India At Last Finding Some Ways to Regulate Imports

- Curbs on Non-Essential Goods: Ways to Regulate Imports

- Impact of High Levels of Import:

- India’s Overall Imports

- Why Import from China?

- Chinese Kites in the Indian Skies:

- Indian Festive Celebrations with Chinese Crackers: Diwali Lights Delighting Chinese Economy:

- Chinese Toys – Indian Joy for Kids

- Made in China Tricolor – Flying in India as National Flag ‘Tiranga’

- Rising Import of Garments from Bangladesh – A Serious Concern

- Anything that’s Foreign is Crazy to Indians – Imports of Consumer Durables Soaring up

- Anything You Pick that May have Chinses Tag

- Government Sets Up High-Level Committee to Reduce India’s Import Dependence

- Some of the Measures to Curb Import

- Government prohibits imports of unregistered, non-complaint electronics and IT goods

- Notification No. 17/2015-2020; Dated: 5 September, 2019

- Notification No. 14/2015-2020; Dated the 28 August, 2019

- Notification No. 24/2015-2020; 11th October, 2019

- Other Proposals in Pipeline:

- This Move is to aid customs curb imports that do not meet quality standards or are in violation of trade norms.

Curbs on Non-Essential Goods: Ways to Regulate Imports

Imports are foreign goods and services that are produced in a foreign country and sold to domestic residents of a country. If a country imports more than it Exports it runs a Trade Deficit. When a country has a trade deficit, it must borrow from other countries to pay for the extra imports. India is traditionally a Trade Deficit Country.

Impact of High Levels of Import:

Imports make a country dependent on other countries’ political and economic power. That’s especially true if it imports Commodities and consumables, such as household items, daily consumables, electronic gadgets, food, oil, and industrial materials. It’s dangerous if it relies on a foreign power to keep its population fed and its Domestic Industry humming and droning. It’s even more perilous when Non-essential and daily used consumables are also imported leading the economy to fall & perish.

India’s imports are growing faster than exports. This means that unless India is careful, it could end up digging a big hole into which it could trip and fall – worsening India’s balance of payments (BoP).

Countries with high import levels must increase their Foreign Currency Reserves. That’s how they pay for the imports. That can affect the domestic currency value, inflation and interest rates and therefore economy may shackle.

Domestic companies with many constraints, restrictions and uncompetitive environment must compete with the imports. Small businesses that can’t compete will fail and collapse.

The large number of employment opportunities are created with use of relatively less capital in the MSME sector. Though MSMEs are small investment enterprises, their contribution to the Indian economy is very significant. MSME Contribution of output (about 45% of manufacturing output), exports (about 40% of the total exports) and employment (about 111 million persons)

As per the National Sample Survey (NSS) 73rd round conducted during the period 2015-16, MSME sector has been creating 11.10 crore jobs (360.41 lakh in Manufacturing, 387.18 lakh in Trade and 362.82 lakh in Other Services and 0.07 lakh in Non-captive Electricity Generation and Transmission) in the rural and the urban areas across the country.

Since they create around 65 percent of all new jobs, that will affect employment if Non-Essential Imports are continuing to flood into the Country.

As sales volumes dwindle, Domestic Companies may also lose Competitive Advantage and may fall in Financial Crunch. The Spiral impact of un-controlled imports are being seen for many years in India, resulting in closure of enterprises specially, small manufacturing units, increased un-employment, stressed finances, increased NPA of Banks for non-repayment of loans by businesses, down fall of economy etc… etc….

India’s Overall Imports

India’s overall imports in April-November 2019-20* are estimated to be USD 408.02 billion, exhibiting a negative growth of (-)5.30 per cent over the same period last year, however still very high compared to exports of USD 353.96 billion for the same period.

India’s Total Merchandize Imports recorded 38.1 bn USD in Nov’2019, compared with a value of 37.4 bn USD in the previous month. The data reached an all-time high of 46.6 bn USD in May’2019.

Non-oil imports in April-November 2019-20 were USD 233.78 billion which was 7.33 per cent lower in Dollar terms, compared to USD 252.27 billion in April-November 2018-19.

Why Import from China?

Visit any Market Place in India or go to any Shopping Mall or visit any online retail site, you will find attractive and cheap Chinese products everywhere whether it’s electronic gadgets, crackers, decoration items, electrical goods, kitchen items or other daily consumables, you will find a cheaper Chinese version for almost everything.

Due to cheap prices, wide availability and attractive outer look and huge profit dissemination to the dealers, Chinese Products becoming best choice for business as well as for Indian consumers. Chinese firms focus on the mass production and consumption strategy, which is the main reason why their products are low cost. On top of that, the Government of China has export-friendly policies and flouts many international norms and laws. Although, these cheap products that usually come at the price of 10-70 percent lower than their original counterparts, help consumers save their hard-earned money; however, they are impelling a negative impact on the Indian economy.

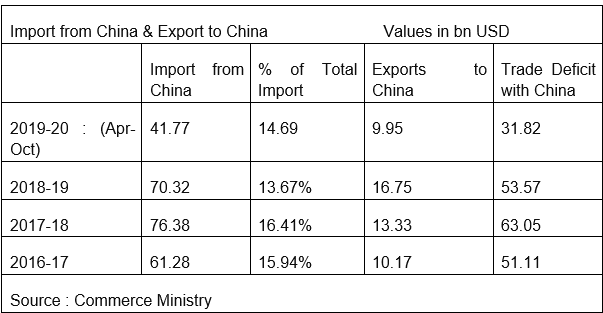

Bilateral trade between India and China increased from USD 38 billion in 2007-08 to USD 89.6 billion in 2017-18. While imports from China increased by USD 50 billion, exports increased by USD 2.5 billion only during the same period. This has widened India’s trade deficit. Trade gap with China is becoming uncomfortably large. Trade with China constitutes more than 40% of India’s total trade deficit.

Realizing adverse impact of fast growing non-essential Imports, India at last taken some measures to lower the in-discriminate imports from China, that has already resulted in narrowing trade deficit (difference between imports and exports) with China to USD 53.56 billion in 2018-19 from USD 63 billion in the previous financial year and further in the current fiscal also the declining trend is seen.

Chinese products are affecting not just the domestic businesses and industrial market, but also the export market of India as many people are replacing Indian goods with Chinese ones. The Made in China label has become the most preferred choice in India and other countries due to price factor and availability large varieties.

Talking about how Cheap Chinese Non-Essential Imports affecting the Indian economy largely is one of the major concerns and let’s now discuss some of the effected MSME sectors:

Chinese Kites in the Indian Skies:

Flying kites is a time-honoured tradition during Sankranti season played mostly in Gujarat, Madhya Pradesh, Punjab, Rajasthan and some parts of Telangana also. Chinese imports hit India’s Rs 1,200 crore kite market – dwindling fortunes of the kite industry in India.

Indian kites are mostly square-shaped while Chinese kites are triangular. The foreign kites are also high on decoration and available in the shape of eagles, dragons and so on. Unlike the paper-made Indian kites, they are made of nylon and have a stronger manja (thread), which also uses nylon. Chinese kites are preferred for their stability and attractive varieties.

Chinese manjha was banned in the national capital by the government on January 10, 2017. The notification put a ban on sale, production, storage, supply, import and use of kite flying thread made out of nylon, plastic or any other synthetic material — including ‘Chinese manjha’ and any other kite flying thread that is sharp and laced with glass and metals. Though the ban was imposed, the authorities have failed to implement the ban, as sale of Chinese Kites are seen the Indian Skies.

Indian Festive Celebrations with Chinese Crackers: Diwali Lights Delighting Chinese Economy:

Unchecked Import of Chinese Crackers having very nice-looking and packed are drawing attention of customers due to their low price. A majority of buyers get attracted to these products for which the revenue of the India’s domestic cracker industry has to bear the brunt. The Domestic Firecracker industry which is valued at over Rs 6,000 crore, and is one of the most labour-intensive industries was dented beyond recovery. The industry which has over 1,000 manufacturing units around Sivakasi – a major hub for fireworks unable to sustain the Chinese competition. Chinese Import has affected the livelihood of over 5,00,000 households in Sivakasi and 4,00,000 small factories in West Bengal.

Chinese origin Fireworks are known to contain Sulphur and other Hazardous substances like potassium chlorate, a highly explosive chemical which is banned in India. The colour inducing chemicals and Nitrates when mixed with Sulphur, an important ingredient for manufacture, becomes extremely reactive and create a lot of pollution in the country and also creating health related problems.

The Chinese Crackers are not only dangerous for the environment but are also against Explosive Rules, 2008 as they contain other banned chemicals like red lead, copper oxide and lithium among others.

“The import of firecrackers is ‘Restricted’ in terms of the ‘Foreign Trade Policy’ and is allowed only against an import license issued by the Director-General of Foreign Trade. As soon as the ban was in effect, an illegal trade began with China because Chlorate is much cheaper than its alternatives. It has also been observed that in order to circumvent the licensing requirements, unscrupulous importers are indulging in the illegal import of firecrackers by any misdeclaration and concealment. The Government is warning against the purchase of such illegal crackers not only because it harms the Indian Industry but also because it is extremely dangerous for health.

After a gloomy 2018 in the wake of the Supreme court banning the conventional crackers on pollution grounds, the Domestic industry which provides livelihood to eight lakh people in and around this arid town – sivakashi is struggling in meeting the demand for green crackers.

The Court defined ‘green cracker’ as something that could be an improved formulation or an all new formulation. The Council of Scientific and Industrial Research (CSIR) and National Environmental Engineering Institute (NEERI) began work on designing a green cracker.

The changeover to green crackers after extensive experiments is a great challenge. While the Domestic Industry is Struggling to Comply with Regulatory Requirements on one side and Combat Cheap Chinese Import other side, huge quantity of hazardous Chines Fireworks is continued to reaching India illegally ahead of Diwali time.

Directorate of Revenue Intelligence (DRI) has warned all investigating and intelligence agencies that “It is requested that the field formations under your jurisdiction may be sensitized and suitably alerted to carefully assess and examine consignments of consumer and miscellaneous goods imported by traders from China and other countries in order to rule out the possibility of such illegal imports.” However these warning are proving ineffective. Regulations and Restrictions are more for Domestic Industry and lenient towards Imports.

Chinses Made Indian Gods

Gaily coloured resin figurines of Deities –beautifully rendered images and Idols of Hindu Gods / Goddesses are bountifully overflowing in India and available everywhere. Most shopkeepers do not know where the figurines were manufactured or originated, or sometimes even though know the source will not tell and conceal the truth considering sentiments and faith of some sects. Unfortunately, we Indian Hindus often unaware of or knowingly unknown take of facts that the Chinses Made Indian Gods adorn our Pooja Rooms & Mandirs – a Sanctum-Sanctorum.

Even it is shame, that diyas (deepam, pramida – an oil lamp usually made from clay, with a cotton wick dipped in ghee or vegetable oils) and agarbattis (Incense sticks) are being Imported from China and Prayed before Gods / Goddesses.

Increasing imports of mass-produced idols of Hindu deities from China – by the millions flooding since several decades – early 2000. Though the sale of Chinese goods has witnessed a major drop in this festive season, as about 60% less Chinese products were sold this year, however, Indians still purchased Chinese goods worth about Rs 3,200 crore while items worth Rs 8,000 crore were sold in the country during the Diwali last year, industry body CAIT said in a statement.

Chinese Toys – Indian Joy for Kids

The toys industry in India is primarily in the unorganised sector, comprising about 4,000 small and medium enterprises. About 85 per cent of toys are imported in the country, with maximum coming from China. It is followed by Sri Lanka, Malaysia, Germany, Hongkong and the US.

Many of the Chinese Products are of Poor Quality, but the Indian Consumers are Very Price Sensitive and so Imports Continued to peaking up and Indigenous Industry almost vanished – simply now we have no other Alternative – Forced Dependency Syndrome.

According to the ASSOCHAM, the Indian market is full of Chinese toys, so the Indian toy industry is struggling hard to survive. Nearly 40 percent of Indian toy companies have been closed in the last five years, and rest 20 percent are struggling to break even. In fact, the Chinese toy market is the largest in the world. Cheap Chinese products have become the reason for the shutdown of nearly 60 percent of the industrial units in Bhiwandi and Thane.

Made in China Tricolor – Flying in India as National Flag ‘Tiranga’

It’s a great shame to the nation that even our National Flag is also being imported from China and we proudly celebrating our Independence Day and Republican Day by flying high our Triclour.

Indian Medicines : Surviving with Chines Support

Heavy Dependency on Chinese Intermediates and Raw Materials for Industrial Use

A rise in imports of intermediates and raw materials reflect growing economic activities. However, inbound shipments of final goods impact domestic manufacturers.

China accounted for 67.56 per cent of total imports of bulk drugs and drug intermediates in 2018-19 at $2,405.42 million. The import of bulk drugs and drug intermediates from China stood at $2,055.94 million in 2017-18, accounting for 68.68 per cent of their total import.

India imports bulk drugs / active pharmaceutical ingredients (APIs) for producing medicines including certain essential medicines. According to Pharmexcil, in 2018/19, India imported Rs 17,400 crore worth of APIs from China and exported APIs worth around Rs 1,600 crore. This shows India still has to cover a long distance in substantially reducing its China dependence. The department of pharma has identified 125-130 items which are banned but are being imported as chemicals.

Now we reached a stage where without Chinese Import Support Indian Pharma Industry can’t survive. As India is a signatory to the WTO and TRIPs agreement, as such the import restrictions have been removed.

However, Chines Regulations on API firms may be an Opportunity for Indian Industry to make it sufficiently self-reliant in end-to-end indigenous drug manufacturing and become globally competitive, provided the policies of the government are designed to minimise the country’s dependence on imports and to give fillip to indigenous manufacturing.

As per new Chinese regulations become effective from Jan’2017, API firms that pollute will have to pay a tax to local Government. China’s environmental tax will mean higher costs for drug and API firms that rely on intermediates made in the country. The tax replaces the previous “pollution discharge fee” system that saw local environmental authorities collect fees based on the volume

Rising Import of Garments from Bangladesh – A Serious Concern

India’s second-largest job provider, the Textile Sector continues to gasp for growth. The Textile and Apparel Exports have declined from $38.60 billion in 2014 to $37.12 billion in 2018 while imports have increased from $5.85 billion to $ 7.31.

A huge jump in duty-free garment imports from Bangladesh under the free trade agreement has put the domestic industry in a fix. This comes amidst slowing domestic demand and banks curtailing credit to 80 per cent of MSMEs (micro, small and medium enterprises) in the sector.

Import of garments from Bangladesh was up 82 per cent to $365 million last fiscal. It has been growing steadily at a CAGR (compounded annual growth rate) of 52 per cent and is expected to touch $3.6 billion by 2024-25. This will render about 10 lakh people jobless with most of the small garment industry shutting shop.

Anything that’s Foreign is Crazy to Indians – Imports of Consumer Durables Soaring up

In fiscal year 2019, India imported electronic products valued at nearly four trillion rupees. This sector of imports accounted for nearly 11 percent of all imports into the country that year. Products include computer hardware, consumer electronics, electronic components and instruments and telecom instruments.

India imported nearly $2 billion of finished televisions, washing machines, refrigerators, vacuum cleaners, digital cameras and mixer grinders in FY18. Moreover, these imports have been rising rapidly–up 35% in FY18. Mobile phone imports touched $3.5 billion.

Despite all the noise government has been making around ‘Make in India’, imports of consumer durables have significantly risen in FY19 and are several times higher than exports. The increase in import duties on Chinese goods last year has not helped much, as the free trade agreements with a few countries is still marring domestic production.

As per the DIPP data, imports of refrigerators are 150 per cent higher than exports. In FY19, the country imported Rs 3,919.71 crore worth refrigerators against exports of Rs 1,568.47 crore. While the imports went up from Rs 3,497 crore in FY18 to Rs 3,919 crore in FY19, the exports declined from Rs 1,578 crore to Rs 1,568 crore.

The situation is not different for other durables. India’s imports of washing machines and laundry machines are 484 per cent higher than exports. In 2018-19, the country imported Rs 1,670.78 crore worth machines against exports of Rs 286.24 crore. While the imports went up 33 per cent from Rs 1,258 crore in FY18 to Rs 1,670 crore in FY19, exports dipped 10 per cent from Rs 320 crore to Rs 286 crore in one year’s time.

In the case of air conditioners, even production in the organised sector came down from 38.08 lakh units to 35.23 lakh units in FY19. The imports worth Rs 8,343 crore were 624 per cent higher than exports worth Rs 1,152 crore. Imports went up from Rs 7,495 crore in FY18 to Rs 8,343 crore in FY19.

Last year, India had doubled import duty on a few Chinese products, including air-conditioners, refrigerators and washing machines, from 10 to 20 per cent. The duty hike happened in September and by then most of the imports for festive sales had been made. Hence, the impact of duty hike did not reflect on the import figures. This year also the trend is not declined as expected. Chinese products are still finding an easy way into the market through countries like Thailand with which India has a free trade agreement.

Anything You Pick that May have Chinses Tag

Chinese items such as gifting, electrical gadgets and other items, fancy lights, kitchenware and appliances, plastic items, home decoration goods, toys, wall hangings, lamps, home furnishing items, footwear, garments and apparels etc are being sold in India, killing the indigenous small industry – most of them are home made cottage business mostly engaged by women. On the other side, trade gap between India and China is quite alarming hitting hard the economy.

The unsafe Chinese goods are of inferior quality and do not come with any guarantee or service. These products are not even long-lasting. There are many manufacturers in India that import cheap Chinese goods and then sell them under their own label. India fast becoming a Dumping Ground for Foreign Goods mostly from China. Indian Manufacturing Units and Business Premises are being Converted to Godowns to Stock Imported Foreign Goods. As a Consequence, More and More Jobs are being Created for Security Persons to Guard the Godowns and Delivery Boys to House Deliver the Foreign Goods sans Decent Employment.

Before it gets too late to act, Government must consider taking actions to reduce the import of these cheap and inferior quality Chinese goods to save its MSME units and economy. The government should encourage country’s small businesses to reduce the foreign goods and should also bring some serious changes in the policies, infrastructure, technology, and duties to protect the domestic manufacturers from these Chinese dumping.

Government Sets Up High-Level Committee to Reduce India’s Import Dependence

The government has set up a committee to implement policies required to reduce dependence on imports in the month of June. The committee is headed by Cabinet Secretary PK Sinha and have Secretaries from departments of commerce, industrial policy and promotion, skill development, revenue, defence production, steel, petroleum, electronics and telecommunications.

India is unveiled a number of steps to curb imports of several non-essential items.

The government has identified restrictions on non-essential imports as one of the ways in which to rein in the current account deficit and reduce pressure on the rupee. The products have been identified based on the recommendations of a committee and some actions are already taken and results showing up.

Government aims to restrict the import of goods such as gold, finished electronics, certain textiles, automobiles and high-end consumer products. The ministry is also looking at stricter quality control norms for toys industry by explicitly stating definition of toys to minimise evasion from compliance, the official added.

As a result of recent actions, Imports to India slumped 12.71 percent from a year earlier to USD 38.11 billion in November 2019, dragged by transport equipment (-48.53 percent), coal, coke & briquettes (-23.21 percent), organic & inorganic chemicals (-21.07 percent), petroleum, crude & products (-18.17 percent), electronic goods (-3.98 percent). In April-November, imports dropped 8.91 percent to USD 318.78 billion compared to the same period in the previous fiscal year. source: Ministry of Commerce and Industry, India

Some of the Measures to Curb Import

- Import of Agarbatti Restricted

Import policy of Agarbatti and other odoriferous preparations which operate by burning under Exim code 33074100 and “Others” under Exim Code 33074900 of ITC (HS) 2017 — Schedule — 1 (Import Policy) is revised from ‘Free’ to ‘Restricted’. Notification No. 15/2015-2020; Dated the 31 August, 2019

- DGFT Amends Import Policy for Toys / Dolls

Notification No. 33/2015-2020; Dated: 2nd December, 2019

Govt taking steps to ensure import and sale of quality toys in India. Quality control order on toys is one of the ways to stop flow of cheap sub-standard toys in the market.

To ensure import of quality toys, the notification prescribes that samples will now be randomly picked from each import consignment and will be sent to NABL accredited labs for testing and clearance.

If the sample fails to meet the required standards, the consignment will be sent back or will be destroyed at the cost of importer.

These measures are being implemented on the back of a study conducted by the Quality Council of India. According to the study, about 67 per cent of toys failed all safety and standard tests, while about 30 per cent of plastic toys failed to meet the safety standards of admissible levels of heavy metals and phthalates. Similarly, 80 per cent of these toys failed on mechanical and physical safety properties. In case of soft toys, 45 per cent failed on admissible levels of phthalates and 75 per cent of electric toys failed on mechanical standards.

-

Government prohibits imports of unregistered, non-complaint electronics and IT goods

Notification No. 5/2015-2020; Dated 7 May, 2019

Import of electronics and IT goods without registration with the Bureau of Indian Standards (BIS) is prohibited, according to the notification.

Under the Electronics and IT Goods (Requirement of Compulsory Registration) order 2012, imports of these goods is allowed through the registration with the BIS or on specific exemption letter from the ministry of IT and electronics (MeitY).

“Import consignment without valid registration with BIS shall be re-exported by the importer failing with customs shall deform the goods and dispose them as scrap under intimation to ministry of IT and electronics

- Amendment in import policy of Iron & Steel and incorporation of policy condition in Chapter 72, 73 and 86of ITC (HS), 2017, Schedule — I (Import Policy).

Amends the import policy from `free’ to ‘free subject to compulsory registration under Steel Import Monitoring System (SIMS)’ for the following items under Chapter 72, 73 and 86 of ITC (HS). 2017. Schedule — I (Import Policy) and insert a new policy Condition to these three Chapters – 284 Items at 8 Digit ITC (HS) level.

Notification No. 17/2015-2020; Dated: 5 September, 2019

The Steel Import Monitoring System (SIMS) shall require importers to submit advance information in an online system for import of items in the Annex and obtain an automatic Registration Number by paying registration fee of Rs.1 per thousand subject to minimum of Rs.500/ and maximum of Rs. 1 lakh on CIF value. The importer can apply for registration not earlier than 60th day and not later than 15th day before the expected date of arrival of import consignment. The automatic Registration Number thus granted shall remain valid for a period of 75 days.

Importer shall have to enter the Registration Number and expiry date of Registration in the Bill of Entry to enable Customs for clearance of consignment.

The SIMS will be effective from 21.11.2019, i.e. Bill of Entry on or after 21.11.2019 for items as listed in the Annex to this Notification (284 Items at 8 Digit ITC (HS) level) shall be governed by SIMS. (Notification No. 32/2015-2020; Dated: 13th November, 2019)

- Registration of Imported Vehicles in Compliance with Central Motor Vehicles Rules 2018

Registration of vehicles imported by the vehicle manufactures or through their authorised representatives in India or by the organisation / citizen for personal use, demonstration, testing, research or scientific use etc. shall comply with the Central Motor Vehicles (Eleventh Amendment) Rules, 2018.

Notification No. 14/2015-2020; Dated the 28 August, 2019

- Gold & Silver : Free Trade Agreements (FTAs) : Measure to Curb Misuse

Notification No. 36/2015-2020; Dated: 18 December, 2019

Misuse of Free Trade Agreements (FTAs) by certain unscrupulous traders of gold and silver could end with the government amending the import policy conditions of gold and silver under Chapter 71 of the Indian Trade Clarification (ITC).

Gold and silver in any form, other than monetary gold and silver in any form, has been moved from free to restricted list, a government notification dated December 18 said. The imports under FTA were at a nominal duty against present rate of 12.5% import duty and 3% IGST on gold and silver. India has signed FTAs with Asean countries, Japan and South Korea.

Unscrupulous importers would import gold plates, kettles , pots etc , melt and make them into bars. They would sell the bars in the domestic market at the applicable duty, making a windfall.

Under the revamped Import Policy of gold in any form, other than monetary gold and silver in any form, like in powder, sheet, plate, tubes and pipes and other unwrought forms is amended from ‘Free’ to ‘Restricted and will be allowed only through nominated agencies (banks) as notified by RBI and those approved by DGFT. However, import under advance authorisation and supply of gold directly by foreign buyers to exporters under para 4.45 of of the Foreign Trade Policy 2015-2020 against export orders have been exempted.

- Import of Indian National Flag – Prohibited if Not Comply with Specifications

“Import of Indian National Flag not adhering to the specifications prescribed under Part – I, Section 1.2 of Flag Code of India, 2002 is Prohibited.”

Notification No. 24/2015-2020; 11th October, 2019

Other Proposals in Pipeline:

- India for ‘Made in’ Tag on all Imported Items

This Move is to aid customs curb imports that do not meet quality standards or are in violation of trade norms.

India could make it mandatory for all imports to carry ‘made in (country)’ tag declaring their place of origin as it looks to tackle large scale dumping and entry of sub-standard goods and give a fillip to local manufacturing.

- Government mulls New Duty on Imports-

Betting on BAT

Ahead of the Budget, the commerce department has asked the finance ministry to levy Border Adjustment Tax (BAT) on imported goods to offset the impact of levies such as electricity duty, clean energy cess, levies on fuel and royalty that are not part of goods and services tax (GST).

Likewise, many Measures are being taken to regulate imports. An import management strategy is being worked out to check imports flooding the Indian market, otherwise trade deficit will become unsustainable. India has also been forced to look at remedial measures such as anti-dumping, safeguards and countervailing duties to curb such imports since China does not seem keen to bridge the widening gap.

More and More Tariff and Non-Tariff Measures need to be taken to Regulate Non-Essential Imports on war foot basis, otherwise, Import into India becomes the norm sans Make in India – major casualty to MSME Sector and also Balance of Payment (BoP) may deteriorate denting the economy.

If you already have a premium membership, Sign In.