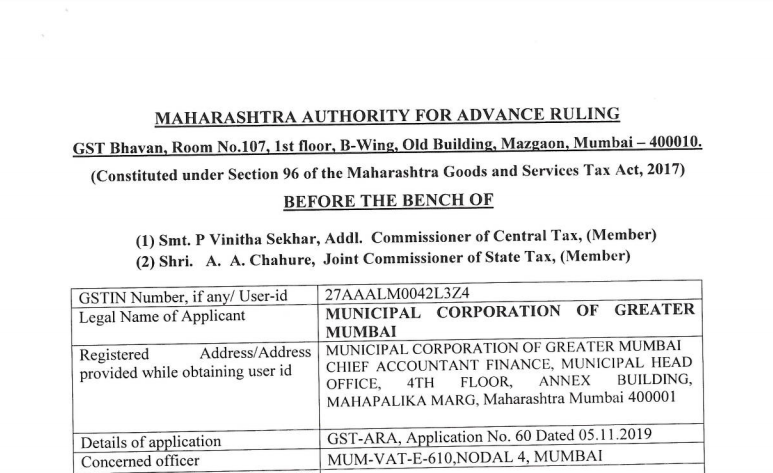

GST ARA order in case of M/s. Municipal Corporation of Greater Mumbai

Case Covered:

Municipal Corporation of Greater Mumbai

Facts of the case:

The present application has been filed under Section 97 of the Central Goods and Services Tax Act, 2017 and Maharashtra Goods and Services Tax Act, 2017[hereinafter referred to as ”the CGST Act and MGST Act” respectively] by Municipal Corporation of Greater Mumbai, the applicant, seeking an advance ruling in respect of the following question.

- Whether services provided by VFS Global to the applicant which are in the nature of the collection services should be exempt from GST as per the notification no. 12/2017 of CGST Rate) read with Notification No. 02/2018 CGST(Rate) being pure service provided to the local authority by way of any activity in relation to any function entrusted to a Municipality under article 243W of the Constitution of India.

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to any dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purpose of this Advance Ruling, the expression ‘GST Act’ would mean the CGST Act and MGST Act.

Observations:

We have gone through the facts of the case and the written submissions made by both, the applicant and the departmental authority. The issue before us is whether services provided by VFS to the applicant, which are in the nature of the collection of taxes, should be exempt from GST as per the Notification No. 12/2017 of the CGST(Rate) read with Notification no. 02/2018 CGST(Rate), being pure service provided to the local authority by way of any activity in relation to any function entrusted to a Municipality under Article 243W of the Constitution of India.

This authority is governed by the provisions of Chapter XVII of the CGST Act & the relevant Section 95 to 98, 102, 103, 104 and 105. As per Section 95, the term ‘advance ruling’ means a decision provided by this authority to the applicant on matters or questions specified in Section 97(2), in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.