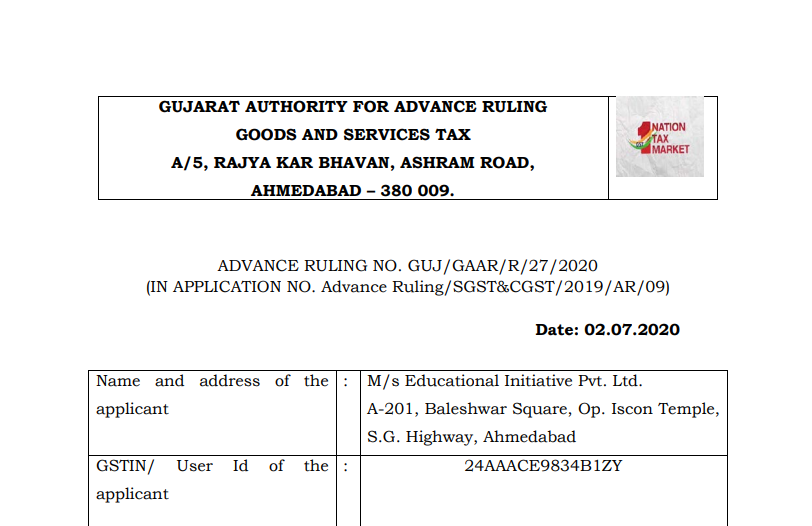

Gujarat AAR in the case of M/s Educational Initiative Pvt. Ltd.

Case Covered:

M/s Educational Initiative Pvt. Ltd.

Facts of the Case:

M/s. Education Initiatives Pvt. Ltd. is a private limited company registered under the provisions of Companies Act, 1956 and having a GSTIN: 24AADCS0861R1ZZ is a company filed an application for Advance Ruling under Section 97 of CGST Act, 2017 and Section 97 of the GGST Act, 2017 in FORM GST ARA-01 discharging the fee of Rs.5,000/- each under the CGST Act and the SGST Act.

M/s. Education Initiatives Pvt. Ltd. an applicant, inter Alia, deals in the products and solutions mainly intended to be used by K-12 education segment i.e. primary and secondary schools for the assessment and learning. The applicant is working with private schools, public schools, and leading organizations like World Bank, Michael and Susan Dell Foundation, Google, Azim Premji Foundation, and is doing large scale assessment projects with various state Governments.

Observations:

We find that the applicant has stated that they are supplying “ASSET” multiple questions to the Schools for the students of 3rd to 10th Standard. Therefore, such schools are already covered under the definition of ‘Educational Institution’, as provided under sub-clause (i) of clause (y) of Paragraph 2 of the said Notification No. 12/2017-Central Tax (Rate). We find that schools are providing education to the students up to higher secondary standards and therefore fall under the definition of Educational Institution as defined vide clause (y) of Paragraph 2 of the said Notification. In this regard, we refer to a sample copy of the agreement held between the applicant i.e. Educational Initiative and B R Birla Public School, Jhawar Road, Jodhpur submitted by the applicant. Upon perusal of the said agreement and web site of said School http://brbirlaschool.org/, it is observed that the said school is providing education up to Higher Secondary and affiliated to Central Board of Secondary Education (CBSE). Further, the terms and conditions of the said agreement reveal that the applicant has made an agreement with the School for supply of ASSET multiple question paper. Accordingly, we hold that the first condition has been fulfilled in respect of the claim of subject exemption.

Related Topic:

New Education Policy 2020

Ruling:

(i) Whether the educational assessment examination (ASSET) with its variants) provided by the applicant to school/educational organization is exempted from payment of GST under Sr. No. 66(b)(iv) of the Not. No. 12/2017-CT (Rate) dated 28.06.2017 and entry No. 69(b)(iv) of Not. No. 9/2017-Integrated Tax (Rate) dated 28.06.2017 as well as equivalent SGST Notification.

Ans. Yes, the exemption is available in view of the above discussion in respect of ASSET services provided to educational institutions.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.