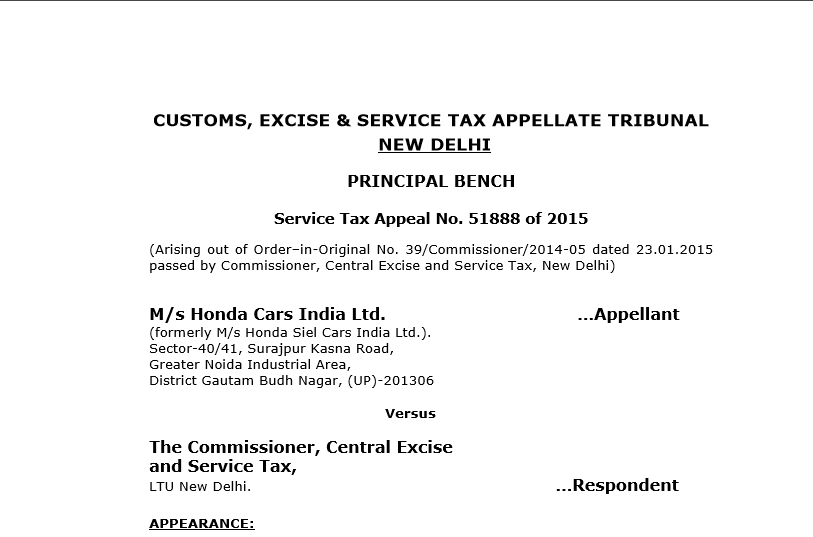

CESTAT in the case of M/s Honda Cars India Ltd.

Case Covered:

M/s Honda Cars India Ltd.

Versus

The Commissioner, Central Excise and Service Tax

Facts of the Case:

M/s Honda Cars India Ltd. has sought the quashing of the order dated January 23, 2015, passed by the Commissioner of Central Excise and Service Tax, New Delhi, by which the demand for service tax has been confirmed with penalty and interest, after invoking the extended period of limitation contemplated under the proviso to section 73(1) of the Finance Act 1994.

The appellant, a manufacturer of motor vehicles in India, entered into a “Technical Collaboration Agreement‟ dated April 1, 2010, with Honda Motor Co. Limited Japan 5 for receiving technical and proprietary information for manufacturing new models of cars. Subsequently, the parties entered into a „Model Agreement‟ dated May 31, 2011, for the launch of a new model of „Honda Civic‟ in India. This Model Agreement provided that the model fee and royalty fee would be determined as per the Technical Agreement.

Observations:

The contention of the learned authorized representative of the Department is that between the execution of the Model Agreement and the Termination Agreement, some technical information must have been furnished on a regular basis by Honda Japan and, therefore, the Termination Agreement cannot undo the technical information already provided by Honda Japan. In this connection the learned Authorized Representative of the Department has also made reference to the amount to JPY 400,000,000/- that was required to be paid in terms to the Model Agreement/ Termination Agreement

towards the first installment.

Decision:

In view of the aforesaid discussion, it has to be held that the amount paid by the appellant to Honda Japan was not towards any consideration for a taxable service. It is, therefore, not possible to sustain the demand confirmed by the Commissioner (Appeals).

It would, therefore, not be necessary to examine the other contentions raised by the learned counsel for the appellant to assail the order passed by the Commissioner (Appeals).

Thus, for all the reasons stated above, the order dated January 23, 2015, passed by the Commissioner (Appeals) is set aside and the appeal is allowed.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.