Input Service Distributor (ISD)

- Input Service Distributor (ISD)

- Definition –

- Non-Applicability of ISD –

- Manner of Distribution of Credit by ISD –

- Availment of ITC by Input Service Distributer

- Conditions to be fulfilled by ISD to Distribute ITC

- Procedure for distribution of input tax credit by Input Service Distributor:

- Mandatory Registration as per Section-24

- Registration Process [Key points]: ISD

- Manner of credit of Excess Credit Distributed

- Filing of Returns

- FAQ: Input Service Distributor[ISD]

- 1- How can I register as an ISD?

- 2- Can ISD take multiple registrations in a State?

- 3- Can I obtain ISD registration if my place of business is not fixed?

- 4- Can an ISD opt for Composition?

- 5- Which return will I have to file as an ISD?

- 6- By when do I need to file Form GSTR-6?

- 7- Can I file my ISD return if my counterparties have not filed Form GSTR1/5?

- 8- Is there any late fee in case of delayed filing of Form GSTR-6?

- Read the Copy:

Input Service Distributor (ISD)

Definition –

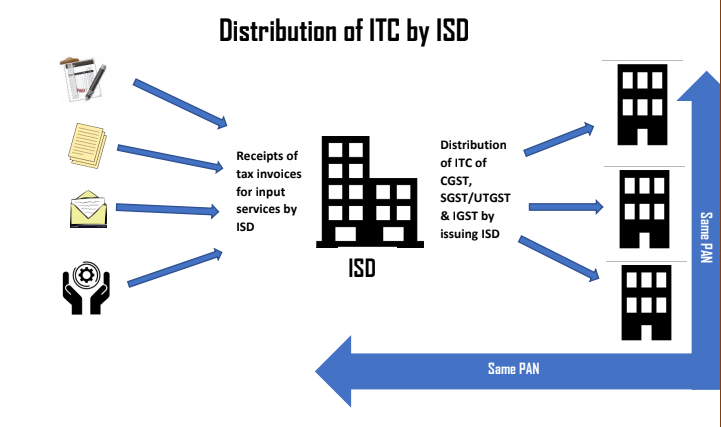

As per Section 2(61) of CGST Act,2017, Input Service Distributor means an office of the supplier of goods or services or both which receives tax invoices issued under section 31 towards the receipt of input services and issues a prescribed document to distribute the credit of central tax, State tax, integrated tax or Union territory tax paid on the said services to a supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office.

In Simple words, an ISD is a business that receives invoices for services rendered by its branches [head office, registered office, regional office, marketing office, branch, godown, sales depot, etc.]. It issues tax paid to its branches on a

proportionate basis by issuing an ISD Invoice.

It helps in resolving the challenges of optimum utilization of accumulated ITC while the distribution of ITC to various units.

Non-Applicability of ISD –

ISD cannot distribute input tax credit:

• Paid on Inputs & Capital goods [Raw material & machinery etc.]

• To outsourced service providers or manufacturers.

Manner of Distribution of Credit by ISD –

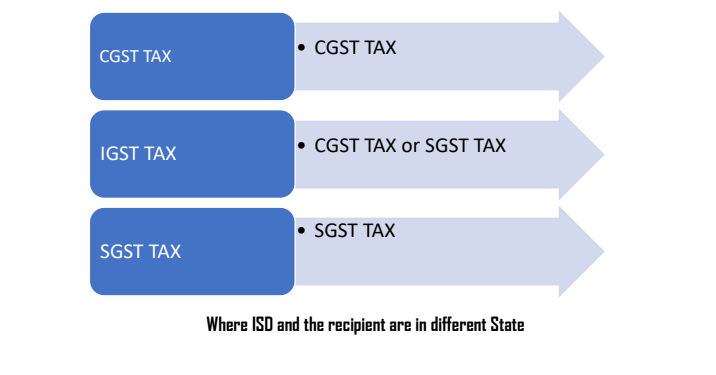

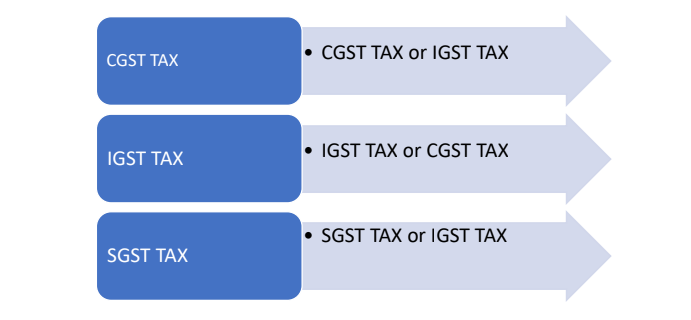

The Input Service Distributor shall distribute the credit of central tax as central tax or integrated tax and integrated tax as integrated tax & the credit of state tax as State tax or integrated tax and integrated tax as integrated tax or state tax, by way of issue of a document containing the amount of the input tax credit being distributed in such manner as may be prescribed.

Where ISD and the recipient are in the same State

An ISD may receive invoices towards ITC, on payment of CGST and SGST (On intra-State supply) but the receiver unit may be situated in different states. If the ISD distributes the SGST of its state to the recipient state it cannot utilize the said input to claim any credit. However, the Credit of CGST & SGST can be distributed as IGST when the ISD and recipient are in different States. It is included for the smooth distribution of credit by large organizations having a presence in two or more different states.

Availment of ITC by Input Service Distributer

As per section 16 of the CGST Act 2017, Credit will be available to a Taxable Person in an Electronic credit ledger on GST common portal. Every person who declares their outward supply also have to declare the registration number of recipient, credit gets auto-populated in the accounts of the recipient based on such declaration. a recipient may have multiple registrations under GST Law (State-wise registration and ISD registration). In order to avail the Credit Recipient will have to specify their ISD registration number.

Conditions to be fulfilled by ISD to Distribute ITC

As per Sec.20(2) of the CGST Act,2017 specifies condition subject to which credit can be distributed by Input Service Distributor. These are: –

(1) The credit can be distributed to the recipients of credit against a document containing such details as may be prescribed.

(2) The amount of the credit distributed shall not exceed the amount of credit available for

(3) The credit of tax paid on input services attributable to a recipient of credit shall be distributed only to that recipient.

Procedure for distribution of input tax credit by Input Service Distributor:

As per Rule 39 of CGST Rules,2017 these following procedure we have to follow:

1) An Input Service Distributor shall distribute input tax credit in the manner and subject to the conditions, namely: –

(a) The input tax credit available for distribution in a month shall be distributed in the same month and the details thereof shall be furnished in FORM GSTR-6 in accordance with the provisions of Chapter VIII of these rules,

(b) The Input Service Distributor shall, in accordance with the provisions of clause (d), separately distribute the amount ineligible as an input tax credit (ineligible under the provisions of sub-section (5) of section 17 or otherwise) and the amount eligible as an input tax credit.

(c) The input tax credit on account of central tax, State tax, Union territory tax, and integrated tax shall be distributed separately in accordance with the provisions of clause (d);

(d) The input tax credit that is required to be distributed in accordance with the provisions of clause (d) and € of sub-section (2) of section 20 to one of the recipients” R1”, whether registered or not, from amongst the total of all the recipients to whom input tax credit is attributable, including the recipient(s) who are engaged in making exempt supply, or are otherwise not registered for any reason, shall be the amount,” C1”, to be calculated by applying the following formula: –

C1=(t1÷T) ×C

Where,

“C” is the amount of credit to be distributed,

”t1” is the turnover, as referred to in section 20, of person R1 during the relevant period, and

“T” is the aggregate of the turnover during the relevant period, of all recipients to whom the input service is attributable in accordance with the provisions of section 20,

(e) the input tax credit on account of integrated tax shall be distributed as an input tax credit of tax to every recipient,

(f) The input credit on account of central tax and State tax or Union territory tax shall,

(i) In respect of a recipient located in the same State or Union territory in which the Input Service Distributor is located, be distributed as an input tax credit of central tax and State tax or Union Territory Tax respectively,

(ii) In respect of a recipient located in a State or Union territory other than that of the Input Service Distributor, be distributed as integrated tax and the amount to be so distributed shall be equal to the aggregate of the amount of input tax credit of central tax and State tax or Union territory tax that qualifies for distribution to such recipient in accordance with clause (d),

(g) The Input Tax Distributor shall issue an ISD invoice, as prescribed in sub-rule (1) of rule 54 clearly indicating in such invoice that it is issued only for distribution of input tax credit.

(h) The Input Service Distributor shall issue an ISD credit note, as prescribed in sub-rule (1) of rule 54, for reduction of credit in case the input tax credit already distributed gets reduced for any reason.

(i) Any additional amount of input tax credit on account of issuance of a debit note to an Input Service Distributor by the supplier shall be distributed in the manner and subject to the conditions specified in clauses (a) to (f)and the amount attributable to any recipient shall be calculated in the manner provided I clause (d) above and such credit shall be distributed in the month in which the debit note has been include in the return in FORM GSTR-6.

(j) Any input tax credit required to be reduced on account of issuance of a credit note to the Input Service Distributor by the supplier shall be apportioned to each recipient in the same ration in which input tax credit contained in the original invoice was distributed in terms of clause (d) above, and the amount so apportioned shall be: –

(i) Reduced from the amount to be distributed in the month in which the credit note is included in the return in FORM GSTR-6; and

(ii) Added to the output tax liability of the recipient and where the amount so apportioned is in the negative by virtue of the amount of credit under distribution being less than the amount to be adjusted.

(2) If the amount of input tax credit distributed by an Input Service Distributor is reduced later on for any other reason for any of the recipients, including that it was distributed to a wrong recipient by the Input Service Distributor, the process prescribed in clause (j) of sub-rule (1) shall, mutatis mutandis applies for reduction of credit.

(3) Subject to sub-rue (2), the Input Service Distributor shall, on the basis of the ISD credit note specified in clause (h) of sub-rule (1), issue an ISD Invoice to the recipient entitled to such credit and include the ISD credit note and the ISD Invoice in the return in FORM GSTR-6 for the month in which such credit note and invoice was issued.

Example:

1. XYZ Limited has its corporate office in Delhi and three manufacturing facilities in Haryana, Delhi, and Tamil Nadu. Its Corporate Office is registered as an Input Service Distributor.

Turnover of the three units in its states for the last financial year and current year (Q-1 and Q-2) are as follows.

| Unit |

Financial Year 2016-17 |

Q-1 F.Y.2017-18 | Q-2.F.Y 2017-18 |

| Haryana | Rs.800 crs. | Rs.125 crs. | Rs.150 crs. |

| Delhi | Rs.NIL | Rs.100 crs. | Rs.75 crs. |

| Tamil Nadu | Rs. 700 crs. | Rs.150 crs. | Rs.100 crs. |

ISD has obtained certain common services for all its units on which IGST of Rs.80 lakhs was paid. ISD wanted to distribute the credit in July 2017 (Financial Year 2017-18). The credit will be distributed as under:-

Haryana = Rs. 80 Lakhs ×(Rs.125 crs/ (Rs.125crs + 100crs +150 crs)= Rs.26.66 lakhs

Tamil nadu= Rs. 80 Lakhs ×(Rs.100 crs/ (Rs.125crs + 100crs +150 crs)= Rs.21.33 lakhs

Delhi= Rs. 80 Lakhs ×(Rs.150 crs/ (Rs.125crs + 100crs +150 crs)= Rs.32 lakhs

2. XYZ Limited has its corporate office in Delhi and three manufacturing facilities in Haryana, Delhi, and Tamil Nadu. Its Corporate Office is registered as an Input Service Distributor. Turnover of the three units in its states for the last financial year and current year (Q-1 and Q2) are as follows.

| Unit |

Financial Year 2016-17 |

Q-1 F.Y.2017-18 | Q-2.F.Y 2017-18 |

| Haryana | Rs.800 crs. | Rs.125 crs. | Rs.150 crs. |

| Delhi | Rs.NIL | Rs.100 crs. | Rs.75 crs. |

| Tamil Nadu | Rs. 700 crs. | Rs.150 crs. | Rs.100 crs. |

Input Service Distributor (ISD) has obtained certain services for its units in Haryana ad Tamil Nadu on which CGST and SGST of Rs.80 Lakhs were paid. ISD wanted to distribute the credit in July 2017 (Financial Year 2017-18). The credit will be distributed as under:-

Haryana = Rs. 80 Lakhs ×(Rs.800 crs/ (Rs.800crs + 700crs)= Rs.42.66 lakhs

Tamil Nadu= Rs. 80 Lakhs ×(Rs.700 crs/ (Rs.800crs + 700crs)= Rs.37.33 lakhs

Delhi= Nil ( as the services were only for Haryana and Tamil Nadu )

Mandatory Registration as per Section-24

As per Sec.24 of CGST Act,2017, an Input Service Distributor (ISD) whether or not separately registered under the Acts, is required to obtain registration. The application for obtaining registration is required to be made in Form GST REG-01.

Registration Process [Key points]: ISD

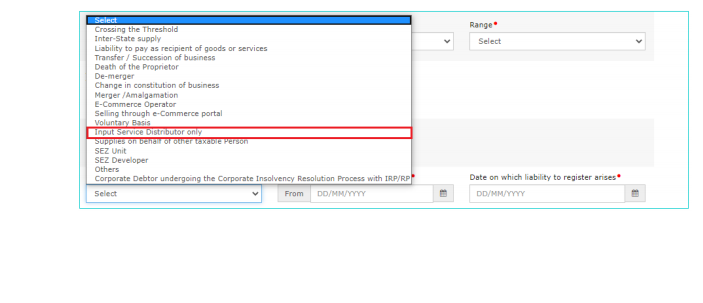

➢ The Registration Application and its Process for Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD)/ SEZ Developer/ SEZ Unit are almost the same.

➢ The only difference is while selecting reason to obtain registration drop-down list, select Input Service Distributor as the reason to obtain registration for your business

Manner of credit of Excess Credit Distributed

As per sec.21 of the CGST Act,2017, Where the Input Service Distributor distributes the credit in contravention of the provisions contained in section 20 resulting in the excess distribution of credit to one or more recipients of credit, the excess credit so distributed shall be recovered from such recipients along with interest, and the provisions of section 73 or section 74 as the case may be, shall, mutatis mutandis, apply for a determination of the amount to be recovered.

“This section provides for the recovery of credit where the credit has been distributed in excess of the credit permissible, it does not specify for transfer of credit from one unit to another unit wherein excess credit was issued to one unit and lower to another.

EXAMPLE – If XYZ limited company has one unit in Haryana and other units in Delhi and as per the provisions contained in Section 21, Rs.2 Lakh was to be distributed to the unit in Haryana and Rs.3 Lakhs to the unit in Delhi. However, due to some calculation error credit of Rs.2.4 Lakh was issued to the Haryana unit and Rs.2.6 lakh to the unit in Delhi. Thus, excess credit of Rs. 40,000/- issued to the unit in Haryana shall be recovered from the unit in Haryana and show cause notice shall be issued by the jurisdictional officer of Haryana.

Filing of Returns

As per section 34(4) of the CGST Act,2017, states that every taxable person registered as an Input Service Distributor shall, forever calendar month or part thereof, furnish, in such form and in such manner as may be prescribed, a return, electronically, within thirteen days after the end of such month.

As per Rue 65 of the GST Rules,2017 states that every input service distributor shall, on the basis of details contained in FORM GSTR-6A, and where required, after adding, correcting or deleting the details, furnish electronically the return in FORM GSTR-6, containing the details of tax invoices on which credit has been received and those issued under section 20, through the common portal either directly or from a Facilitation Centre notified by the Commissioner

As per Rule 60(5) of the GST Rules,2017 states that the details of invoices furnished by an Input Service Distributor in his return in FORM GSTR-6 under rule 65 shall be made available to the recipient of credit in Part B of Form GSTR-2A electronically through the Common Portal and the said recipient may include the same in FORM GSTR-2.

FAQ: Input Service Distributor[ISD]

1- How can I register as an ISD?

Answer – While applying for the New Registration Application of a normal taxpayer. All you need to do is select Input Service Distributor only under Reason to obtain registration in the Business Details section of PART B of the New Registration Application.

2- Can ISD take multiple registrations in a State?

Answer – ISD cannot take multiple registrations in a State.

3- Can I obtain ISD registration if my place of business is not fixed?

Answer – It is mandatory to provide Principal place of business in the application form so you need to mention the address of the place from where you are conducting your business. However, you can file an amendment in case you need to change your place of business and the change is allowed within the state.

4- Can an ISD opt for Composition?

Answer – ISD cannot opt for composition.

5- Which return will I have to file as an ISD?

Answer – Form GSTR-6 is a monthly return to be filed by all the Input Service Distributors (ISD) for distribution of credit (ITC) amongst its units.

6- By when do I need to file Form GSTR-6?

Answer – ISD Returns for month M can only be filed on or before the 13th of month M+1 or the extended date if any.

7- Can I file my ISD return if my counterparties have not filed Form GSTR1/5?

Answer – Yes, you can file your Form GSTR-6 return even if your counterparties have not filed their respective Form GSTR-1 or Form GSTR-5.

8- Is there any late fee in case of delayed filing of Form GSTR-6?

Answer – the GSTR 6 will be filed after the due date, the taxpayer is charged with a late fee as a penalty. The late fee is now Rs. 50 per day of default. However, there is no fees for delay in filing of Nil return.

Read the Copy:

If you already have a premium membership, Sign In.