Tax Liability on Issue of Gift Vouchers.

Case covered:

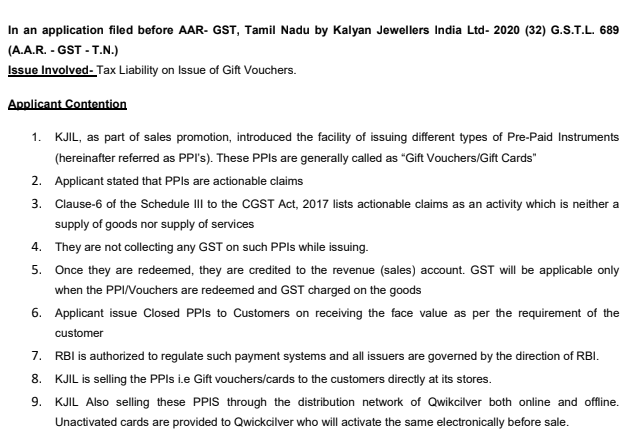

Kalyan Jewellers India Ltd

Issue Involved:

Tax Liability on Issue of Gift Vouchers.

Applicant Contention:

1. KJIL, as part of sales promotion, introduced the facility of issuing different types of Pre-Paid Instruments (hereinafter referred to as PPI’s). These PPIs are generally called as “Gift Vouchers/Gift Cards”

2. The applicant stated that PPIs are actionable claims

3. Clause-6 of the Schedule III to the CGST Act, 2017 lists actionable claims as an activity which is neither a supply of goods nor supply of services

4. They are not collecting any GST on such PPIs while issuing.

5. Once they are redeemed, they are credited to the revenue (sales) account. GST will be applicable only when the PPI/Vouchers are redeemed and GST charged on the goods

6. Applicant issue Closed PPIs to Customers on receiving the face value as per the requirement of the customer

7. RBI is authorized to regulate such payment systems and all issuers are governed by the direction of RBI.

8. KJIL is selling the PPIs i.e Gift vouchers/cards to the customers directly at its stores.

9. KJIL Also selling these PPIs through the distribution network of Qwikcilver both online and offline. Unactivated cards are provided to Qwickcilver who will activate the same electronically before the sale.

Order:

1. It is not a claim to a debt nor does it give a beneficial interest in any movable property to the bearer of the instrument.

2. If the holder of the gift card/voucher loses or misplaces the instrument itself becomes invalid. Thus it is not an actionable claim as defined under the Transfer of Property Act.

3. PPIs under consideration squarely falls under the definition of ‘Voucher’ as defined in Section 2(118) of CGST Act.

4. Those instruments which satisfy the conditions of being accepted as consideration/part consideration against the purchase of specified goods and the identities of the potential suppliers are indicated in the instruments are to be considered as ‘Vouchers’ for the purposes of GST. Applying the above, the PPIs under consideration are ‘Vouchers’ for the purposes of GST

5. It is neither money nor actionable claim

6. Gift vouchers/cards issued by the applicant being ‘vouchers’ under the CGST/TNGST Act are “Goods” as per Section 2(52) of CGST and TNGST Act

7. supply of voucher qualifies as “supply” under Section 7 of the CGST Act/TNGST Act, specifically as the supply of goods

8. The PPIs under consideration are ‘Vouchers’ time of supply is governed by the provisions under Section 12(4) of the CGST Act- Date of issue of vouchers if the vouchers are specific to any particular goods. If the gift vouchers/gift cards are redeemable against any goods bought, the time of supply is the date of redemption of voucher.

9. In the case of paper-based gift vouchers classifiable under CTH 4911, the applicable rate is 6% CGST as per Sl. No. 132 of Schedule II

10. Gift cards, the same are classifiable under CTH 8523 and the applicable rate is 9% CGST as per Sl. No. 382 of Schedule III.

Download the copy:

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal