Original Copy GST AAR of U.S Polytech

Original Copy GST AAR of U.S Polytech

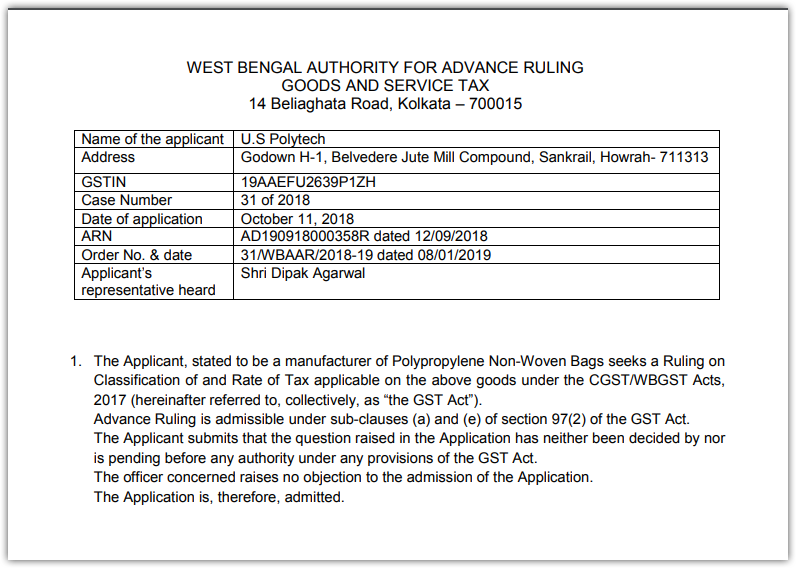

In the case GST AAR of U.S Polytech, the applicant has raised the query regarding the applicability of the tax rate on the Polypropylene Non-Woven Bags manufactured by him. Following is the GST AAR of U.S Polytech:

Order:

1. The Applicant, stated to be a manufacturer of Polypropylene Non-Woven Bags seeks a Ruling on Classification of and Rate of Tax applicable on the above goods under the CGST/WBGST Acts, 2017 (hereinafter referred to, collectively, as “the GST Act”). Advance Ruling is admissible under sub-clauses (a) and (e) of section 97(2) of the GST Act.

The Applicant submits that the question raised in the Application has neither been decided by nor is pending before any authority under any provisions of the GST Act.

The officer concerned raises no objection to the admission of the Application

. The Application is, therefore, admitted.

2. The Application states that the Applicant manufactures Polypropylene Non-Woven Bags which are mainly used by big industrial units, retail outlets and textile shops for packing of different goods and have been granted registration by the Office of the Textile Commissioner of Textile-based products.

The Applicant is of the opinion that PP Non-woven bags manufactured is classifiable under Tariff Head 6305 90 00 of the GST Tariff which is aligned to the First Schedule of the Customs Tariff Act, 1975 (hereinafter referred to as the “the Tariff Act”).

The Applicant submits his samples of PP non-woven bags.

The Applicant also submits an article on “Experimental Investigation of Properties of Polypropylene And Non—Woven Spun bond Fabric” by Harsh Kansal published in the IOSR Journal of Polymer and Textile Engineering, Volume 3, Issue 5 (Sept-Oct 2016) to explain the different types and manufacturing processes of non-woven Polypropylene bags.

Download the GST AAR of US Polytech, by the clicking the below image:

3. The Applicant relies on the order passed in case of the Office of the Commissioner of Central GST & Central Excise, Madurai vide C.No. IV/16/84/2017 –Tech (GST) Vol I dated 01.01.2018 that Non-woven bags and rice bags falling under HSN 6305 90 00 of Customs Tariff will attract GST @5% (SGST 2.5% and CGST 2.5%) if sale value does not exceed Rs. 1000/- and GST @ 12% (SGST 6% and CGST 6%) is sale value exceeds Rs.1000/- The Applicant also submits the order of AAR, Kerala wherein bags of non-woven fabrics are classified under Entry 224 of Schedule 1 of Notification 01/2017-Central Tax (Rate) dated 28.06.2018.

During Hearing the Applicant submits a copy of order No C3/17556/09/CT dated 29.09.2009 issued by the Department of Commercial Taxes, Kerala, in which it is clarified that non woven fabrics made of Polypropylene would fall under the general heading of 5603 of the Customs Tariff Act and under Entry 103 of SRO No 82/2006, and Packing Bags, textile bags and carry bags made out of non woven fabrics of polypropylene is covered under HSN 6305.33.00 and the mentioned HSN Code appears under Entry 174(7)(1) of List A of the Third Schedule to the KVAT Act, 2003.

4. The Applicant has not submitted any details of the product manufactured in terms of the raw materials/inputs used, the manufacturing process or the end use of the manufactured product, but has simply referred to various judgments. However, from a careful reading of the Article submitted, it may be inferred that the raw materials are PP granules which are bonded to form a sheet before stitching them into bags.

Nowhere has the Applicant listed the raw materials used for manufacturing, as well as the manufacturing process.

The Applicant merely annexes and refers to various rulings and clarifications issued by various authorities and has stated that the Applicant is manufacturing a similar kind of product as is mentioned in the aforesaid Advance Ruling issued by AAR, Kerala dated 29.05.2018 and seeks to clarify whether the Applicant can also apply the same rate as stated in the Advance Ruling.

5. The Applicant has referred to a registration granted by the Office of the Textile Commissioner of Textile-based products, but has not submitted any copy of the Registration, nor has clarified, neither in the Application or during Hearing, the parameters that were examined and approved before the issuance of the Registration. Neither is there provided a list of the products which were found to be textile based.

Thence, the Registration granted to the Applicant by the Office of the Textile Commissioner of Textile-based products cannot be taken up for consideration by this Authority;

The Applicant’s reference to the communication from the Office of the Commissioner GST & Central Excise, Madurai is also of little relevance. The above communication has been made to The Madurai Non-Woven Bag & Cotton Bag Manufacturer Association in response to a specific letter dated 22.12.2017, a copy of which is not submitted by the Applicant. In the absence of either the products considered in that communication and the content of the submissions made before the authority, its relevance to the Applicant’s question appears doubtful

.6. By the Applicant’s own admission, the product being manufactured on which Ruling has been sought is the same as that mentioned in Advance Ruling Order No CT/5492/18-C3 dated 29.05.2018 issued by the Kerala Authority of Advance Ruling on M/s J J Fabrics, Ernakulam (hereinafter referred to as “JJ Fabrics”).

JJ Fabrics had submitted that the primary raw materials for polypropylene sheets are polypropylene granules, color masterbatches and filter content (calcium carbonate). These raw materials are sucked through a vacuum, heated, passed through an extruder and melted. The material thus obtained is filtered and passed through the spinning unit to obtain continuous single filament which is called polypropylene filament. The filament is lapped on each other on a lapper and then subjected to thermal bonding to form the polypropylene sheet.

JJ Fabric also submitted that the bags made out of these Polypropylene Sheets are used by industrial units, big retail outlets, and textile shops for packing their commodities.

In light of the submission in the Application that the product manufactured by the Applicant is the same as that taken up by the Authority of Advance Ruling, Kerala, and the sample submitted by the Applicant, and in the absence of any contrary independent information provided by the Applicant, it is to be assumed that raw material of the non woven bags manufactured by them is Polypropylene, the manufacturing process involves obtaining a continuous single polypropylene filament, portions of which is lapped on each other on a lapper and then subject to thermal bonding to form a polypropylene sheet from which bags are made, which are used by industrial units, big retail outlets, and textile shops for packing their commodities.

7. Tariff item 6305 33 00 under the GST Tariff covers sacks and bags, of a kind used for packing of goods, made, not of jute or of other textile bast fibres of Heading 5303, but of man-made textile materials which are not flexible intermediate bulk containers but are of polyethylene or polypropylene strip or the like.

The bags made by the Applicant are non-woven and are manufactured from polypropylene sheets, not from Polypropylene Strips.

“Strip” in the English language, in the absence of any meaning particular to GST, is ordinarily defined as a long, narrow piece of cloth, paper, plastic, or some other material and a strip of linen is synonymous to narrow piece, bit, band, belt, ribbon, sash, stripe, bar, swathe, slip, fillet, shred. The sample bag as submitted by the Applicant during Hearing is a sheet of fabric cut to appropriate size and stitched at the sides and at the top to fashion a bag, it is evident, from the sample bag submitted by the Applicant during Hearing that the bags manufactured are not from “strips”.

Tariff item 6305 33 00, therefore, will not be an appropriate classification for the bags manufactured by the Applicant.

8. In its order dated 26/10/2018, disposing of Appeal Case No. 06/WBAAAR/Appeal/2018 dated 08/08/2018, the West Bengal Appellate Authority for Advance Ruling (hereinafter the Appellate Authority) refers to the judgment in the case of Raj Pack Well Ltd [1993 (41) ECC 285 (Madhya Pradesh)]. In the aforesaid case, the High Court examines the meaning of textile and fiber under sections 2(g) and 2(a) respectively of the Textile Committee Act, 1963, and concludes that plastic is not included in either textile or fiber. It examines the process of manufacturing HDPE woven bags and observes that they are made from plastic. Finally, such bags are known as plastic goods in common parlance also. The court, therefore, holds that HDPE bags, being woven from plastic strips, are to be classified as goods of plastic under Chapter 39. This judgment has since been followed repeatedly by different courts of law and has not yet been overturned. The Appellate Authority has followed this judgment for ascertaining whether PP woven Leno bags are classifiable under Chapter 39 and classifies such bags as plastic goods. The moot point, therefore, is whether the Polypropylene Non-Woven Bags the Applicant refers to are finished goods made from intermediate forms of polymers of propylene, commonly known as plastic. In such case the above judgment is squarely applicable.

9. It is pertinent to note here that the IOSR Journal of Polymer and Textile Engineering (IOSRJPTE), Volume 3, Issue 5 (Sep-Oct, 2016), PP 08-14 [www.iosrjournals.org] explains that Polypropylene (PP) is the homopolymer that is widely used for the production of non woven fabric. Polypropylene sheets are stitched into bags.

Note 1 to Chapter 39 of the GST Tariff clarifies that throughout the nomenclature the expression “plastics” means those materials of headings 39.01 to 39.14 (Primary forms of Polypropylene is classified under HSN 3902) which are or have been capable, either at the moment of polymerisation or at some subsequent stage, of being formed under external influence (usually heat and pressure, if necessary with a solvent or plasticiser) by moulding, casting, extruding, rolling or other process into shapes which are retained on the removal of the external influence. Polypropylene sheets are, therefore, plastic, and, applying the ratio of the judgment in the matter of Raj Pack Well Ltd (supra), bags made from Polypropylene sheets are to be classified as plastic goods under Chapter 39.

Sub-heading 3923 29 covers articles of conveyance or packing of goods, namely sacks and bags, made of plastics other than polyethylene. Polypropylene Non-Woven Bags that the Applicant manufactures are, therefore, classifiable under Sub-heading 3923 29.

In view of the foregoing, we rule as under:

RULING

‘PP Non-woven Bags’, specifically made from non-woven Polypropylene fabric are plastic goods to be classified under Sub Heading 3923 29 and taxed at 18 % rate under Serial No. 108 of Schedule III of Notification no. 01/2017-C.T (Rate) dated 28-06-2017 under the CGST Act, 2017 & Notification No. 1125-FT dated 28/06/2017 under the WBGST Act, 2017.

This Ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.

Source: http://www.wbcomtax.nic.in/GST/GST_Advance_Ruling/31WBAAR2018-19_20190108.pdf

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.