How to Claim Opening ITC on New Registration and Transfer of Business

Table of Contents

Opening ITC on first-time registration

ITC is GST paid on Inward supplies. Only a person registered under the GST can claim ITC. A person carrying on business holds inputs, semi-finished goods, finished goods & Capital goods at their place of business. If such a person is not registered under GST cannot avail the benefit of claiming the credit. Only after obtaining the registration taxpayers can avail of the ITC on lying stock by filing Form GST ITC – 01.

At the time of first-time registration in GST, a taxpayer is eligible to claim the ITC of opening balances. But it is restricted. ITC related to inputs is only allowed. The ITC in case of input services and capital goods is not available for first-time registration in GST.

Related Topic:

PPT on All input tax credit forms in GST

Required Form for claiming the opening ITC on first time registration -GST ITC – 01

According to section 18(1) of The CGST Act, a registered person can file Form GST ITC – 01. Form GST ITC – 01 is a declaration form filed on GST Portal for claiming the ITC by the newly registered taxpayer under GST. In this form, he declares the details of invoices eligible for ITC. Take care to note that ITC of invoices older than a year is not eligible.

Related Topic:

What is ITC 2A and how to file it?

Cases where ITC-01 is required to be filed for claiming the Input tax credit

Apart from the first-time registration, this form can be used in some other cases also.

1) On becoming liable to pay GST:

If a person becomes liable to obtain registration under GST law i.e his aggregate turnover crosses the threshold limit applicable. Such a person applies for the registration within 30 days from the date he becomes liable to obtain registration. Then he/she can claim the input tax credit of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax under the provisions of the GST act.

For Example – ABC & co. are in the business of manufacturing shoes exclusively in Haryana & their aggregate turnover crossed the threshold limit of Rs. 40 Lakhs on 25-June-2021. If ABC & co. applies for the GST registration within 30 days i.e. before 26-July-2021, then they can claim the Input tax credit of inputs, semi-finished goods, or finished goods held in Stock on 24-June-2021.

Related Topic:

Can the taxpayer be denied the benefit of ITC on the basis of Form-2A?

2) Voluntary registration:

If a Person voluntarily obtains GST registration then he can claim the input tax credit of inputs, semi-finished goods, or finished goods held in stock on the day immediately preceding the date of grant of registration.

For Example – ABC & co. are in the business of manufacturing shoes exclusively in Haryana & their turnover is Rs. 28 lakhs within the threshold limit of Rs 40 Lakhs. However, they applied for GST registration voluntarily & GST registration was granted on 26-July-2021. Now, Abc & co. can claim the Input tax credit of inputs, semi-finished goods, or finished goods held in Stock on 24-June-2021.

Related Topic:

Can the buyer be denied the ITC on account of the fraud or malpractices committed by the supplier?

3) Composition taxpayer to regular taxpayer:

A Person who has Opted for Composition Levy Under the GST act, ceases to pay taxes under the Composition Levy i.e. Section – 10 of the CGST Act & becomes liable to pay tax under Section 9 of the Act, can claim an input tax credit of inputs, semi-finished goods, or finished goods held in Stock & on capital goods on the day immediately preceding the date on which he becomes liable to pay taxes under section – 9.

For Example – ABC & co. are in the business of manufacturing shoes exclusively in Haryana are paying tax under Section – 10 of the CGST act ( under composition Levy ) & on 26-July-2021 they sold their product to a retailer in Delhi. As they made an Inter-state supply of goods now they cease to pay tax under section – 10 & are liable to pay taxes under section – 9. Now, ABC & Co. can claim an input tax credit of inputs, semi-finished goods, or finished goods held in Stock & on capital goods on the day immediately preceding the date on which he becomes liable to pay taxes under section – 9.

Related Topic:

Amended Section 16(4) to de-link ITC on Debit Note with Invoice fails to get stamping of Gujarat AAR

4) Exempt supply of goods/services becomes taxable:

When an exempt supply becomes a taxable supply then any person who is engaged in the supply of such exempt goods or service or both is eligible to claim an input tax credit of inputs, semi-finished goods, or finished goods held in Stock related to such exempt supply & on capital goods exclusively used for such exempt supply.

Related Topic:

GST on Transfer of Development Rights or Long term Lease

For example – ABC & Co. was in the business of selling Garments & handloom products. Handloom products which were Exempted goods on 26-June-2021 by way notif. Are now taxable goods under GST. Now ABC & co. can claim ITC of inputs, Semi-finished goods, finished goods related to handlooms products.

Related Topic:

GSTR-2A VS With GSTR-3B why the reversal of availed ITC on reconciliation of does not arise

Step by Step Guide to File FORM GST ITC – 01

Step 1: Log in to the GST portal.

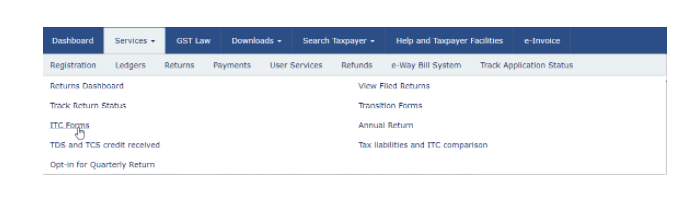

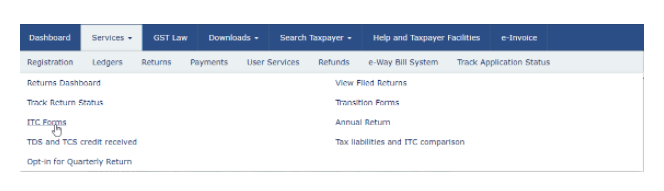

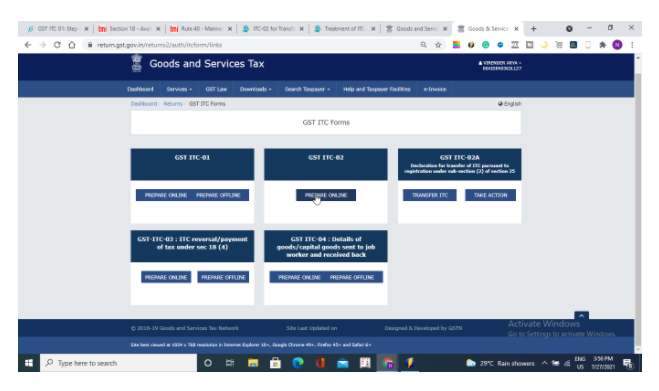

Step 2: Go to Services > returns > ITC forms

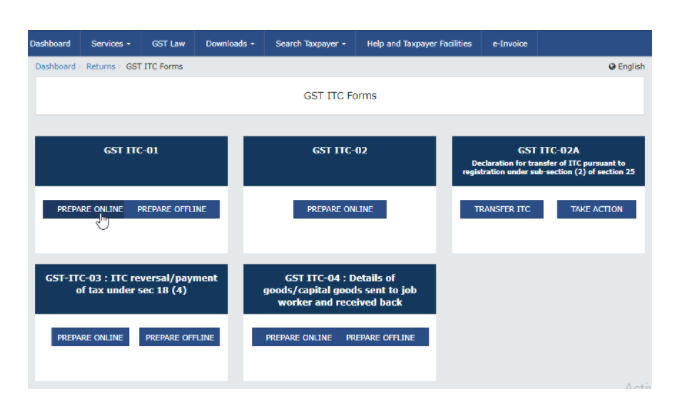

Step 3: Now click on GST ITC – 01

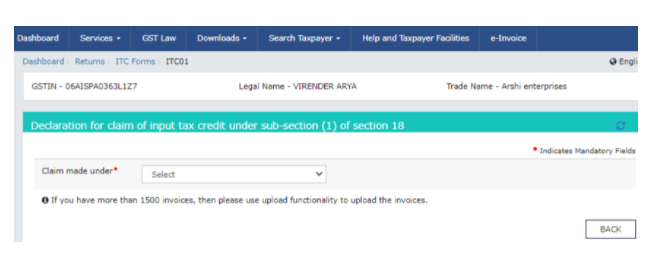

Step 4: Select the applicable section from the “claim made under’ drop-down list.

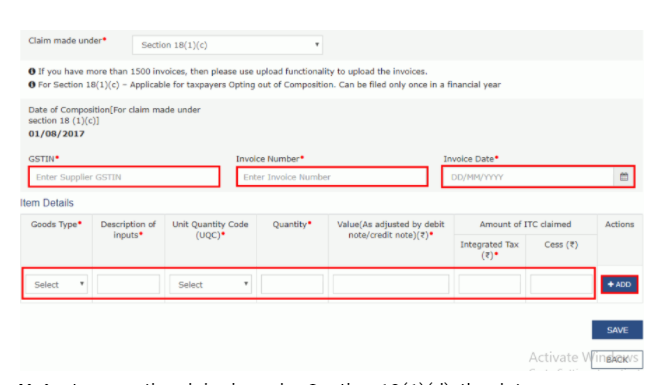

Step 5: Provide Invoice wise details as required in the form.

- Type of goods

- GSTIN of the supplier

- Invoice no. & date

- Select Unique quantity code

- Description of goods

- Quantity

- Invoice Value

- ITC amount

- Now click on ‘ADD” to add more invoices or Click on “Save” to Proceed.

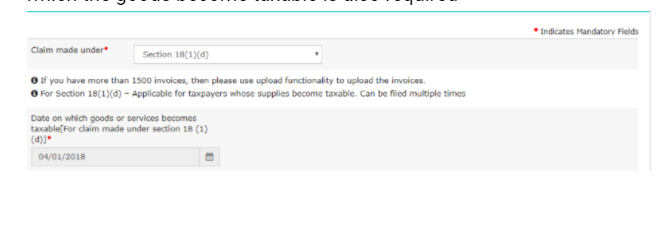

Note: In case, the claim is under Section 18(1)(d), the date on which the goods become taxable is also required

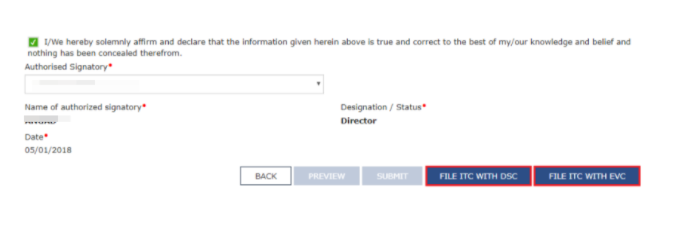

Step 6: When all invoices are entered, click on the preview > Submit > Proceed.

Step 7: For Claims of more than Rs. 2 Lakhs the taxpayer will have to upload a CA certificate.

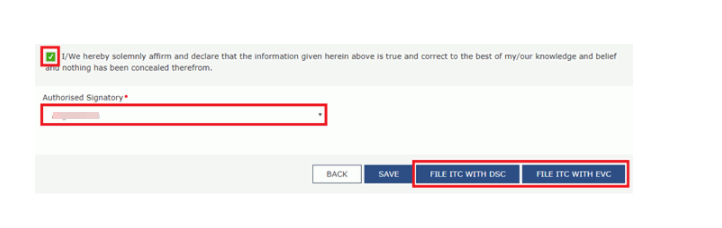

Step 8: Once the form is submitted Successfully, file the return using an EVC or DSC.

Form GST ITC – 02

FORM GST ITC – 02 is a form used to transfer input tax credit balance in the electronic credit ledger of a GSTIN to another GSTIN due to a change in the constitution of the registered person.

Cases where GST ITC – 01 is required to be filed

To transfer ITC from one GSTIN to another GSTIN due to –

- Sale of business

- Merger

- Demerger

- Amalgamation

- Transfer of business

Related Topic:

The journey of ITC From July-2017 to Jan-2021…and onwards

Step by step guide to filing form GST ITC – 02

Step 1: Log in to the GST portal.

Step 2: Go to Services > returns > ITC forms

Step 3: Click on GST ITC – 02

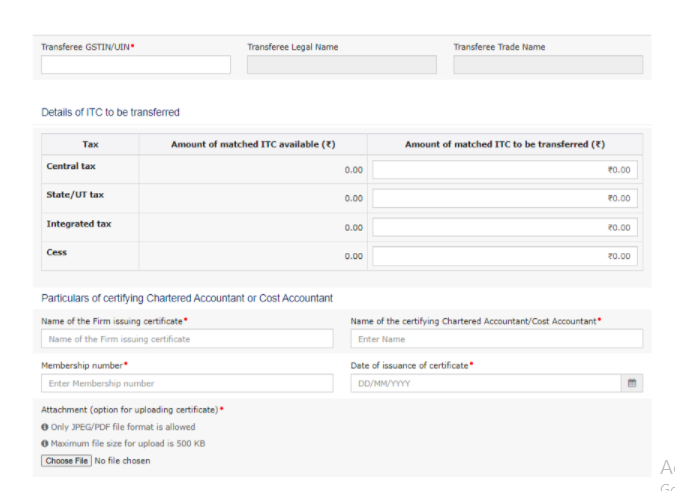

Step 4: Now enter the required details –

- GSTIN of transferee

- Amount of matched ITC to be transferred

- Name of the Firm issuing certificate

- Name of the certifying Chartered Accountant/Cost Accountant

- Membership number of Chartered Accountant/Cost Accountant

- Date of issuance of the certificate

- Upload CA certificate

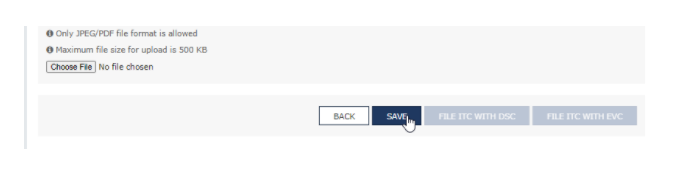

Step 5: Click on Save

Step 7: After the form is saved successfully, file the form using an EVC or DSC.