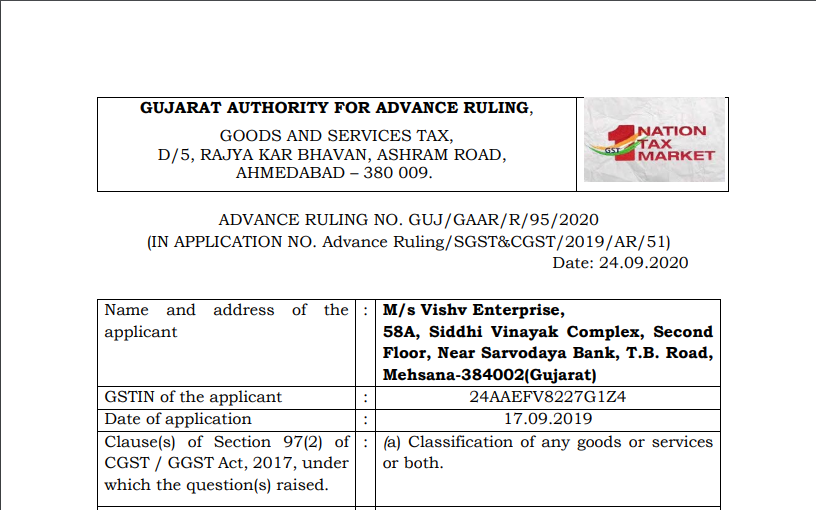

Gujarat AAR in the case of M/s Vishv Enterprise

Case Covered:

M/s Vishv Enterprise

Facts of the Case:

The applicant is engaged in the business of contract work services of Man Power Recruitment & Supply by outsourcing in the Government Department. There is a matter which needs clarification regarding the applicability of GST on the supply of contract work service of Man Power and House Keeping in Government Municipal Corporation, Government Hospital, and any other Government Department.

The applicant further submitted that there is an issue regarding payment of GST amount with Ahmedabad Municipal Corporation Seth L.G. Hospital, Maninagar, Ahmedabad. They regularly place their contract service bill with 9% CGST & 9% SGST but they are not ready to pay and respond that they are not in the category to pay GST. There is an exemption to service to Municipality under Article 243W & Panchayat under Article 243G. Now, they are confused that either said services are exempted or not? Therefore, they requested to provide them some evidence so they can give Seth L.G. Hospital and ask for their pending payment which has not been released since April 2019. They have also submitted a copy of the letter dated 16.08.2019 given by Seth L.G. Hospital.

Observations:

We have considered the submissions made by the applicant in their application for advance ruling as well as at the time of the personal hearing. We also considered the issue involved, on which advance ruling is sought by the applicant, relevant facts & the applicant’s interpretation of the law.

At the outset, we would like to state that the provisions of both the CGST Act and the GGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the GGST Act.

In this case, a moot point is to be decided regarding tax liability on providing of Para-medical Administrative, Technical and other Staff on Outsource basis to Seth L.G. General Municipal Hospital, Maninagar, Ahmedabad.

Related Topic:

Gujarat AAR in the case of M/s Gujarat Narmada Valley Fertilizers & Chemicals Ltd.

Ruling:

Question 1: Whether services of providing Para-medical Administrative, Technical, and other Staff on Outsource basis to Seth L.G. General Municipal Hospital are exempted or not?

Answer: Answered in Negative.

Read & Download the full Ruling in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.