Section 8 of CGST Act:Composite & mixed supply updated till date

Section 8 of CGST Act: What it contains

Composite and mixed supply have different treatments. Section 8 of CGST Act provides for that treatment.

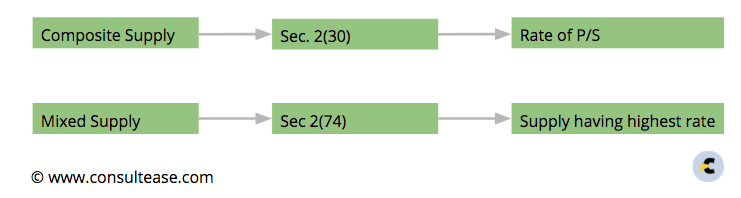

Supply in the CGST Act includes all the permutation and combinations of supply of goods and services. Section 8 of the CGST Act provides for the taxation of mixed and composite supply. The definition of composite supply is given in section 2(30) of the CGST Act.

The definition of mixed supply is given in section 2(74) of the CGST Act. It is important to note that the IGST and SGST/UTGST Act will also have the same definition. This provision is borrowed from CGST Act vide section 20 of the IGST Act and section 21 of the UTGST Act.

In case you need to refer these terms for SGST/UTGST or IGST same provisions will apply.

Go to section 7 – Supply Go to section 9– Levy

Section 8 of CGST Act: Composite & mixed supply as per the CGST Act

“The tax liability on a composite or a mixed supply shall be determined in the following manner, namely:—

(a) a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

(b) a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.”

(This is the text from the bare provisions of the CGST Act)

This provision provides for the applicability of the tax rate for these two supplies. Thus to see their meaning you will refer the definitions. To determine their taxability this section is relevant.

Latest developments:

Case laws: Torrent Power Vs. State of Gujrat

International Jurisprudence on Composite and Mixed Supply

Case of the European Union of Composite Supply

12% tax on composite supply of works contract of Metro Monorail

Supply with transportation will be treated as a Composite supply: AAR

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.