claim of the input tax credit either by directing the respondents to open online portal or by directly them to allow the same manually

Case covered:

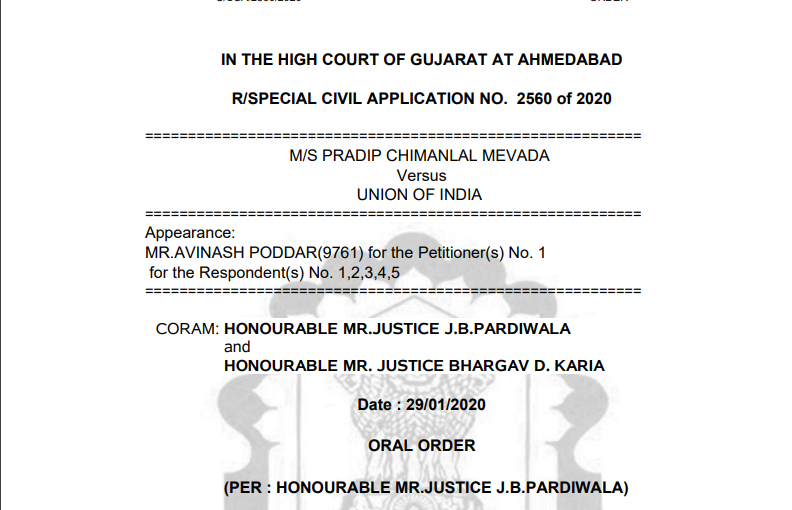

M/S PRADIP CHIMANLAL MEVADA

Versus

UNION OF INDIA

Facts of the case:

By this writ application under Article 226 of the Constitution of India, the writ applicant has prayed for the following reliefs: “(a) To issue writ or in the nature of a mandamus or any other appropriate writ, order, or direction the respondent to allow the petitioner to file the form GST ITC 01 in order to claim the input tax credit of the petitioner to which it is entitled as per the provisions of Section 18 of the CGST and GGST Acts, 2017;

(b) To issue necessary writ(s), direction(s), and/or pass necessary order(s) directing the respondents to allow/consider the bonafide intentions of the petitioner and grant the claim of the input tax credit either by directing the respondents to open online portal or by directly them to allow the same manually; (c) to issue necessary writ(s), direction (s) and/or pass necessary order(s) directing the respondent Revenue to not to deprive the petitioner’s vested right due to bonafide error of the accountant of petitioner and instead apply the law based on the provisions of the CGST Act;

(d) Pending admission, hearing and till final disposal of this petition, Your Lordships may be pleased to direct the respondents from resorting to any coercive measure against the petitioner. (e) To issue an order(s), direction(s), the writ(s) or any other relief(s) as this Hon’ble Court deems fit and proper in the facts and circumstances of the case and in the interest of justice. (f) To award costs of and incidental to this application be paid by the respondents.”

Download the copy:

Observations of the court:

Having heard the learned counsel appearing for the writ applicant and having gone through the materials on record, we dispose of this writ application with a direction to the Joint Commissioner of State Tax, Mahesana Division, Mahesana to immediately look into the request made by the writ applicant to upload ITC01 vide representation dated 13th January 2020 at Annexure: ‘N’ to this petition and also look into the communication dated 18th October 2019 referred to above of the office of the Commissioner, Central GST Gandhinagar. The Joint Commissioner of State Tax is, accordingly, directed to take an appropriate decision in this regard and communicate the same to the writ applicant within two weeks from the date of receipt of the writ of this order.

With the above, this writ application is disposed of. Direct service is permitted.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.