Letter for extension of due date for filing 9,9C due date

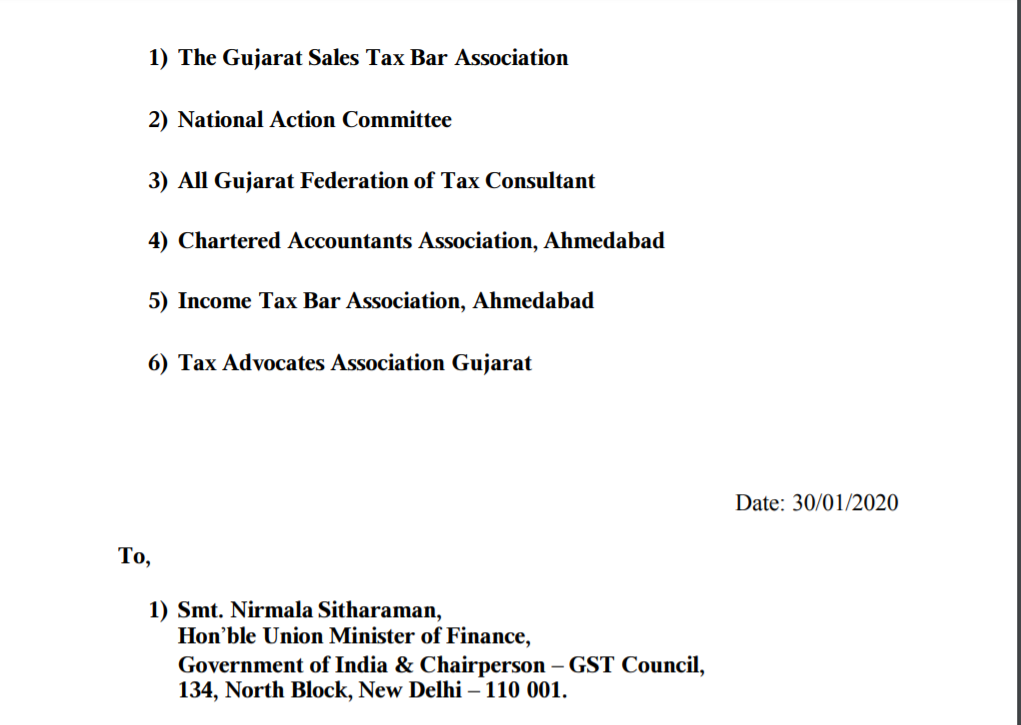

The following entities have sent a letter to finance ministry to extend due date of GSTR 9,9C for FY 2017-18.

1) The Gujarat Sales Tax Bar Association 2) National Action Committee 3) All Gujarat Federation of Tax Consultant 4) Chartered Accountants Association, Ahmedabad 5) Income Tax Bar Association, Ahmedabad 6) Tax Advocates Association Gujarat

Subject : Request to extend due date of GSTR-9, 9A & 9C for the F.Y. 2017-18

We, the following professional associations and organizations who represent thousands of Advocates, Tax Professionals, Tax Consultants, Tax Practitioners and Chartered Accountants across the country and thereby, lakhs of taxpayers of our great nation.

At the outside we appreciate and thank the Government of India for coming out with pro-active measures to redress taxpayers’ grievances and issued and thereby boosting taxpayers and professionals’ faith in the government machinery.

We take this opportunity to bring to your honours’ kind attention on important issue of extension of time limit to file GSTR-9, GSTR-9A & GSTR-9C. We are sure the same will be considered by the Government to further strengthen the taxpayers’ confidence. We offer our fullest co-operation and support for compliances of the provisions of GST Act

As the due date for filing of GSTR-9, GSTR-9A & GSTR-9C for the F.Y. 2017-18 is approaching fast being 31st January, 2020, and various trade and professional associations and organizations and other stakeholders have made various representations in this regard. We have also made representation earlier for the extension of due date for filing of above referred returns and reports from 31st January, 2020 to 31st March, 2020.

In this regard, jointly we would like to bring to your kind notice that in the past the extension of time limits were given and we sincerely appreciate for the response given by the government and authorities so far. Madam, we are conscious of the fact that last date for filing these forms have been extended several times but equally important is the fact that extension of date was not for reasons attributable to registered persons but for reasons solely attributable to framers of Forms and managers of portal. The difficulties faced by the persons required to file these forms have been stated to be simplified by notification on 14.11.2019 but portal was modified on 08.01.2020. During the period after this day, registered persons were busy with several time barring compliances.

final Letter for extension of GSTR-9 (2)

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.