GST Enrolment of existing Central Excise

Enrolment of central excise taxpayers into GST

All existing Central Excise and Service Tax assessees will be migrated to GST starting 7th January 2017. Enrolment of existing central excise taxpayer will start from 9th January. To migrate to GST, assessees would be provided a Provisional ID and Password by CBEC. In GST you may use E-sign instead of DSC if you are not a company or LLP. Also you will be required to submit the authorization letter for signatory.

When provisional ID may not be available for GST migration of central excise:

Provisional IDs would be issued to only those assessees who have a valid PAN associated with their registration. An assessee may not be provided a Provisional ID in the following cases:

a.In case the PAN associated with the registration is not valid

b. The PAN is registered with State a Tax authority and Provisional ID has been supplied by the said State Tax authority.

c. There are multiple CE/ST registrations on the same PAN in a State. In this case only 1 Provisional ID would be issued for the 1st registration in the alphatebical order provided any of the above 2 conditions are not met.

The assessees need to use this Provisional ID and Password to logon to the GST Common Portal (https://www.gst.gov.in) where they would be required to fill and submit the Form 20 along with necessary supporting documents. Subsequent pages provide the Steps to be followed by each assessee to migrate to GST.

How to get the login id and password for GST enrolment of existing central excise taxpayers:

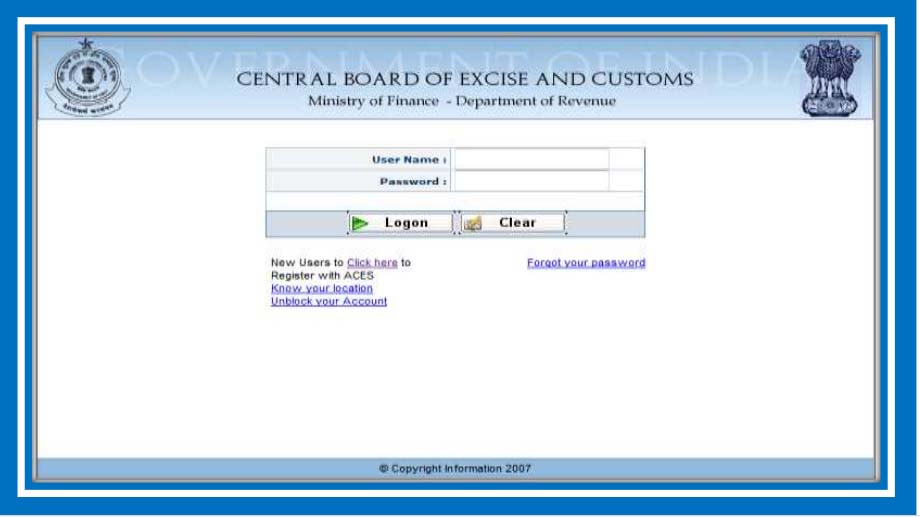

Step1: Logon to ACES portal using the existing ACES User ID and Password

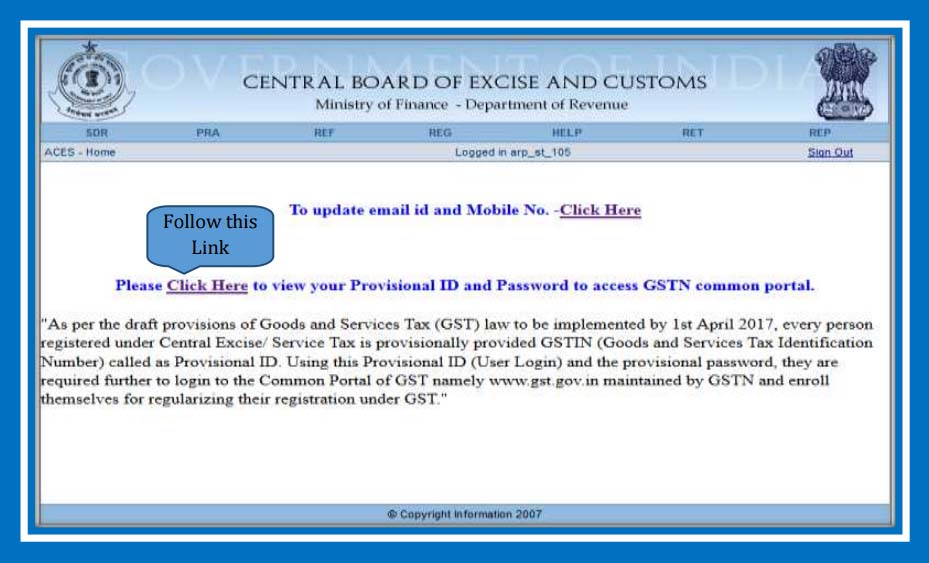

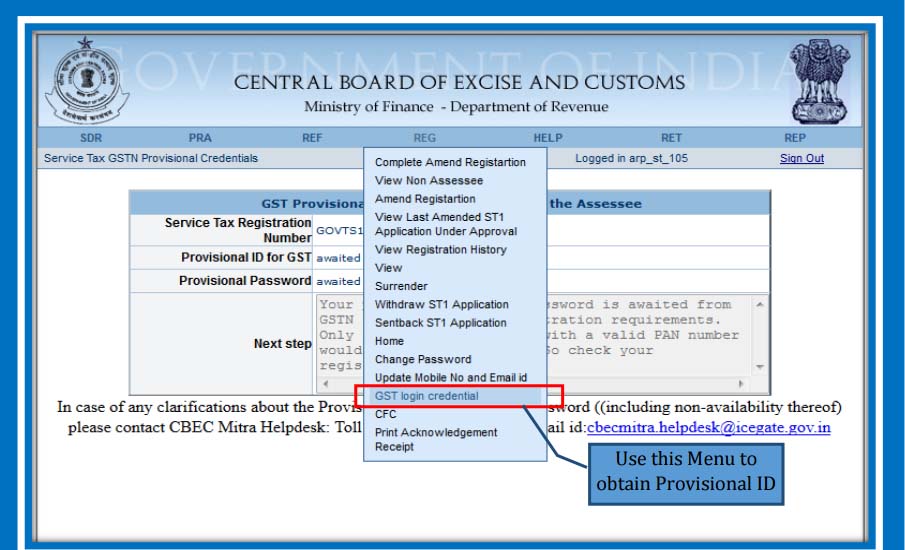

Step2 :Either follow the link to obtain the Provisional ID and Password OR navigate using the Menu

Now you can simply click on the link given to get your ID and password. You can use this ID and password at the website of GSTIN. It will be for first time use. Thus you can change your login ID and password once you login to GSTIN first time using this login and password.

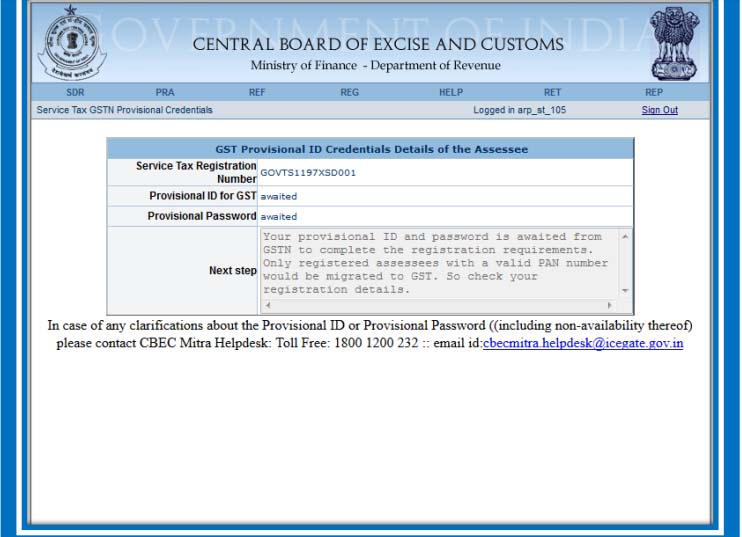

Step3:Make a note of the Provisional ID and password that is provided. In case a Provisional ID is not provided, please refer the Next Step section. In case of further doubt please contact the CBEC Helpdesk at either 1800-1200-232 or email at cbecmitra.helpdesk@icegate.gov.in.

Once you have obtained the Provisional ID and Password, logon to the GST Common Portal (https://www.gst.gov.in) using this ID and Password. The GST Common Portal has made available a manual on how to fill the Form-20. It is available on www.gst.gov.in.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.