CESTAT in the case of M/s. DLF Cyber City Developers Ltd Versus C.C.E.

Case Covered:

M/s. DLF Cyber City Developers Ltd

Versus

C.C.E.

Facts of the Case:

The facts of the case are that the appellant-assessee is engaged in providing various taxable services and is registered with the department paying service tax thereon. During the course of the Audit, it was found that the appellant-assessee has provided a corporate guarantee to various banks/ financial institutions on behalf of their holding companies / Associate enterprises/ Joint Venture and Other loan facilities. The Revenue alleges that such activity is taxable under Banking and Finance Institution Services whereas the appellant-assessee is contesting that they are not liable to pay service tax on the said activity as they have not received any consideration for providing a corporate guarantee to various banks on behalf of their associates. In these set of facts, the two show-cause notices were issued to the appellant-assessee to demand service tax on the corporate guarantee provided by the appellant-assessee to various banks/ financial institutions on behalf of their holding companies / Associate enterprises for their loan or overdraft facility under Banking and Financial Institutions after or before 01.07.2012.

Observations:

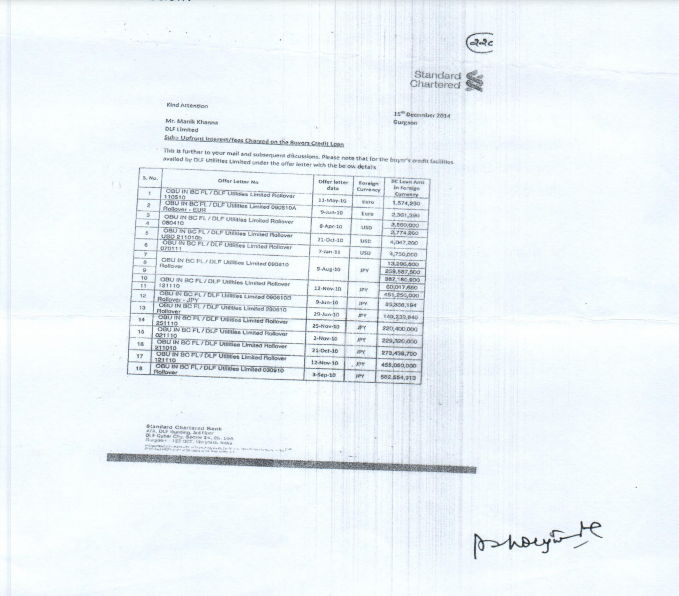

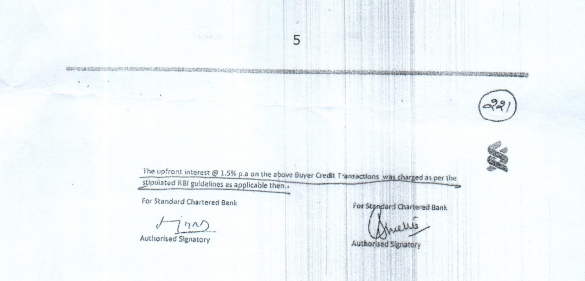

We have find that if it is an interest then service tax is not payable by the appellant in terms of Circular No. F. No. B2/8/2004-TRU dt. 10.09.2004 wherein interest on the loan is not part of taxable value. We have gone through the facts of the case and the respondent has produced a letter from the Standard Chartered Bank dated 15.12.2014 to show that the Offshore Upfront Fee is nothing but interest on buyer credit transaction as stipulated by RBI Guidelines. For better appreciation, the said letter has extracted herein below:

Decision:

Ongoing through the said letter, we hold that the said amount on which the service tax is being demanded and Upfront Fee is nothing but interest and on the interest, no service tax is payable by the respondent, therefore, we hold that the respondent is not liable to pay service tax on the said amount. Accordingly, we do not find any infirmity with the impugned order qua dropping the demand against the respondent. Therefore, we do not find any merit in the appeal filed by the revenue. Accordingly, the same is dismissed.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.