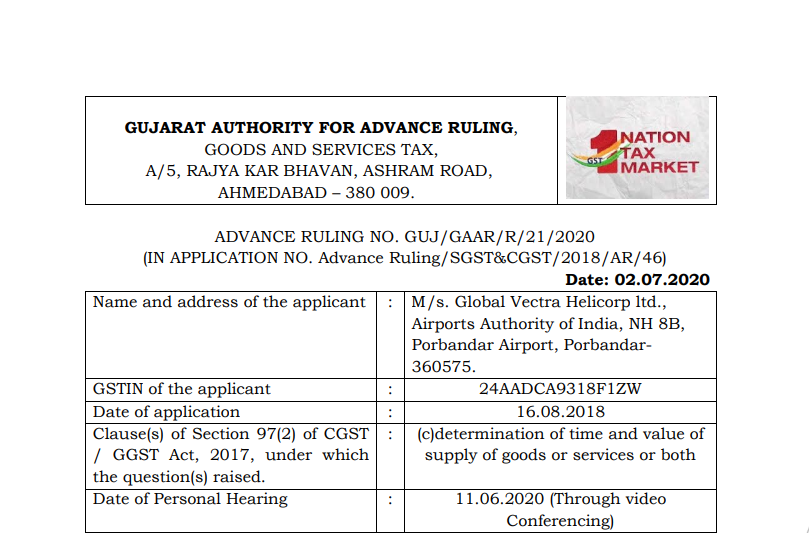

Gujarat AAR in the case of M/s. Global Vectra Helicorp Ltd.

Case Covered:

M/s. Global Vectra Helicorp Ltd.

Facts of the Case:

The applicant M/s. Global Vectra Helicorp ltd. vide their application for Advance Ruling has submitted that they are having their registered office at A54, Kailash Colony, New Delhi-110048 and GST registered office at Airports Authority of India, NH 8B, Porbandar Airport, Porbandar, Gujarat-360575. They have submitted that they hold a Non-scheduled Operators Permit (NSOP) (No.8/1998) issued by the Directorate General of Civil Aviation (hereinafter referred to as the ‘DGCA’). It employs a fleet of around 30 helicopters (aircraft) for providing services classifiable under HSN 996603 i.e. Rental services of aircraft including passenger aircraft, freight aircraft, and the like with or without operator) in terms of Annexure to Notification No.11/2017-Central Tax (Rate) dated 28.6.2017 (Charter Hire Services). Under the charter hire services entered into by the applicant with various customers, the applicant is responsible for operating and maintaining the aircraft. The applicant employs experienced and qualified pilots and qualified engineering crew in accordance with aviation standards and ensures that the Aircraft are available and fully operational during the term of the contract. Aviation Turbine Fuel (ATF) is required for flying the Aircrafts. While in terms of the contracts, the applicant agreed to provide rental services of aircraft (with or without operator) in respect of the ATF, it was agreed that provision of the same for the purpose of flying of the aircraft would be the responsibility of the Customers. However, at locations where the customer is unable to provide the fuel, in order to ensure continuity of flying, the contract requires GVHL to procure the fuel on behalf of the Customer and subsequently the cost of the fuel is reimbursed by the Customer at actual (without charging any mark-up). GVHL undertakes the activity of procurement of fuel as a ‘pure agent’.

Observations:

We have considered the issue involved on which advance ruling is sought by the applicant, relevant facts, applicant’s interpretation of the law as well as the arguments/discussions made by their representative Shri Anand Nainawati at the time of the personal hearing.

At the outset, we would like to state that the provisions of both the Central Goods and Services Tax Act, 2017, and the Gujarat Goods and Services Tax Act, 2017 are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the GGST Act.

The applicant is holding a Non-scheduled Operators Permit (NSOP) (No.8/1998) issued by the Directorate General of Civil Aviation (hereinafter referred to as the ‘DGCA’) and employs a fleet of around 30 helicopters (aircraft) for the purpose. Under the charter hire services entered into by the applicant with various customers, the applicant is responsible for operating and maintaining the aircraft. The applicant employs experienced and qualified pilots and qualified engineering crew in accordance with aviation standards and ensures that the Aircraft are available and fully operational during the term of the contract. Aviation Turbine Fuel (ATF) is required for flying the Aircrafts. While in terms of the contracts, the applicant agreed to provide rental services of aircraft (with or without operator) in respect of the ATF, it was agreed that provision of the same for the purpose of flying of the aircraft would be the responsibility of the Customers. However, at locations where the customer is unable to provide the fuel, in order to ensure continuity of flying, the contract requires GVHL to procure the fuel on behalf of the Customer, and subsequently, the cost of the fuel is reimbursed by the Customer at actual (without charging any mark-up). GVHL undertakes the activity of procurement of fuel as a ‘pure agent’.

Ruling:

In terms of the valuation provisions under GST legislation, the amount recovered as reimbursement (at actual) by the applicant M/s. Global Vectra Helicorp ltd. from the customer, for the fuel procured on behalf of the Customer, is required to be included in the value of services provided by the Applicant.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.