New returns for composition dealers

New returns for composition dealers:

Notification No. 20/2019 – Central Tax New Delhi, the 23rd April, 2019 introduced CGST (Third amendment rules). These rules have changed the returns to be filed by a composition dealer. In current regime a composition dealer files a quarterly return and then an annual return in form GSTR -9A. A new scheme of filing of returns has been introduced by CBIC. Now they will be required to file only 4 statements quarterly. A return will be filed annually. It will ease the compliance burden on a composition dealer. Now we will discuss these changes in detail.

Applicability of new return scheme for composition dealer:

The scheme of new returns for composition dealer will be applicable from 23rd April 2019. This is date when the relevant notification was issued.

Who will be covered by this new return filing scheme?

It will be applicable on the following taxpayers.

- Registered taxpayer making payment of tax u/s 10 of CGST Act

- Registered person opted to pay tax at 6% under notification no. 2/2019, Central Tax (Rate), dated the 7th March, 2019.

Compliances under the new scheme:

Under the new scheme a statement will be filed by the taxpayer. This statement will be filed in FORM CMP 08. Return in CMP 04 will also be filed annually.

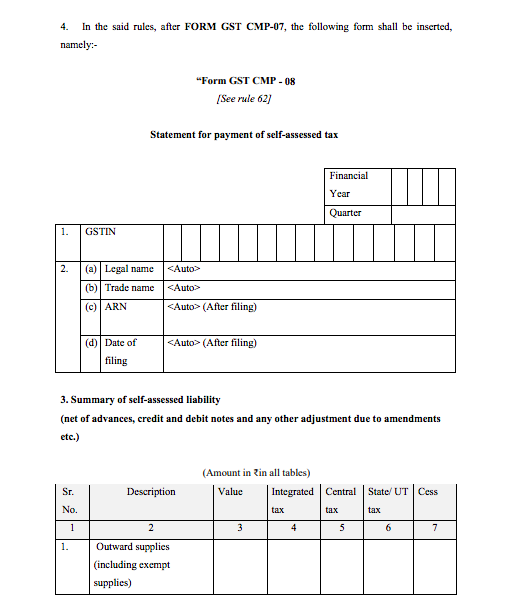

Format of new statement for composition dealer in form CMP 08.

Following is the format of CMP08. It is required to be filed quarterly by all composition dealers. Taxpayer opted to pay 6% under notification no. 2/2019 will also be liable to fill this form.

New returns for composition dealers

New returns for composition dealers

This return contains the following details:

- Outward supplies (including exempt supplies)

- Inward supplies attracting reverse charge including import of services

- Tax payable (1+2)

- Interest payable, if any

- Tax and interest paid

- Verification I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom

- Signature of Authorised signatory will be required here.

Instructions to fill new return for composition dealers:

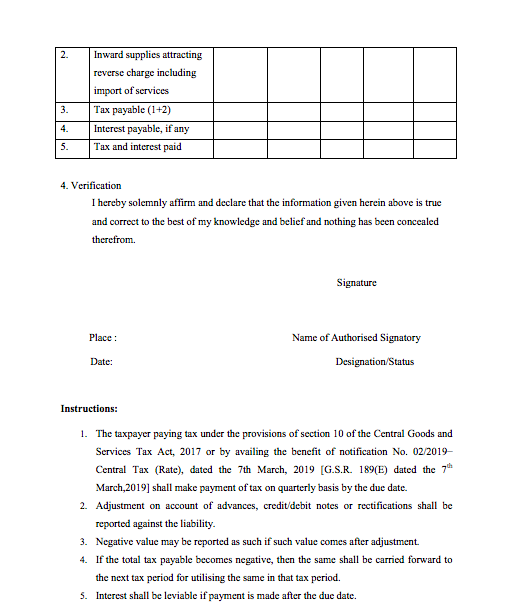

Instructions: 1. The taxpayer paying tax under the provisions of section 10 of the Central Goods and Services Tax Act, 2017 or by availing the benefit of notification No. 02/2019– Central Tax (Rate), dated the 7th March, 2019 [G.S.R. 189(E) dated the 7th March,2019] shall make payment of tax on quarterly basis by the due date.

2. Adjustment on account of advances, credit/debit notes or rectifications shall be reported against the liability.

3. Negative value may be reported as such if such value comes after adjustment.

4. If the total tax payable becomes negative, then the same shall be carried forward to the next tax period for utilising the same in that tax period.

5. Interest shall be leviable if payment is made after the due date.

6. „Nil‟ Statement shall be filed if there is no tax liability due during the quarter.”

Benefits of this new scheme:

It is made to ease compliance burden. There will be no quarterly returns for composition dealers. They only need to pay tax via statement in form CMP08.

They need to file only one return in a year in form GSTR 04.Earlier they were filing GSTR 04 quarterly.

Challenges in the new returns for composition dealer :

It is a myth of one return. The statement have the same set of information. Only thing is burden to file one additional return will be there.

Hope you will enjoy this new filing. It will take some time to understand.

Pls post your queries in comment or in QA section.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.