A.F.BABU versus UNION OF INDIA:assesee cannot be deprived of the substantive benefit under the GST Act merely on account of a technical procedure

Case covered:

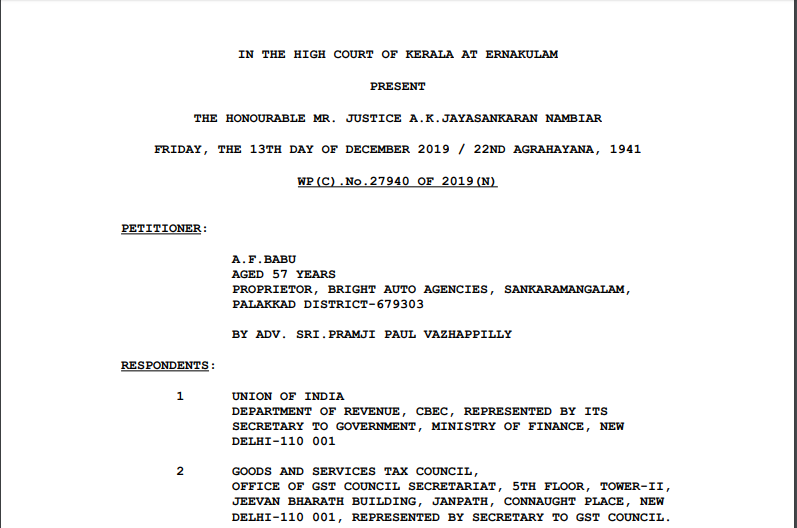

A.F.BABU

versus

UNION OF INDIA

Facts of the case:

On a consideration of the facts and circumstances of the case and the submissions made across the bar, I find that, while it is a fact that the petitioners did not make an attempt to log into the system before 27.12.2017, the cut-off date prescribed by the respondents for uploading the TRAN-1 Form to the web portal, I find that the petitioners were guided by a press release of the GST Council, which suggested that they could upload the statutory form on any date before 31.12.2017.

Download the copy of the order

The petitioners in both these Writ Petitions were assessed under the Kerala Value Added Tax Act, 2003, who migrated to the GST regime pursuant to the enactment of the Central Goods and Service Tax/ State Goods and Service Tax (CGST/SGST) Act, 2017. The petitioners, consequent to their migration to the GST regime, were entitled to carry forward the tax paid on the purchase of goods during the VAT regime to the GST regime and to avail credit under the later regime. The transition provisions, which govern the transfer of credit under the CGST/SGST Act and Rules are Sections 139 to 143 of the Act and Rule 117 of the SGST Rules. As part of the procedure for the transfer of credit, the petitioners had to file a declaration in Form GST TRAN-1 on or before 27.12.2017 for the purposes of successfully migrating the credit to the GST regime. In both these Writ Petitions, the grievance of the petitioners is essential that they had come across a press release by the GST Council, which indicated that the last date for uploading the details in the GST portal for the purposes of carrying forward the accumulated credit from the erstwhile regime was extended up to 31.12.2017. Relying on the said press release, the petitioners sought a clarification from the GST Network, on finding that the web portal had closed by 27.12.2017, as to when the portal would re-open again for them to upload the necessary details for migration of the credit to the GST regime. The respondents however clarified that inasmuch as the petitioners had not made any attempt to log into the system before 27.12.2017 their request for migration of credit could not be accepted. In these Writ petitions, the communications issued to them by the respondents denying them the facility of transfer of accrued credit are impugned, inter alia, on the contention that the substantial rights available to them under the GST Act cannot be deprived solely on account of a technical lapse that was occasioned at the instance of the respondents.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.