Analysis of provisions for refunds in GST

- Refunds in GST –

- What are the provisions related to refund in GST?

- When a refund is granted in GST?

- What is the time limit to file a refund in GST?

- What is the relevant date for filing a refund in GST?

- What is the process to file a refund application in GST?

- What are the various types of online refunds in GST?

- What is the process for the online filing of refunds in GST?

- Whether the refund of provisionally accepted ITC can be granted?

- What is an inverted rated refund in GST?

- How inverter rated refund is calculated?

- Whether the input services are also eligible for a refund in case of an inverted rated refund?

Refunds in GST –

Refunds in GST – In this article, I have tried to cover the various provisions related to refund in GST. I have incorporated the provisions from CGST & IGST Act, Rules, and various notifications. All the provisions related to refunds in GST are compiled in FAQ form. It is easy fro reference.

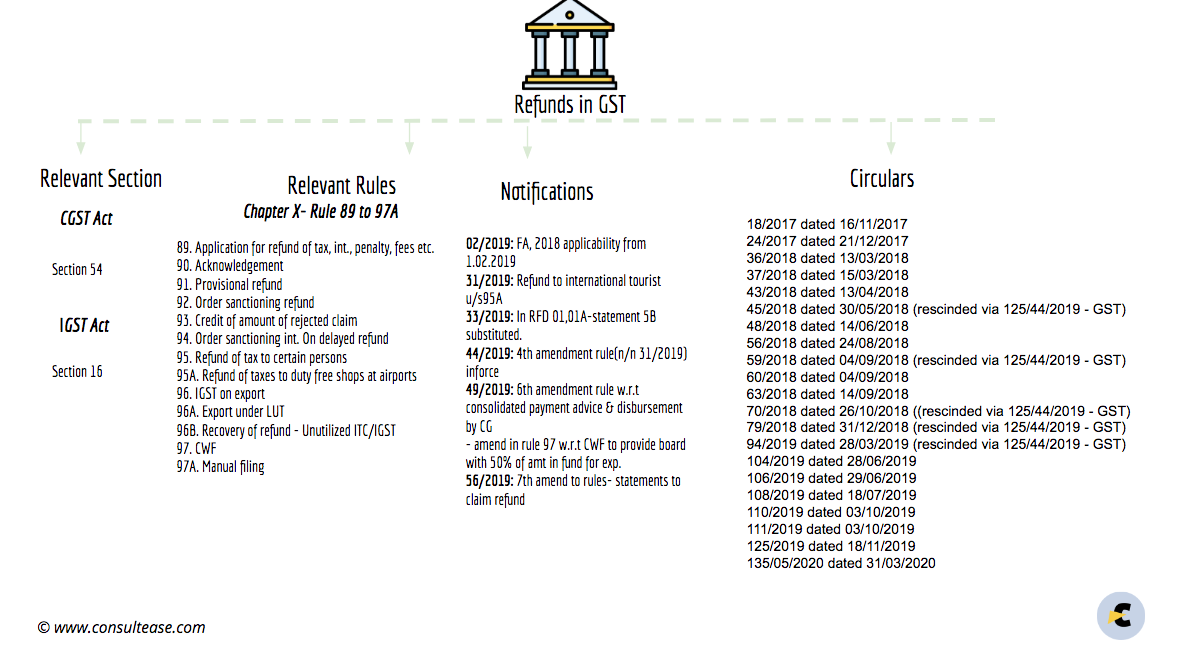

What are the provisions related to refund in GST?

When a refund is granted in GST?

As per section 54, A refund is possible in the following scenarios-

- Export of Goods

- Export of services

- Deemed Export

- Excess balance in cash ledger

- Inverted rated supply

- Wrong classification of supply, when it is corrected

Related Topic:

Documents for refund application in GST

What is the time limit to file a refund in GST?

Section 54(1) prescribes a time limit of 2 years from the relevant date. Thus a taxpayer can apply for a refund within 2 years from the relevant date.

Related Topic:

Uploading supporting documents with the GST refund application

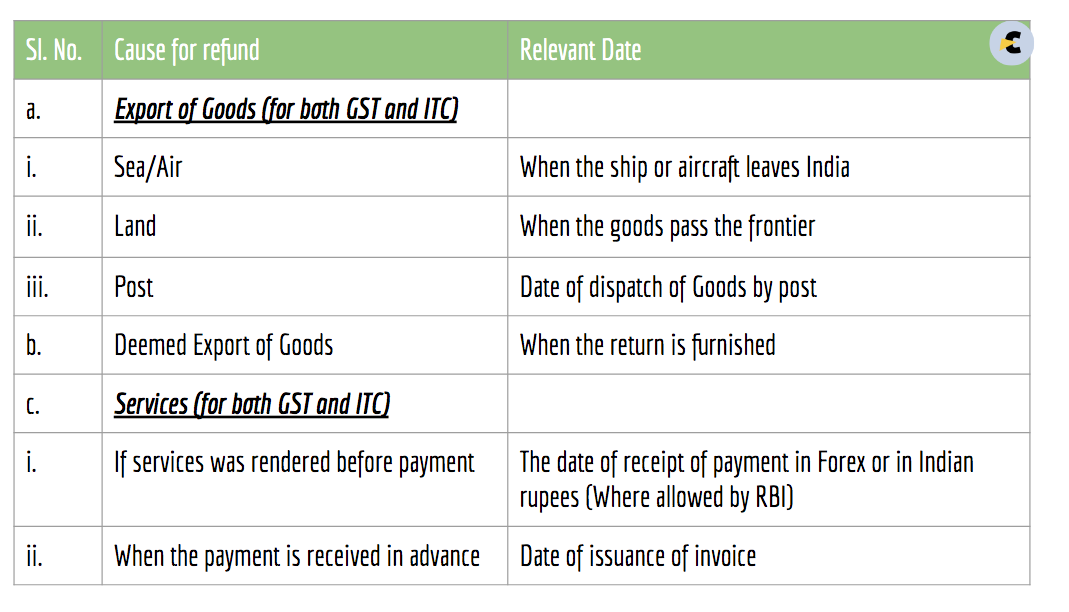

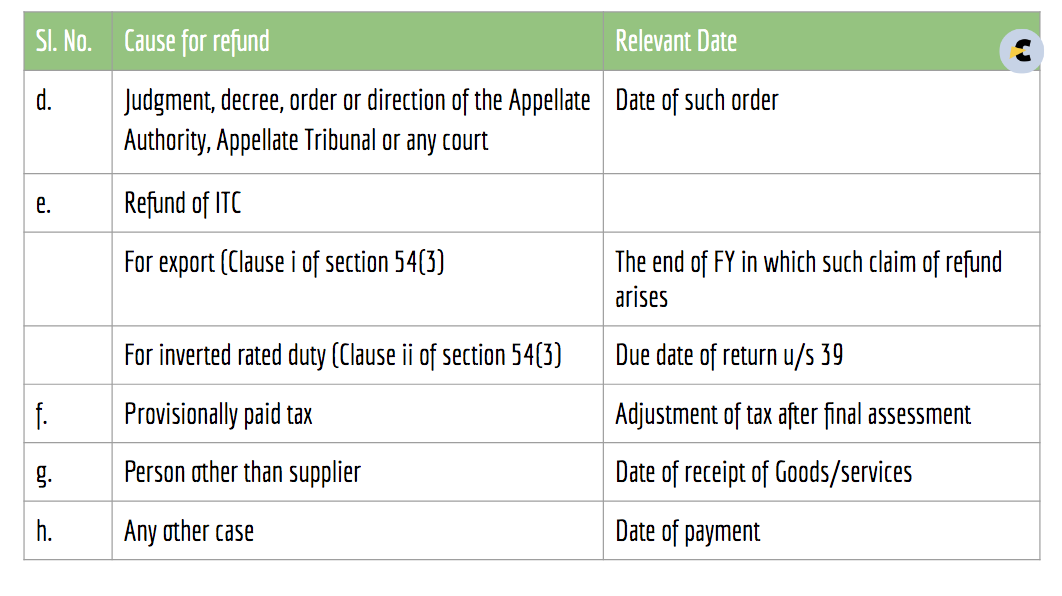

What is the relevant date for filing a refund in GST?

The relevant date differs for a variety of refunds. It is explained in explanation 2 to section 54.

What is the process to file a refund application in GST?

Earlier the GST refund was manual. It is now completely online from 29th September 2019. The detailed procedure of filing it online is given in Circular no. 125/44/2019 – GST.

What are the various types of online refunds in GST?

With effect from 26.09.2019, the applications for the following types of refunds shall be filed in FORM GST RFD 01 on the common portal and the same shall be processed electronically:

- The Refund of unutilized input tax credit (ITC) on account of exports without payment of tax;

- Refund of tax paid on export of services with payment of tax;

- The Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax;

- Refund of tax paid on supplies made to SEZ Unit/SEZ Developer with payment of tax;

- The Refund of unutilized ITC on account of accumulation due to inverted tax structure;

- Refund to the supplier of tax paid on deemed export supplies;

- The Refund to the recipient of tax paid on deemed export supplies;

- Refund of excess balance in the electronic cash ledger;

- The Refund of excess payment of tax;

- Refund of tax paid on an intra-State supply which is subsequently held to be inter-State supply and vice versa;

- The Refund on account of assessment/provisional assessment/appeal/any other order;

- Refund on account of “any other” ground or reason.

Related Topic:

Important issues in GST refund resolved

What is the process for the online filing of refunds in GST?

Circular 125/2019 CGST explains the procedure for filing of refund after the online system for filing of GST refund is introduced.

Related Topic:

Re-credit of GST Refund Claim Rejected through GSTR-3B | Gujarat High Court

No need to submit physical copies of any document

- An application in form RFD 01 is filed via the GSTN portal. No need to submit any document physically. All the statements and invoices can be uploaded online. A comprehensive list of such documents is provided at Annexure-A and it is clarified that no other document needs to be provided by the applicant at the stage of filing of the refund application. The facility of uploading these other documents/invoices shall be available on the common portal where four documents, each of maximum 5MB, may be uploaded along with the refund application

- Then an ARN number will be generated if the refund application is complete in all aspects. If it is not complete a deficiency memo in form RFD 03 will be issued.

Filing of all returns for the tax period of refund

- Any refund claim for a tax period may be filed only after furnishing all the returns in FORM GSTR-1 and FORM GSTR-3B which were due to be furnished on or before the date on which the refund application is being filed. However, in case of a claim for refund filed by a composition taxpayer, a non-resident taxable person, or an Input Service Distributor (ISD) furnishing of returns in FORM GSTR-1 and Form GSTR-3B is not required.

- Instead, the applicant should have furnished returns in FORM GSTR-4 (along with FORM GST CMP-08), FORM GSTR-5 or FORM GSTR-6, as the case may be, which were due to be furnished on or before the date on which the refund application is being filed.

Whether the refund of provisionally accepted ITC can be granted?

Since the functionality of furnishing of FORM GSTR-2 and FORM GSTR-3 remains unimplemented, it has been decided by the GST Council to sanction refund of provisionally accepted input tax credit. However, the applicants applying for refund must give an undertaking to the effect that the amount of refund sanctioned would be paid back to the Government with interest in case it is found subsequently that the requirements of clause (c) of sub-section (2) of section 16 read with sub-section (2) of section 42 of the CGST Act have not been complied with in respect of the amount refunded. This undertaking should be submitted electronically along with the refund claim. (Circular 125/2019 CGST).

What is an inverted rated refund in GST?

Proviso 1(ii) of section 54(3) read with rule 89(5) provides for refund of the input tax credit in case of inverter rated tax. Here the meaning of inverted rated is where the tax on input is more than the tax on output.

How inverter rated refund is calculated?

Rule 89(5) provides for the formula of calculation of invented rated refund.

Maximum Refund Amount = {(Turnover of inverted rated supply of goods and services) x Net ITC ÷ Adjusted Total Turnover} – tax payable on such inverted rated supply of goods and services.

Explanation:- For the purposes of this sub-rule, the expressions –

(a) ―Net ITC‖ shall mean input tax credit availed on inputs during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A) or (4B) or both; and

[―Adjusted Total turnover‖ and ―relevant period‖ shall have the same meaning as assigned to them in sub-rule (4)

Whether the input services are also eligible for a refund in case of an inverted rated refund?

It has been controversial since inception. Amendment made effective with effect from 01.07.2017 vide Notf no. 26/2018-CT dt. 13.06.2017 Substituted vide Notf no. 21/2018-CT dt. 18.04.2018. Earlier Net ITC was deriving its meaning from sub-rule 4. ( ―Net ITC‖ and ―Adjusted Total turnover‖ shall have the same meanings as assigned to them in sub-rule (4).) Text of the rule before the amendment. Subrule 4 defines the Input tax credit as ITC of input and input services. But then it was amended to include the input only.

Gujarat High court in 10 cases clubbed together announced that ITC of input services shall also be considered in an inverted rated refund.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.