Meaning of term Contravention for Detention and Seizure u/s 129 of CGST Act, 2017

- Meaning of term Contravention for Detention and Seizure u/s 129 of CGST Act, 2017

- Purposive Construction to be adopted for Meaning of “Contravention”

- Literal Construction vs Purpose Construction

- Vehicle Number not updated in Way Bill due to Change in Load Plan

- Vehicle Number not updated after Tran-shipment due to Lorry Breakdown

- Original Lorry Receipt was not available at the time of Detention

- Non Filing of GSTR 1 and GSTR 3B could not be a reason for detention or confiscation

- The difference in Quantity during Physical Verification at the time of Detention

- Tax Amount not disclosed in Way Bill

- Time Gap between Invoice Date and Way Bill Date

- Transit Sale

- Detention on the ground of Mis-classification

- Detention on the ground of Valuation

- The difference in Way Bill and Tax Invoice

- Wrong Mentioning of GSTIN, Mobile No and E Way Bill not produced at the time of Detention but before the seizure

- Way Bill was downloaded subsequent to Detention

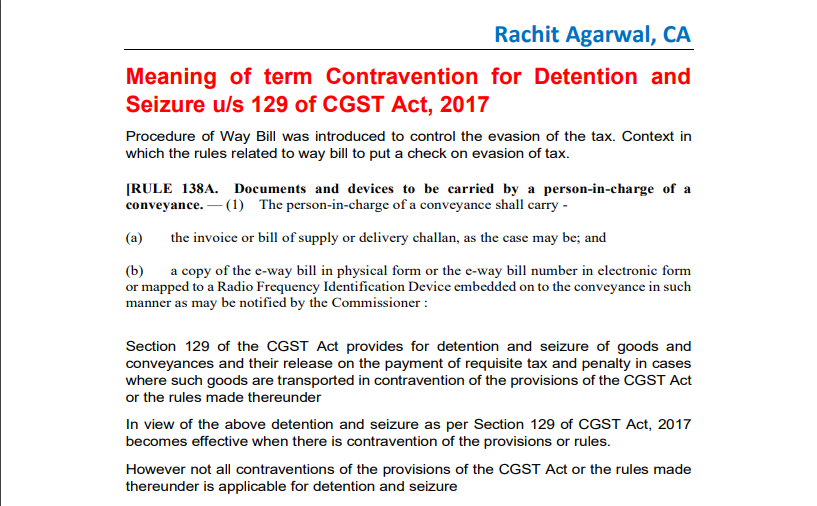

Meaning of term Contravention for Detention and Seizure u/s 129 of CGST Act, 2017

The procedure of Way Bill was introduced to control the evasion of the tax. The context in which the rules related to waybill to put a check on evasion of tax.

[RULE 138A. Documents and devices to be carried by a person-in-charge of a conveyance. — (1) The person-in-charge of a conveyance shall carry –

(a) the invoice or bill of supply or delivery challan, as the case, maybe; and

(b) a copy of the e-way bill in physical form or the e-way bill number in electronic form or mapped to a Radio Frequency Identification Device embedded on to the conveyance in such manner as may be notified by the Commissioner:

Section 129 of the CGST Act provides for detention and seizure of goods and conveyances and their release on the payment of requisite tax and penalty in cases where such goods are transported in contravention of the provisions of the CGST Act or the rules made thereunder

In view of the above detention and seizure as per Section 129 of CGST Act, 2017 becomes effective when there is a contravention of the provisions or rules.

However, not all contraventions of the provisions of the CGST Act or the rules made thereunder as applicable for detention and seizure

Related Topic:

Detention in GST: Important issues and case laws

Purposive Construction to be adopted for Meaning of “Contravention”

Meaning of the term contravention to be understood in the context the same is used. The meaning of the contravention of the provisions should be limited to extent of the evasion of the tax and not that every contravention to be dealt with in the manner prescribed in Section 129.

Nowadays Section 129 of the CGST Act is being initiated for every mistake. Every mistake whether a typographical error or procedural lapses is treated as a contravention of the provisions of the Act or rules made thereunder.

The imposition of tax along with the penalty to be imposed only there was an evasion of tax.

Only minor penalties should be imposed where there is no evasion of tax.

Literal Construction vs Purpose Construction

Supreme Court in Belapur Sugar & Allied Industries Ltd. v. Collector of Central Excise, Aurangabad (1999) 4 SCC 103. It is observed that while granting the benefit of rebate, concession, or exemption, the object behind the issuance of such notification must be taken into consideration and purposive construction must be adopted. It was further observed that if there are two possible interpretations, it is the interpretation that subserves the object and purpose should be accepted. According to the Court, since the objective of the notification was of conferring rebate in excise duty and an incentive was given to a factory for encouraging sugar production during the lean period, the said object should be kept in view by granting the benefit to the factory.

Supreme Court in Hotel & Restaurant Association vs Star India Pvt Ltd [2007 (5) S.T.R. 161 (S.C.)]- This Court opined that although dictionary meanings are helpful in understanding the general sense of the word it cannot control a situation where the scheme of the statutes or the instrument considered as a whole clearly conveys a somewhat different shade of meaning. In that fact situation, it was opined:

“… It is not always a safe way to construe a statute or a contract by dividing it by a process of etymological dissection and after separating words from their context to give each word some particular definition given by lexicographers and then to reconstruct the instrument upon the basis of those definitions. What particular meaning should be attached to words and phrases in a given instrument is usually to be gathered from the context, the nature of the subject matter, the purpose or the intention of the author, and the effect of giving to them one or the other permissible meaning on the object to be achieved. Words are after all used merely as a vehicle to convey the idea of the speaker or the writer and the words have naturally, therefore, to be so construed as to fit in with the idea which emerges on a consideration of the entire context. Each word is but a symbol which may stand for one or a number of objects…”

CBIC Vide Circular No- 64/38/2018-GST, dated 14-9-2018 clarified that proceedings under Section 129 of the CGST Act may not be initiated, inter alia, in the following situations:

(a) Spelling mistakes in the name of the consignor or the consignee but the GSTIN, wherever applicable, is correct;

(b) Error in the pin-code but the address of the consignor and the consignee mentioned is correct, subject to the condition that the error in the PIN code should not have the effect of increasing the validity period of the e-way bill;

(c) Error in the address of the consignee to the extent that the locality and other details of the consignee are correct;

(d) Error in one or two digits of the document number mentioned in the e-way bill;

(e) Error in 4 or 6 digit level of HSN where the first 2 digits of HSN are correct and the rate of tax mentioned is correct;

(f) Error in one or two digits/characters of the vehicle number.

Related Topic:

GST Returns Due Dates for GTSR 1 and GSTR 3b

Apart from the above, there are certain other procedural lapses, where the minor penalty could be imposed

The above errors are only illustrative and not to be treated as exhaustive.

Vehicle Number not updated in Way Bill due to Change in Load Plan

2020 (10) TMI 888 – Commissioner (Appeals) Central Goods And Service Tax, Jaipur in M/S. L.G. Electronics India Pvt. Ltd. Versus The Assistant Commissioner, CGST Division-B, Jaipur

The E- way- Bill No.731043011329 was got generated prior to the commencement of movement of the goods at 04.38 PM which was contained all details i.e. details of the goods, tax invoice number as well as the name of the buyer of the goods including his registration number under the GST Act; and the transport receipt of the transporter and packing list was also accompanying the goods. In so far as E-way Bill was not available with the conveyance at the time of interception at 05.19 PM, the appellant has explained and I also find that the vehicle of the Driver was carrying the E-way Bill No.731043011329 in which the vehicle registration number was shown RJ14-GF9189 in place of vehicle registration number RJ-14-GF-6831 due to sudden change in vehicle plan by the transporter,’ the transporter has placed another vehicle bearing Registration No. RJ-14-GF-6831 in place of Registration No. RJ-14-GF-9189. As soon as the mistake came to the notice of the appellant the same mistake was rectified by the appellant and got generated the E-Way Bill at 05.19 mentioning therein the vehicle registration number RJ-14-GF-6831 – thus, all the necessary statutory requirement under the provisions of CGST Act and Rules was fulfilled by the appellant except mentioning corrected vehicle number at the time of interception, though this mistake was corrected soon after it came to notice. Thus, there appears no ill intention to evade the tax and just a mere technical mistake.

Penalty – HELD THAT:- Though the appellant has made an error in mentioning the vehicle number they himself admitted that due to a sudden change in vehicle plan by the transporter they could not change the vehicle number. Since the appellant himself admitted their mistake by not correcting the vehicle number. Therefore, they are liable for a penalty under Section 125 of the CGST Act, 2017 – Penalty upheld.

Vehicle Number not updated after Tran-shipment due to Lorry Breakdown

Appellate Authority – GST, Himachal Pradesh, OM Dutt v. ACSTE-Cum-Proper Officer- [2020]

The vehicle was detained in course of transportation. Due to the breakdown of goods carrying vehicles, goods were trans-shipped to another vehicle however Part B of Eway Bill was not updated due to poor internet connectivity before Inspection and was updated after Inspection.

The taxpayer has made a procedural lapse and violated the provisions of the CGST/HPGST Act, 2017, and HPGST Rules 138(10). The Ld. Respondent also failed to prove that the appellant changed the vehicle to evade tax. In my opinion, the proper officer has acted in haste and levied tax/penalty without giving the proper opportunity of being heard as mentioned in Section 129(4). Ld respondent has imposed penalties in a mechanical manner and has ignored the corrected and updated e-way bill as produced by the appellant.

The tax and penalty deposited by the appellant under section 129(3) may be refunded and a penalty of Rs. Ten Thousand only (Rs. 10,000/-) is imposed on the taxpayer under section 122(xiv) of the Act.

The mistake occurred for not updating vehicle no. in the E-way bill is a procedural lapse, liable to a penalty of Rs. 10,000 only

Appellate Authority, GST, Himachal Pradesh in Integrated Constructive Solutions Versus ACST & E-Cum-Proper Officer. Goods were detained for the reason that after transshipment vehicle no was updated and a penalty equivalent to the tax amount was imposed. Vehicle No was updated subsequent to detention.

Held respondent has imposed penalty in a mechanical manner. The taxpayer has made a procedural lapse and the appellant is liable to pay the miner penalty

Original Lorry Receipt was not available at the time of Detention

In a Writ Petition filed before High Court of Gujarat in case of F.S Enterprise vs the State of Gujarat [2020 (32) G.S.T.L 321- Documents being the Invoice and E Way Bill were produced as prescribed under *Rule 138A* of CGST Rules 2017 at the time of *interception of goods*. Photocopy of Lorry Receipt was produced without a computerized serial number and contact number. The impugned order passed contrary to statutory requirements which do not require the production of a *lorry receipt* by the person in charge of a conveyance.

Non Filing of GSTR 1 and GSTR 3B could not be a reason for detention or confiscation

In a Writ Petition filed before High Court of Kerala at Ernakulam by Relcon Foundations Pvt Ltd reported in 2019 (31) G.S.T.L 397 (Ker)- Held that non-filing of GSTR 3B and GSTR 1 cannot be the ground for detention under Section 129. Further non-filing could not be ground for the confiscation of goods u/s 130.

The difference in Quantity during Physical Verification at the time of Detention

Commisisoner (Appeals) Jaipur in case of Deepesh Gupta [2020 (38) G.S.T.L. 117 (Commr. Appl. – GST – Raj.) – Excess quantity was found in the truck during the course of the physical verification. Physical Verification was done in presence of the appellant on an estimate basis and such verification report was signed by the appellant. Held Appellant contention that the estimated basis of verification of quantity should not be made the basis is not acceptable. Appeal dismissed.

Tax Amount not disclosed in Way Bill

Hon’ble High Court of Kerala in M.P Steel and Pipes vs Asst. State Tax Officer

The vehicle was detained on the ground that there was no mention of the tax amounts separately in the e-way bill that accompanied the goods.

The power of detention under Section 129 is to be exercised only in cases where transportation of goods is seen to be in contravention of the provisions of the Act and Rules and not simply because a document relevant for assessment does not contain details of tax payment. As per the statutory provisions applicable to the instant case, a person transporting goods is obliged to carry only the documents enumerated in Rule 138(A) of GST Rules, during the course of transportation. The said documents are (i) the invoice or bill of supply or delivery challan, as the case may be, and (ii) the copy of the e-way bill in physical form or e-way bill Number in electronic form etc. A reading of the said Rule clearly indicates that the e-way bill has to be in FORM GST EWB-01, and in that format, there is no field wherein the transporter is required to indicate the tax amount payable in respect of the goods transported. If the statutorily prescribed form does not contain a field for entering the details of the tax payable in the e-way bill, then the non-mentioning of the tax amount cannot be seen as an act in contravention of the rules. In the instant case, it is not in dispute that the transpiration was covered by a valid tax invoice, which clearly showed the tax collected in respect of the goods and an e-way bill in the prescribed format in FORM GST EWB-01. Since there was no contravention by the petitioner of any provision of the Act or Rule for the purposes of Section 129, the detention in the instant case cannot be said to be justified.

Time Gap between Invoice Date and Way Bill Date

Hon’ble Kerala High Court in a W.P filed by Hero Ecotech Ltd [2020 (7) TMI 607]- Vehicle was detained on account of the fact that the supplier had issued the invoices 21 days and 7 days prior to the time of removal of goods, which was in contravention to the provisions of the CGST Act.

The petitioner pointed out that as per the statute, an invoice could be issued either at the time of removal of goods or prior to the delivery of the goods and that the same is in consonance with the statute and hence, there is no cause for doubting any evasion of tax.

I direct the respondent to complete the adjudication proceedings in relation to Ext.P2 notice, within an outer time period of two months from the date of receipt of a copy of this judgment.

Transit Sale

In a Writ Petition filed before High Court of Kerala by Polycab India Ltd against State of Kerala [2020 (32) G.S.T.L 542]- Sale from the vendor in Gujarat to the purchaser in Uttarakhand and delivery to be effected at Trivandrum – E-way bill containing all details – No justification for the detention of goods on the ground that there was the possibility of evasion of payment of IGST in Kerala – Reason wholly irrelevant for purposes of Section 129 of Central Goods and Services Tax Act, 2017 – Direction to concerned Authority to release goods and vehicle.

Detention on the ground of Mis-classification

Hon’ble High Court of Kerala in a Writ Petition in N.V.K Mohammed Sulthan Rawther And Sons vs Union of India [2019 (20) G.S.T.L. 708 (Ker.)]- Detention was made on the ground that as per the documents accompanying, the tax rate shown is 5% for Roja supari, which is coming under 18% as per HSN 2106. Revenue asserts that there is “contravention”, and that contravention concerns misbranding the product and paying less tax. Relying on the judgment of this Court in the case of Rams v. Sales Tax Officer held that the inspecting authority may entertain a suspicion that there is an attempt to evade tax. But if the records he seizes truly reflect the transaction and the assessee’s explanation accords with his past conduct, for example, the returns he has filed earlier, the detention is not the answer.

At best the inspecting authority can alert the assessing authority to initiate the proceedings “for assessment of any alleged sale, at which the petitioner will have all his opportunities to put forward his pleas on law and on fact.”

Detention on the ground of Valuation

In a Writ Petition filed before the High Court of Kerala by Alfa Group [2020 (34) G.S.T.L 142]

During the course of the transportation of goods by the Petitioner, the vehicle was intercepted by the Proper Officer due to the fact Invoice found to be low than MRP of goods and HSN Code thereof also wrongly mentioned.

Held there is no provision under the GST which mandates that the goods shall not be sold at prices below the MRP. Held further that when the statutory scheme of the GST is such as to facilitate a free movement of goods, after the self-assessment by the assessees concerned, the respondents cannot resort to any arbitrary and statutorily unwarranted detention of goods in the course of transportation. Such action on the part of department officers can erode public confidence in the system of tax administration. Further Commissioner, Kerala State Taxes Department to issue suitable instructions to the field formations so that such unwarranted detentions have not resorted in future

The difference in Way Bill and Tax Invoice

In a Writ Petition filed before High Court of Kerala in case of Haier Appliances India Pvt Ltd vs Asst. State Tax Officer reported in TOG-1036-HC-KRL-GST-2019. The vehicle was detained for the discrepancy with regard to the value of the commodity as shown in the Ext.P1 invoice, which is Rs.25.60, whereas, in the E-way bill, it was shown as Rs.25.66. Held that Reasons are not sufficient for the purposes of detaining the goods in terms of Section 129 of the CGST/SGST Act

Wrong Mentioning of GSTIN, Mobile No and E Way Bill not produced at the time of Detention but before the seizure

Hon’ble High Court at Allahabad in Bhumika Enterprises vs State of U.P [2018 (12) G.S.T.L. 137 (All.)]- E-way Bill-02 could not be generated on 25-3-2018 before the movement of the goods and the same was generated on 26-3-2018 in the morning which was much before the date of seizure order which has been admittedly passed on 27- 3-2018 at 6 p.m.

Petitioner stated that mentioning of the GSTIN number of dealer of Allahabad instead of Fatehpur, the Counsel for the petitioner has submitted that the said mistake was a bona fide mistake as such in fact a clerical error and the same was rectified while downloading E-way Bill-02

Held that there is no dispute with regard to quality and quantity of the goods and further that the invoice issued clearly indicates of charge of C.G.S.T. and S.G.S.T by the petitioner.

Tax invoice indicating the tax charged and the same admittedly found during the course of inspection/detention and E-way Bill-02 has been downloaded much before the seizure order, we see no justification in the impugned seizure order and therefore, we have no option but to allow the present writ petition and to set aside the seizure order dated 27-3-2018 as well as the show cause notice issued under Section 129(3) of the Act for the imposition of penalty.

Way Bill was downloaded subsequent to Detention

In a Writ Petition filed by Durga Rai Vijay Kumar before High Court of Allahabad [2018 (19) G.S.T.L. 406 (All.)]- It was held since the e-way bill has been downloaded subsequent to the detention of the goods not accompanying the e way bill, hence the goods and vehicle should be released upon the petitioner furnishing the security other than cash and bank guarantee to the satisfaction of the authority concerned.

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal