GST portal allows downloading table 8A of GSTR 9

GST portal allows downloading table 8A of GSTR 9

In a recent update, the GSTN portal is allowing us to download table 8A of GSTR 9. This is a reconciliation table. Data from 2A is auto-populated in this table. Then some more information is required. But the taxpayer was facing a problem. The data in Table 8A was not matching with 2A. Now, its invoice wise break up is available.

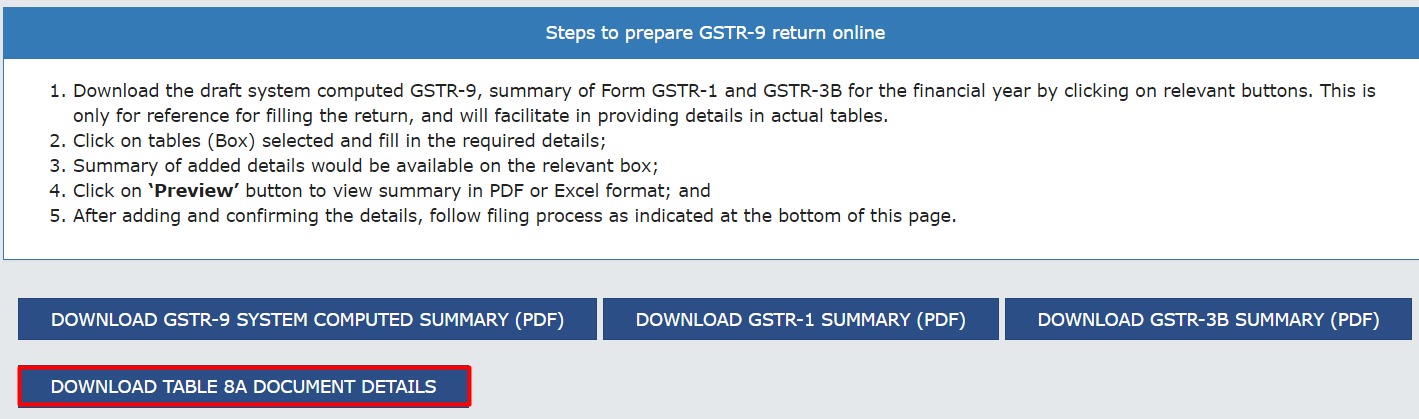

Once you login to your account. Click on the annual return and select the year. Then you will see the option to download table 8A above the tables of annual return.

The data is available under the following heads-

| B2B | Taxable inward supplies received from a registered person |

| B2BA | Amendments to previously uploaded invoices by supplier |

| CDNR | Debit/Credit notes(Original) |

| CDNRA | Amendments to previously uploaded Credit/Debit notes by the supplier |

The data is available in different sheets.

Reasons for ITC availment and non-accounting of ITC-

| Note 1: ITC availability on amended documents | |||||

| 1. In the case of documents that are amended, the actual values are displayed in B2BA and CDNRA tables. However, the ITC would be available on differential values only i.e. Amended value – Original Value 2. In cases, where GSTIN is amended, ITC would not be available to the Orginal recipient and the reason for non-accounting shall be updated as ‘GSTIN is amended’. |

|||||

| Note 2: Reasons for non-accounting of ITC | |||||

| Reason | Details of the reason | ||||

| Reverse charge document | When the supplier has filed the document in GSTR-1 indicated the supply as reverse charge. | ||||

| POS lies in supplier’s State | When the supplier’s State code and POS lies in the same State, but recipient’s State is different. | ||||

| GSTIN is amended | When the supplier has amended the GSTIN, Credit shall be available to amended GSTIN only. | ||||

| Taxpayer opted for composition scheme | When the document date is during the period when supplier was under the composition scheme. | ||||

| Invoice date is after supplier’s cancellation date | When the document date is after the effective date of cancellation of supplier. | ||||

I hope it is quite useful. Many issues related to ITC in table 8A will resolve.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.