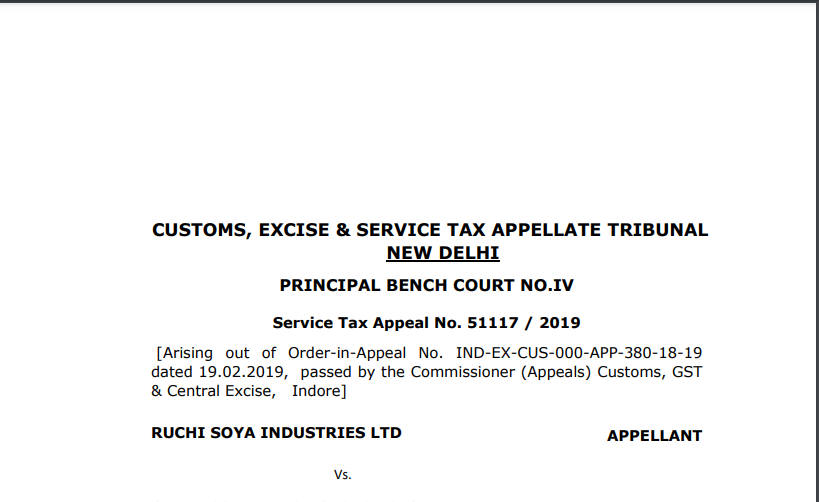

CESTAT Order in the case of Ruchi Soya Industries Ltd

Table of Contents

Case Covered:

Ruchi Soya Industries Ltd

Versus

Commissioner Of Customs

Facts of the Case:

M/s. Ruchi soya appellant herein has filed an impugned appeal to assail the order in appeal No. 380-18-19 dated 19.2.2019. the facts in brief given rise to this appeal are as follows:

The appellant has set up a project for generating electricity using wind energy comprising of one Suzlon-made Wind Turbine Generator (WTG) having an output of 1500 KW electricity. The appellant requested the operator of said WTG M/s. Suzlon Global Services Ltd. (SGSL) to maintain the said WTG. SGSL inter alia is in the business of operating, managing, and maintaining wind farm for projects for the generation of wind energy by means of WTG. Hence, they accepted the aforesaid request of the appellant vide agreement dated 17.12.2014 so entered between them.

During the course of the audit, the officers of Audit, Indore observed that the appellant has shown the receipt of Rs.1.33 crores in the year 2015-16 from M/s SGSL. To explain the nature of activity conducted for such consideration that the appellant provided the Maintenance Agreement dated 17.12.14.

The Department observed that as per the said agreement M/s. SGSL has agreed for providing maintenance services to the appellant who shall be liable to pay operation and maintenance service charges to M/s. SGSL against the invoices as were to be raised from time to time by M/s. SGSL. However, there has been a Machine Availability clause in the said agreement of 17.12.2014. For the purpose thereof M/s. SGSL had issued credit notes on the appellant for the claims raised by the appellant towards Machine availability due to brake down in WTGs.

Observations:

With this understanding of the law, the facts of the present appeal are perused. It is clear from the facts that there is no denial on the part of the department, as is apparent from para 4 of the show cause notice to the fact that the appellant/ service recipient, has already suffered service tax on the invoices raised by M/s. SGSL from time to time. The credit note issued by M/s SGSL, service provider is a refund of the excessive amount paid by the appellant on account of defined service to be provided by M/s SGSL. It does not represent any service rendered by the appellant to M/s SGSL so as to attract any service liability of the appellant. The basis of the transaction between the parties is the agreement dated 17.12.2014. Perusal thereof makes it abundantly clear that the appellant is the service recipient and M/s SGSL is the service provider. Hence the payment of service tax can be the liability only and only of M/s. SGSL.

Order:

In view of the entire above discussion, I am of the opinion that the amount received by the appellant in terms of the Machine Availability clause, from the service provider with reference to the maintenance of WTG due to a shortcoming in said service is merely an amount to safeguard the loss of appellant. The said amount cannot be called as consideration for the tolerance of service provided and some lacunae thereof nor it makes the appellant the service provider. In fact, once the appellant receives compensation for the downfall in service quality, it is because he is not inclined to tolerate the loss as he may suffer on account of said downfall. The concept of ‘Declared Services’ has therefore been wrongly invoked by the Department and the adjudicating authority below. As already discussed above, the service recipients cannot be fastened with any liability to pay tax. I also rely upon the decision of Hon’ble Apex Court in the case of Association of Leasing and Financial Service Companies vs. Union of India reported on 2010 (20) STR 417 (SC) wherein it has been held that when no service has been rendered, service tax cannot be levied.

In view of the entire above discussions, the findings in order under challenge are not at all sustainable. The same are held to be absolutely imaginary and assumptive in nature and thus are hereby set aside.

As a consequence thereto the appeal is hereby allowed.

Read & Download the full Copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.