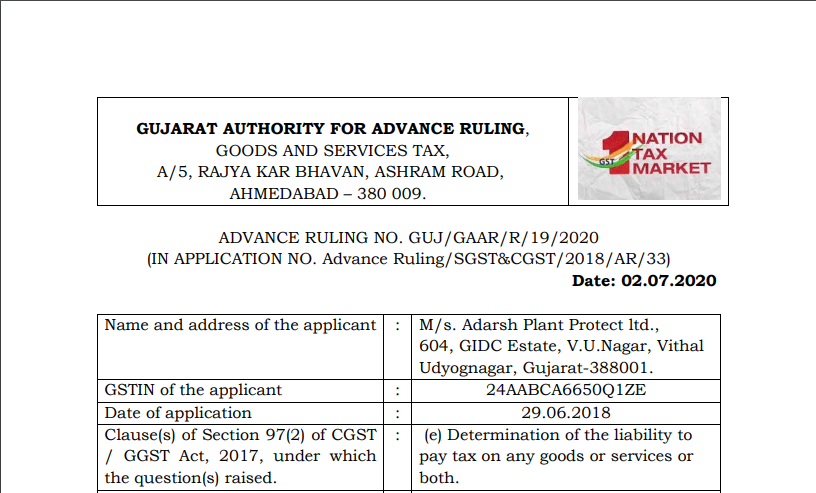

Gujarat AAR in the case of M/s. Adarsh Plant Protect Ltd.

Case Covered:

M/s. Adarsh Plant Protect Ltd.

Facts of the case:

The applicant M/s. Adarsh Plant Protect Ltd. vide their application for Advance Ruling has submitted that they are engaged in the manufacturing of Sprayer Pumps and Adarsh Clean Stove and Adarsh Clean Cook Stove (Community size). They have stated that the sprayer pumps manufactured by them fall under Chapter84 having HSN code: 8424 and all the sprayer pumps manufactured by them are manually operated except model ANM-516 (which is battery operated). The applicant has enlisted the details of the sprayer pumps (manually operated) as well as that of the stoves manufactured by them along with their HSN code.

The applicant has submitted that they are collecting GST of 12% (6% SGST + 6% CGST) on the above items and paying the same to the Government. They have stated that under the VAT Act, no tax was levied on sprayer pumps as the same was used for agricultural purposes. They have also stated that the above items are taxable now but the said items are purely used manually for only agriculture purposes, hence the said items should be treated as agriculture implements manually operated and the rate of tax should be NIL. He has requested to give an advance ruling on the same.

Observations:

We have considered the issue involved, on which advance ruling is sought by the applicant, relevant facts, the applicant’s interpretation of the law as well as the arguments/discussions made by their representative Shri Ketanbhai at the time of the personal hearing.

The applicant has submitted a list of 9 sprayer pumps (all manually operated) along with their production code and HSN code i.e. SH 8424 as well as a list of 4 stoves (all manually operated) along with their production and HSN code i.e. SH 7321 and have asked the following question for the purpose of the advance ruling:

“The applicant are collecting GST of 12% (6% SGST + 6% CGST) on their items namely Sprayer pumps (manually operated) and stoves and paying the same to the Government. As per their view, the said items are used manually for only agriculture purposes so the rate of tax should be NIL. Please give an advance ruling on the same”

First of all, we are required to examine as to what sprayer pumps and stoves are. As per definition: (i)Sprayer pumps are mechanical devices designed to generate a pressure differential to drive spray fluid from a storage tank, through system plumbing, and out to the spray nozzle(s). (ii) A stove is an apparatus for cooking or heating that operates by burning fuel or using electricity. The applicant has submitted that the said items are used manually for agriculture purposes only. Also, from the details submitted by the applicant, it is seen that the sprayer pumps manufactured and supplied by them are used by them to spray pesticides on the field crops whereas the stoves are used for mixing pesticides. Ongoing through the sample invoices submitted by the applicant, it is found that they are (i) classifying ‘Sprayer pumps’ (manually operated) under Sub-heading 8424 (sample invoice No.440 dated 15.03.2018) and (ii) classifying ‘stoves’ under Sub-heading 7321 (sample invoice No.T/082/18-19 dated 11.06.2018) and paying GST of 12% (6% SGST + 6% CGST) during their supply. Further, when the representative of the applicant was asked during the course of personal hearing about the fuel used for operating the stoves manufactured by the applicant, he stated that wood was used as fuel in the said stoves.

Ruling:

(1) The product ‘Sprayer pumps’ (manually operated) manufactured and supplied by M/s. Adarsh Plant Protect Ltd. are classifiable under Tariff item No.84248100 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975). Applicability of GST rate on the said product would be 18% GST (9% SGST + 9% CGST) up to 24.01.2018 and 12% GST (6% SGST + 6% CGST) with effect from 25.01.2018 as per Notification No:01/2017-Central Tax(Rate) dated 28.06.2017 (as amended from time to time) issued under the CGST Act, 2017.

(2) The product ‘Stoves’ manufactured and supplied by M/s. Adarsh Plant Protect Ltd. are classifiable under Tariff item No.73218990 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975). Applicability of GST rate on the said product would be 12% GST (6% SGST + 6% CGST) as per Notification No: 01/2017-Central Tax (Rate) dated 28.06.2017 issued under the CGST Act, 2017.

(3) The aforementioned products of the applicant do not find mention under any of the entries of the exemption notification No.02/2017-Central Tax (Rate) dated 28.06.2017 issued under the CGST Act, 2017.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.