High-Density Polyethylene Woven Tarpaulin does not fall Under HSN 6306: AAR

High-Density Polyethylene Woven Tarpaulin does not fall Under HSN 6306: AAR

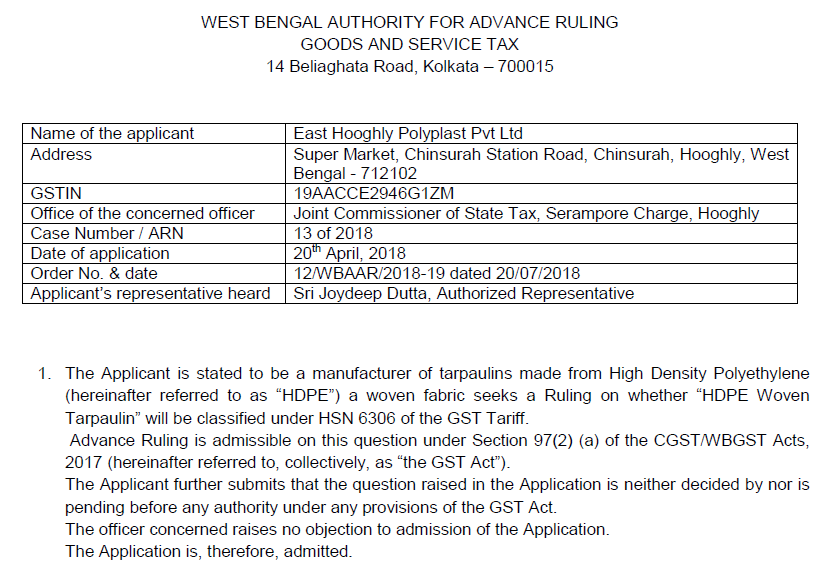

An advance ruling is given by the Authority of the advance ruling of West Bengal. The Applicant manufactures Tarpaulins made of High-Density Polyethylene Woven Fabrics as well as Plastic tarpaulins. The High-Density Polyethylene Woven Tarpaulin is much stronger and durable than other tarpaulins. The Applicant also submits that tarpaulins made from High-Density Polyethylene woven fabric are different from plastic tarpaulins. The former is derived by weaving method using power looms after textile processing. The latter is derived from plain plastic sheets by cutting into shapes and stitching thereafter.

The Applicant submits that High-Density Polyethylene Woven Tarpaulins. Though made from HDPE, are articles of textile, and, therefore, should be classified under HSN 6306 of the GST Tariff.

Explanatory Notes of Notification No 1/2017-CT (Rate) dated 28.06.2017 (1125 – FT dated 28/06/2017 of State Tax) (hereinafter referred to as the “Rate Notification” of GST states the rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

Since HDPE falls under Chapter 39, keeping in mind the Section Notes and the Tariff Heading description it is, therefore, important to ascertain, both, the width of the fabric strip that goes into the weaving and whether or not the tapes are impregnated, coated, covered or laminated with plastics or articles thereof, of Chapter 39.

Nowhere in the Application, nor in the report submitted by the officer concerned are these two conditions, namely, the width of the tape used for weaving and whether or not the tapes are impregnated, coated, covered or laminated with plastics or articles thereof, of chapter 39, stated.

Issue/Question raised in the Advance Ruling:

Whether High-Density Polyethylene Woven Tarpaulin will be classified under HSN 6306 of the GST Tariff.

Download the full facts and reasoning for the advance ruling. Regarding the High-Density Polyethylene Woven Tarpaulins. Click the below image:

Ruling:

‘Tarpaulins made of HDPE woven fabrics’ will not be classified under HSN 6306 of the GST Tariff.

This Ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.