i) and clause (ii) shall have an effect, as if for the words “ten lakh rupees”, the words “twenty-five lakh rupees” had been substituted.

3) The Board may, having regard to the nature of the business or profession carried on by any class of persons, prescribe, by rules, the books of account and other documents (including inventories, wherever necessary) to be kept and maintained under sub-section (1) or sub-section (2), the particulars to be contained therein and the form and the manner in which and the place at which they shall be kept and maintained.

(4) Without prejudice to the provisions of sub-section (3), the Board may prescribe, by rules, the period for which the books of account and other documents to be kept and maintained under sub-section (1) or sub-section (2) shall be retained.

Read & Download the Full Copy in pdf:

If you already have a premium membership, Sign In.