Service Tax Refund on Flat Cancellation

Introduction:

The Comm. of GST and CX (Appeals), Mumbai, grants service tax refund in case of flat cancellation.

Held that, no service has been provided by the builder to the appellant as the consideration for service was returned and the service contract got terminated.

The service tax paid by the appellant is in the nature of the deposit and not service tax.

The date of cancellation of the flat will be considered as the relevant date for calculating the time limit of one year, as the event that led to the refund of taxes is the cancellation by the buyer.

The claim is not hit by the doctrine of unjust enrichment.

Case Covered:

Mr. Haresh V Kagrana (HUF)

Versus

Deputy Commissioner (Refund) CGST & CX

Facts of the Case:

The facts of the case, in brief, are that the appellant had booked a residential flat in a project of M/s. Bharat Infrastructure & Engineering Pvt. Ltd.(ST Registration No. AABC3630PST001) for the total agreement value of Rs. 52,58,245/- on 28.12.2015. M/s. Bharat Infrastructure & Engineering Pvt. Ltd., issued invoice No. BIEPL/ECO/ST/1002/2015-16 dated 29.12.2015 and BIEPL/ECO/ST/1007/2015-16 dated 01.01.2016 to Mr. Haresh V Kagrana (HUF) on receipt of Rs. 25,00,000/- and 27,50,000/- on 24.12.2015 from the appellant for service tax (including SBC) amounting to Rs. 90,625/- and Rs. 99,688/- respectively.

Observations:

I find that no service has been provided to the appellant in this case and therefore, the provision of the relevant date of one year and date of payment as per Section 11B of CEA can not be made applicable in the present case. The service tax paid by the appellant is in the nature of the deposit and not service tax.

Notwithstanding the above, even if the payment is in the nature of service tax, the date of cancellation of the flat will be considered as the relevant date for calculating the time limit of one year, as the event that led to the refund of taxes is the cancellation would not have happened, the refund claim would not arise at all.

Order:

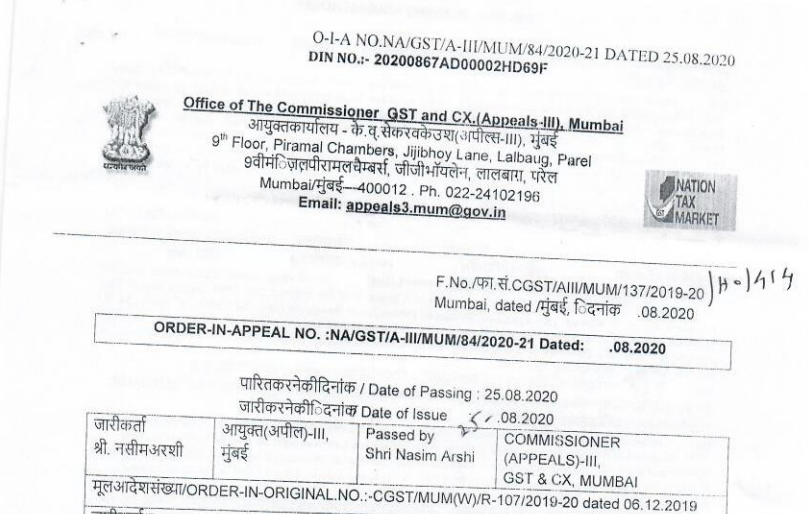

In view of the above findings, I set aside the Order-in-Original No. CGST/MUM(W)/R-107/2019-20 dated 06.12.2019 passed by the Deputy Commissioner (Refund) CGST, Mumbai West, and allow the appeal filed by the Appellant, Mr. Haresh V Kagrana (HUF), with consequential relief.

Read & Download the full Order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.