Time of supply in case of change in rate of tax under GST

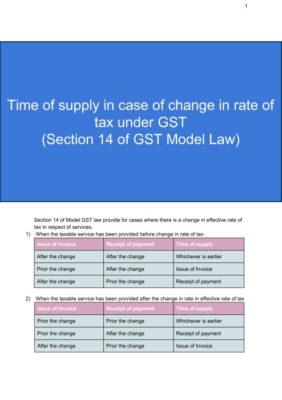

Time of supply is POT in GST regime which has replaced the all other POT in different Laws. In case of service tax taxpayer face a problem in past when there is change in tax rate. In GST regime the Law has specifically provided for the condition when the time of supply will be considered in case of change in tax rate. These provisions are given in section 14 of Model GST law. Here we have summarized these provisions for ease of understanding.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.