Transfer of ownership in goods without entering into India is a supply: Tamil Nadu AAR

Case Covered:

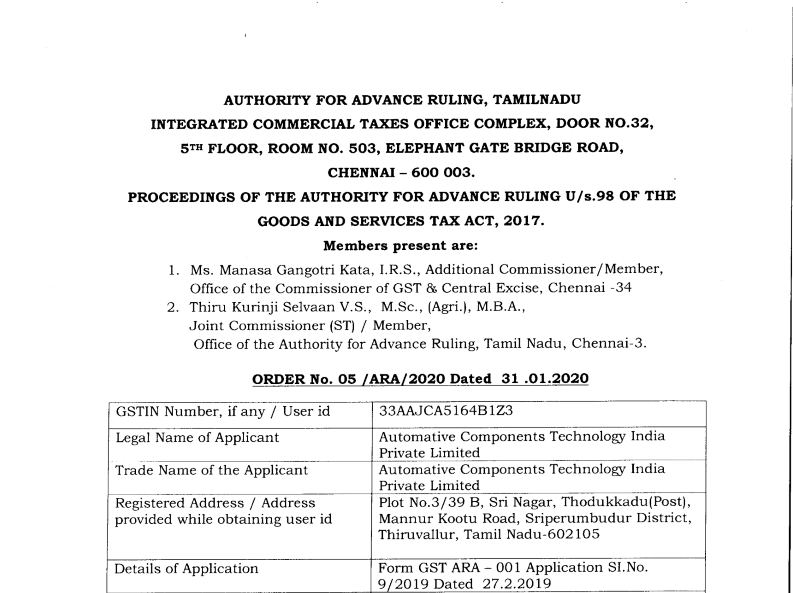

Automative Components Technology India Private Limited

Facts of the case:

M/s. Automative Components Technology India Private Limited, Plot No.3/39 B, Sri Nagar, Thodukkadu(Post), Mannur Kootu Road, Sriperumbudur District, Thiruvallur, Tamil Nadu-602105 (hereinafter referred to as the Applicant’or’ACTI) is registered under GST vide GSTIN 33AANFP5828N IZM. The Applicant has sought Advance Ruling on the following questions:

1. Whether GST will be applicable on the transfer of title in molds from applicant to Indian buyer?

2. If yes, whether the Indian buyer would be eligible to take credit for the GST paid to the applicant for said purchase?

The Applicant has submitted a copy of the application in Form GST ARA – 01 and also submitted a copy of the Challan evidencing payment of application fees of Rs.5000/each under Sub-rule (1) of Rule 104 of CGST Rules 2017 and also SGST Rules 2017.

Observations of the court:

We have carefully considered the various submissions made by the applicant. We find that the applicant is engaged in the supply of automotive components. They have stated that they agree to supply certain parts, including moulds to Indian Company located in the State of TamilNadu, for which they place an order for manufacturing the said parts and moulds on a Thailand Company. The parts manufactured are physically imported, while the moulds developed are retained in Thailand and are not physically imported into India, but the ownership in the mould is transferred from the foreign supplier to the Applicant and from the applicant to the Indian buyer by raising of separate invoices. In view of the above the applicant has raised the following questions:

1. Whether GST will be applicable on the transfer of title in moulds from applicant to Indian buyer?

2. If yes, whether the Indian buyer would be eligible to take credit of the GST paid to the applicant for said purchase?

The definition of ‘advance Ruling’ under section 95(a) of CGST/TNGST Act is given below for ease of reference,

(a) “advance ruling” means a decision provided by the Authority or the Appellate Authority to an applicant on matters or on questions specified in sub-section (2) of section 97 or sub-section (1) of section 1OO, in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant;

Section 97(2) of the CGST Act / Tamil Nadu GST Act (TNGST) gives the scope of Advance Ruling Authority, i.e., the question on which the Advance Ruling can be sought. For ease of reference, the section is reproduced as under:

97 (2) The question on which the advance ruling is sought under this Act, shall be in respect of,

(a) classification of any goods or services or both;

(b) applicability of a notification issued under the provisions of this Act;

(c) determination of time and value of supply of goods or services or both;

(d) admissibility of the input tax credit of tax paid or deemed to have been paid;

(e) determination of its liability to pay tax on any goods or services or both;

(f) whether the applicant is required to be registered;

(g) whether anA particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both, within the meaning of that term.

The Act limits the Advance Ruling Authority to decide the issues earmarked for it under Section 97(2) and no other issue can be decided by the Advance Ruling Authority. Of the above questions on which ruling is sought by the applicant, the question at (2) relates to eligibility to the credit of tax paid by them at their buyers’end.

Related Topic:

Tamil Nadu AAR in the case of Chennai Metro Rail Limited

The eligibility to credit of input tax paid by the applicant alone is covered under clause (d) of Section 97(2) above and the eligibility at the buyers’ hand when raised by an applicant do not fall under any of the category specified under Section 97(2) of the Act and therefore not within the ambit of this authority. This position was explained during the personal hearing also. The First Question relating to whether GST is applicable on a transaction is within the ambit of this authority and is taken up for consideration.

6.1 In the case at hand, the applicant is undertaking two transactions

T1: Transfer of title in moulds from the foreign supplier to the Applicant

T2: Transfer of title in moulds from the applicant to the Indian buyer. The question raised by the applicant is with respect to the transaction at T2 above. It is stated that the moulds manufactured by the foreign supplier is not physically imported and only the title in the moulds are transferred from the foreign supplier to the applicant and thereupon by the applicant to the vendor located in India. The applicant on his interpretation of law has stated that on application of Section 10 (1)(c ) of IGST Act 2017, the place of supply is Thailand and the supplier is in India, therefore the supply could get covered under the ambit of Inter-State Supply in terms of IGST Act, but IGST levy can be imposed only to supplies within the territorial jurisdiction of the IGST Act. The applicant has stated that the supply in the case at hand takes place outside the territorial jurisdiction of IGST Act and thereby not subject to IGST and has sought to clarify the applicability of GST in the said transaction.

6.2 From the Amendment for Vendor Tooling PO for NMIPL/2O12/K2/IEVT/92 dated 18th December 2014 furnished by the applicant, it is seen that Order is placed with the conditions that the Tools mentioned under the PO are 100% property of Nissan Motors India Pvt. Ltd; Ordered Tools must be maintained under good condition during production; supplier has to submit the Tool Ownership certificate with clear Tool location; Supplier has to submit the digital Photograph of the actual Tool along-with the tool Ownership Letter; etc.. From the ‘Declaration’ dated 16.03.2019, related to transfer of Tool Ownership by the applicant to their vendor, it is seen that the declaration is against Invoice no. 201364 dated 16.03.2019 raised on the vendor. Also, it is seen from the ‘Tool Ownership Certificate’ dated 16.03.2009, with reference to the PO NMIPL/2012/K2/LEVT/92 dated 18th December 2014, the certificate lists the part number, description of Tools, Location of Tools, etc. Further, in the declaration and in the Tool Ownership Certificate’, it is stated that the moulds and tools shall upon completion of the cycle life of the moulds be disposed off in the premises of such parts manufacturer as may be agreed in the future between the parties/ approval of Nissan Motors India Pvt Ltd. The applicant has not furnished the agreement between the parties stating that the same is not traceable and has further stated that the modes of a transaction are evidenced from the Purchase Order, Invoice, Tool Ownership Certificate, etc described above. From the documents and averments of the applicant, the transaction involved requiring the clarification by the applicant is that the title in the moulds got manufactured by the applicant are transferred to the applicant and thereupon to the applicants’ vendor by way of declaration and against invoice indicating the consideration for the moulds. The moulds/tools remain with the manufacturer for manufacturing the parts, i.e., the moulds are supplied free of cost to the manufacturer of the part and it is stated that the cost of the moulds is not amortised in the cost of the parts.

6.3 Having seen the factual position, the relevant statutory provisions are examined as under. Supply is defined under Section 7 of the CGST Act 2Ol7 and the same is reproduced below for reference:

7. (1) For the purposes of this Act, the expression “supply” includes(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, Licence, rental, lease or disposal made or agreed to be made for a consideration bg a person in the course or furtherance of business;

(b) import of services for a consideration whether or not in the course or furtherance of business; and

(c) the activities specified in Schedule I, made or agreed to be made without a consideration;

(1A) where certain activities or transactions constitute a supply in accordance with the provisions of sub-section (1), they shall be treated either as supply of goods or supply of services as referred to in Schedule II.;

Schedule II determines the list of activities to be considered as supply of goods/Services and entry Sl.No. 1 is as follows: 1. Transfer

(a) any transfer of the title in goods is a supply of goods;

From the above, it is evident that ‘transfer of the title in goods’ is the supply of goods. In the case at hand, there is transfer in title of moulds for consideration and the supply is in the course of business, therefore, the same constitutes the supply of goods and GST is liable to be paid on such supply.

7. In view of the above, we rule as under:

Ruling:

- GST is applicable on the transfer of title in moulds from the applicant to the India buyer

2. The question is not answered as the same is not in the ambit of this authority as per Section 97(2) of the Act.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.