Use the lockdown period to learn GST

Use this lockdown period to learn GST

Lockdown may prove to be a blessing in disguise. You can add some new skills. GST is the biggest reform of independent India. You can learn it. We have a comprehensive course on GST. Learn GST and utilise this period to sharpen your skills. You can not only learn it but can push your questions also. Our course covers the conceptual details along with the practical issues. It is very hard to trach GST. You can download the latest CGST ACt with all amendments and index. This makes it very easy to refer.

Let us have a look at the syllabus:

- It will be Starting from the 101st Constitutional amendment Act. This AA introduced GST to India and is important to set the background.

- Then the basic concepts, important definitions of the CGST Act will be discussed at length with practical examples.

- The concept of supply and meaning and taxability of composite and mixed supply will also be discussed.

- Provisions related to registration. When we need to take registration. When a registration can be cancelled by the taxpayer and by the department. Voluntary and mandatory registration. Exemption from registration. All these provisions along with the latest changes via notifications and circulars will also be covered.

- The most important part of GST is to understand ITC. The provisions related to input tax credit are discussed at length in our course. The provisions were amended by the Amendment Act 2018. Both the provisions, before and after the amendment are covered. Many examples and case laws are also covered.

- Time of supply, another important provision is also covered. It is separate for goods and services. We have covered both of them.

- The place of supply is the base of GST taxability. It is discussed in a lucid manner by our faculty. Four sections of IGST covers the provisions of the place of supply. It is very important to decide the taxability in GST. Place of supply is discussed with the comparative sheet of amendments.

- Returns under GST: Both annual filings and monthly and quarterly filings are covered. In case of annual filing, Annual return and GSTR 9C are covered. Other returns like GSTR 3b, GSTR 1 and CMP 08 is also covered.

- Apart from these misc provisions related to Offense, search and seizure, etc are also covered.

Once you have gone through the course you will be able to understand the provisions and also their practical implementation.

Takeaways and features to help you to learn GST easily:

- You can download the PPT’s anytime. Sessions PPT’s are uploaded on the dashboard of each session.

- Case laws and advance rulings are discussed at length wherever relevant. Also, the copies of original orders are also uploaded along with PPT. In case you want to have an in-depth study, you can download it at any time. This can help you to learn GST easily and also advance your level once you understand the basics.

- The videos of the sessions are available for an unlimited time. You can watch them at your convenience. You can even watch them on a mobile phone or tablet.

- Questions can be pushed anytime you are watching the videos. It will take some time to reply to them but we try to reply to all the questions. Also, the PDF of FAQ’s already asked and answered are also uploaded on the dashboard. You can also download them and read them to have better knowledge. Even if there is no specific question in your mind. you can go with the FAQ’s asked by others

About the Faculty:

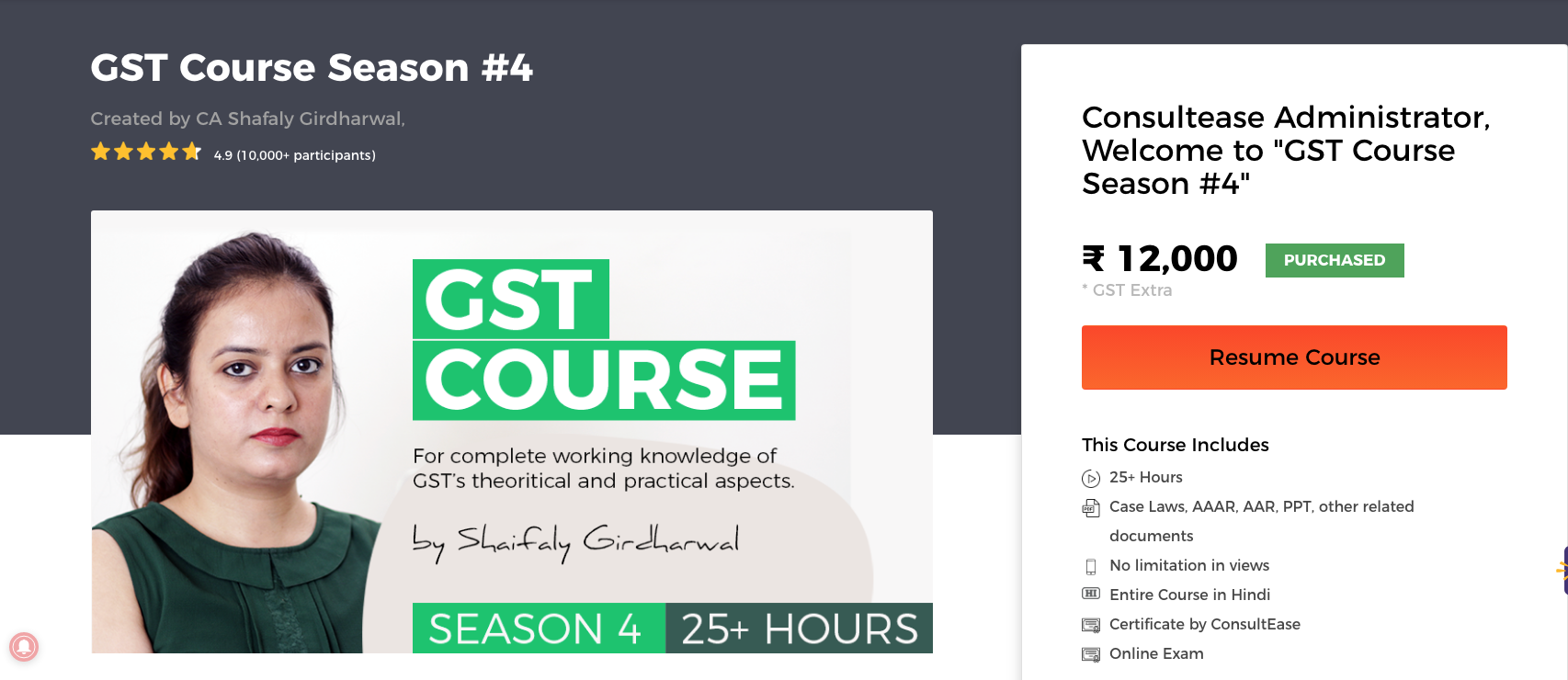

Most of the sessions are taken by CA Shafaly Girdharwal. Famous speaker and you tuber posting videos on GST since its introduction in India. She is famous for her skills to orate the law in simple language. Her You tube Channel is followed by 233000 people as a guide for GST. She is also an author of book of GST for Taxmann. Wherever we felt the requirement we have also introduced the other speakers also to take up specific sessions.

Join it today to learn GST and use this lockdown period.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.