Section 36 of CGST Act: period of retention (updated till October 2023)

Section 36 of the CGST Act as amended by the Finance Act 2023

Note: Section 36 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

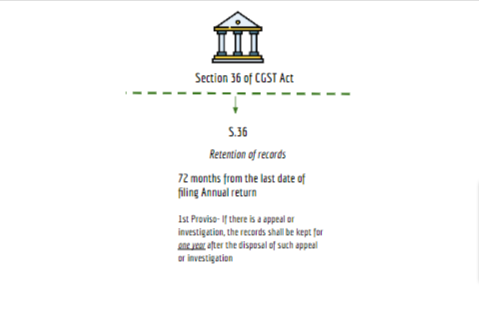

Section 36 of CGST Act provide for the retention period of records in GST. As per this provision accounts and records shall be retained for 72 months from the due date of furnishing of annual return. In GST last date for filing of annual return in 31st december of next year.

Text On Section:

“Every registered person required to keep and maintain books of account or other records in accordance with the provisions of sub-section (1) of section 35 shall retain them until the expiry of seventy two months from the due date of furnishing of annual return for the year pertaining to such accounts and records:

Provided that a registered person, who is a party to an appeal or revision or any other proceedings before any Appellate Authority or Revisional Authority or Appellate Tribunal or court, whether filed by him or by the Commissioner, or is under investigation for an offence under Chapter XIX, shall retain the books of account and other records pertaining to the subject matter of such appeal or revision or proceedings or investigation for a period of one year after final disposal of such appeal or revision or proceedings or investigation, or for the period specified above, whichever is later.”

Chart of the Section:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.