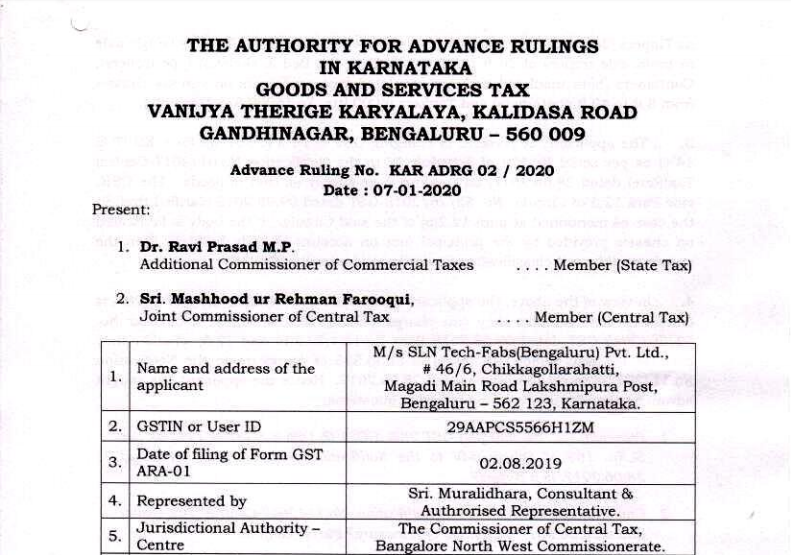

AAR Karnataka Order in the case of M/s SLN Tech-Fabs(Bengaluru) Pvt. Ltd.

Case covered:

M/s SLN Tech-Fabs(Bengaluru) Pvt. Ltd.

Facts of the case:

The applicant is a Private Limited Company and is registered under the Goods and Services Tax act, 2017. The applicant is engaged in providing services in the area of Transport Solutions, in the field of fabrication and truck bodybuilding area, with the trademark ”SLN Diamonds”, for transport equipment such as Tippers (200 to 500 ft capacity on 6 to 10 wheelers vehicles), trailers (single axle to the multi-axle trailer of 20 to 40 ft Low Bed, Fat Bed & skeleton-type trailers), Containers (both insulated and non-insulated type containers on various chassis from 8ft to 40ft containers) and Tankers (6000 Ltrs. capacity).

The applicant, at present, is charging GST @ 28% (CGST @ 14% + KGST @ 14%) as per serial no. 169 of schedule IV to the Notification No. 01/2017-Central Tax (Rate) dated 28.06.2017, on treating their supply as that of goods. The CBIC via Para 12.3 of Circular No. 52/26/2018-GST dated 09.08.2018 clarified that in the case as mentioned at para 12.2(b) of the said Circular if the body is fabricated on chassis provided by the principal (not on account of the bodybuilder), then the supply would merit classification as service and attracts 18% GST.

Observations:

We have considered the submissions made by the applicant in their application for advance ruling as well as the submissions made by Sri. Mursalidhara, consultant & duly authorized representative of the applicant during the personal hearing. We have also considered the issues involved, on which advance ruling is sought by the applicant, and relevant facts.

At the outset, we would like to state that the provisions of both the CGST Act and the KGST Act are the same except for certain provisions. Therefore unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the KGST Act.

We proceed to examine the issue of whether the activity of the applicant is akin to that of the one mentioned in the circular and the benefits of classification of the activity as service be extended to them.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.