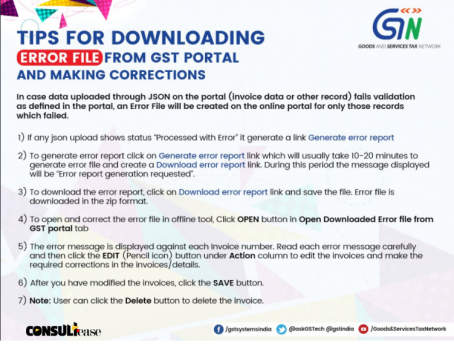

Tips for downloading ERROR FILE from GST PORTAL

Tips for downloading ERROR FILE from GST PORTAL and making corrections

In case data uploaded through JSON on the portal (invoice data or other record) fails validation as defined in the portal, an Error File will be created on the online portal for only those records which failed.

I) If any json upload shows status °Processed with Error° it generate a link Generate error report

2) To generate error report click on Generate error report link which will usually take 10-20 minutes to generate error file and create a Download error report link. During this period the message displayed will be ‘Error report generation requested’.

3) To download the error report, click on Download error report link and save the file. Error file is downloaded in the zip format.

4) To open and correct the error file in offline tool, Click OPEN button in Open Downloaded Error file from GST portal tab

5) The error message is displayed against each Invoice number. Read each error message carefully and then click the EDIT (Pencil icon) button under Action column to edit the invoices and make the required corrections in the invoices/details.

6) After you have modified the invoices, click the SAVE button.

7) Note: User can click the Delete button to delete the invoice.

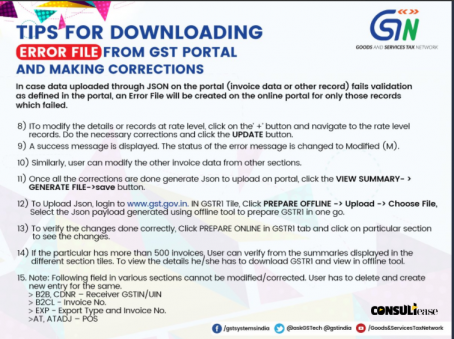

8) ITo modify the details or records at rate level, click on the -1-* button and navigate to the rate level records. Do the necessary corrections and click the UPDATE button.

9) A success message Is displayed. The status of the error message Is changed to Modified (M).

10) Similarly, user can modify the other invoice data from other sections.

II) Once all the corrections are done generate Json to upload on portal, click the VIEW SUMMARY- > GENERATE FILE->save button.

12) To Upload Json, login to www.gst.gov.in. IN GSTRI Tile, Click PREPARE OFFLINE -> Upload -> Choose File, Select the Json payload generated using offline tool to prepare GSTRI in one go.

13) To verify the changes done correctly, Click PREPARE ONLINE in GSTRI tab and click on particular section to see the changes.

14) If the particular has more than 500 invoices, User can verify from the summaries displayed in the different section tiles. To view the details he/she has to download GSTRI and view in offline tool.

15. Note: Following field in various sections cannot be modified/corrected. User has to delete and create new entry for the same. > B2B, CDNR – Receiver GSTIN/UIN > B2CL – Invoice No. > EXP – Export Type and Invoice No. CONSULIflltie >AT, ATADJ – POS

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.