GST Year End Checklist

GST Year-End Checklist

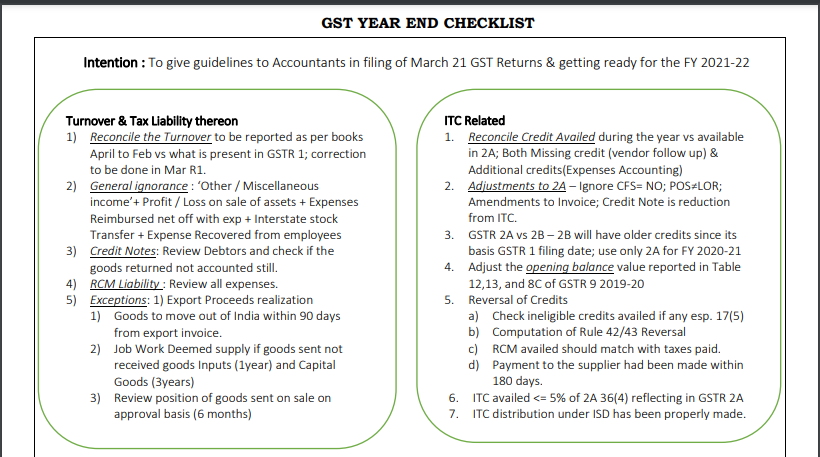

Intention: To give guidelines to Accountants in filing of March 21 GST Returns & getting ready for the FY 2021-22

Turnover & Tax Liability thereon

1) Reconcile the Turnover to be reported as per books April to Feb vs what is present in GSTR 1; correction to be done in Mar R1.

2) General ignorance: ‘Other / Miscellaneous income’+ Profit / Loss on sale of assets + Expenses Reimbursed net off with exp + Interstate stock Transfer + Expense Recovered from employees

3) Credit Notes: Review Debtors and check if the goods returned not accounted still.

4) RCM Liability: Review all expenses.

5) Exceptions: 1) Export Proceeds realization

1) Goods to move out of India within 90 days from export invoice.

2) Job Work Deemed supply if goods sent not received goods Inputs (1year) and Capital Goods (3years)

3) Review position of goods sent on sale on approval basis (6 months)

Related Topic:

A Handy Checklist of Various Compliances to Be Completed Till 31 July 2021

ITC Related

1. Reconcile Credit Availed during the year vs available in 2A; Both Missing credit (vendor follow up) & Additional credits(Expenses Accounting)

2. Adjustments to 2A – Ignore CFS= NO; POS≠LOR; Amendments to Invoice; Credit Note is reduction from ITC.

3. GSTR 2A vs 2B – 2B will have older credits since its basis GSTR 1 filing date; use the only 2A for FY 2020-21

4. Adjust the opening balance value reported in Table 12,13, and 8C of GSTR 9 2019-20

5. Reversal of Credits

a) Check ineligible credits availed if any esp. 17(5)

b) Computation of Rule 42/43 Reversal\

c) RCM availed should match with taxes paid.

d) Payment to the supplier had been made within 180 days.

6. ITC availed <= 5% of 2A 36(4) reflecting in GSTR 2A

7. ITC distribution under ISD has been properly made.

Related Topic:

GST ON RENT A CAB

RCM Liability: ( Discharge + ITC availment).

| Service | Provided By | Provided to |

| Security Services | other than Pvt / Ltd company | Any registered person |

| Rent a Cab Services | Ind, HUF, firm service provider | Pvt/Ltd Co |

| Real Estate | URD >20% other than cement | Builder to pay 18% ; cement Actual Rate |

| Import of Service | Any | Registered Perion |

| Legal Services + GTA | Any | Registered person / Comp / firm |

| Services from Govt | Govt – Check Rates & Taxes ; License & Renewal etc | Business Entity |

| Sponsorship Expenditure | Any service provider | Company/Partnership Firm |

Book Closure Entries

1. Basis GSTR 3B post journal from Input and out put ledgers to Electronic Credit and Liability ledger

2. Offset the liability ledger along with cash payment.

3. Balance if any in Input / output ledgers to be explained after the above entries.

4. Parking ledgers for GSTR 2A mismatch; Refund to claim; Reversal for Rule 37;

Miscellaneous: Register New Branches / Godown; Issue Self Tax Invoice; Update Aadhar + RC + supply type +Contact Details + Change in Directors /partners in GSTN portal; File ITC 04 Qrtly basis

Payment of Taxes for FY 2021-22

1. Taxes reported in Table 10 & 11 of GSTR 9 19-20 to be adjusted from GSTR 3B of FY 20-21

2. RCM to be discharged only in cash.

3. Delayed interest to be paid @18% on tax paid in cash.

Getting read for 2020-21

1. New HSN Reporting Limit Aggregate Turnover <= 5 Cr 4 digit; >=5 Cr 6 Digit

2. Opting into/out of QRMP scheme for Q1 of FY 21-22 to be done within 30th April 2021

3. Application for LUT for next year before 31st March

4. eInvoice mandatory where Turnover More than 50 Cr

5. B2C QR code Mandatory where TO > 500 Cr.

6. Else penalty from 1.12.2020

7. Time Limit to Correct GSTR 1 /3B; issue credit note is Sept 2021 return.

If you already have a premium membership, Sign In.

CA Venu Gopal Gella

CA Venu Gopal Gella

Keep learning

Banglore, India

GST