AAR observing the tax rate of “Parota” 18% is void ab initio

Case Covered-

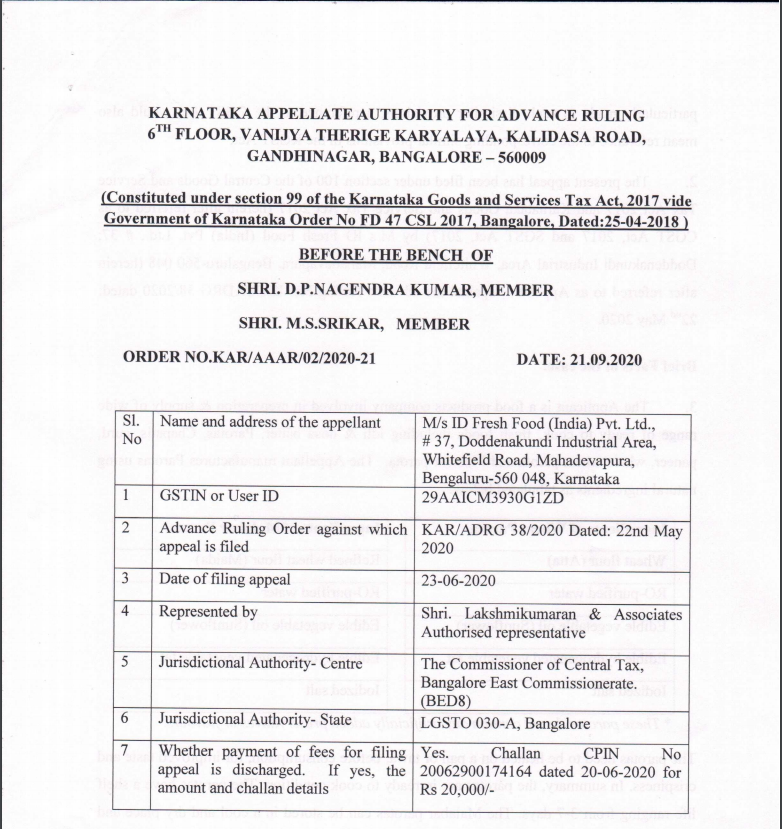

Applicant- M/s ID fresh food (India) Pvt ltd.

AAAR Karnataka

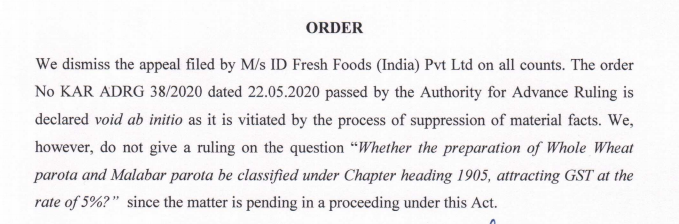

The tax rate of “Parota” 18% is void ab initio

You must have heard about this headline. Some months back it was the news of the town. The tax rate of Parota 18% was the decision of AAR in the case of M/S ID Fresh food (India) Pvt. Ltd. But now the AAAR has decided that the ruling of AAR was void ab initio.

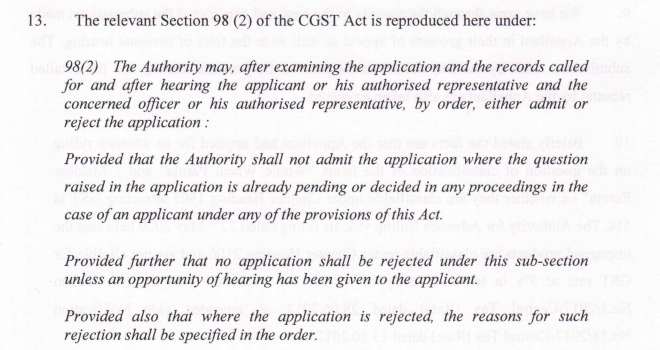

The case reached a completely different footing. When The department revealed that the investigation of DGGI already started in this case. The fact was suppressed by the appellant. Then the argument got a new direction. The proviso to section 98(2) provides that if there is any decision or proceedings in the same issue, the applicant is not eligible for an Advance ruling. But the fact that an investigation of DGGI is there, in this case, was not revealed by the applicant.

Order-

But the authority said that the proceedings are a very comprehensive term and generally means a prescribed course of action for enforcing a legal right. Hence it necessarily embraces the requisite step by which judicial action is invoked. The investigation in tax administration is such a step towards the action of issuance of a show-cause notice which culminates in a decision.

Therefore commencement of investigation in terms of section 67 of the CGST Act can be said to be the start of a proceeding to safeguard the government revenue.

Thus the term “proceedings” in the proviso to section 98(2) will cover the investigation.

Read and download the full copy of the decision

IDFreshFood(India)PvtLtd

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.