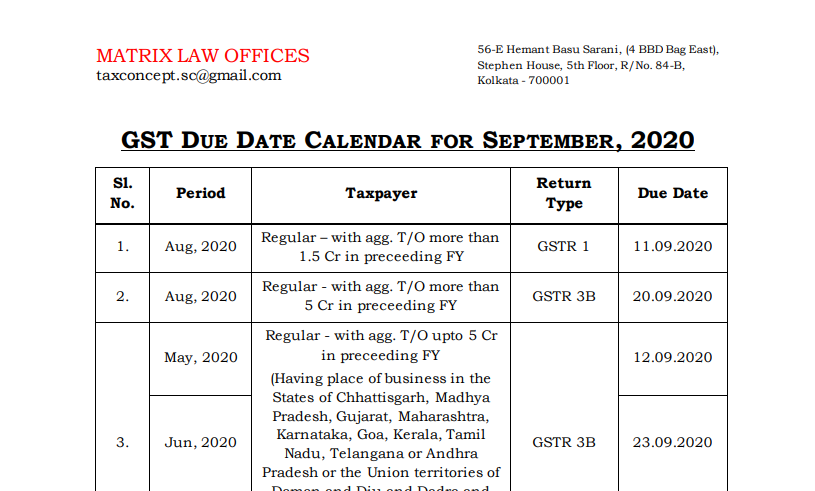

GST Due Date Calendar For September, 2020

GST Due Date Calendar For September 2020

| Sl. No. | Period | Taxpayer | Return Type | Due Date |

| 1. | Aug 2020 | Regular – with agg. T/O more than 1.5 Cr in preceeding FY | GSTR 1 | 11.09.2020 |

| 2. | Aug 2020 | Regular – with agg. T/O more than 5 Cr in preceeding FY | GSTR 3B | 20.09.2020 |

| 3. | May 2020 | Regular – with agg. T/O up to 5 Cr in preceeding FY

(Having a place of business in the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana or Andhra Pradesh or the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and the Nicobar Islands and Lakshadweep) |

GSTR 3B | 12.09.2020 |

| Jun 2020 | 23.09.2020 | |||

| Jul 2020 | 27.09.2020 | |||

| 4. | May 2020 | Regular – with agg. T/O up to 5 Cr in preceeding FY

(Having a place of business in the States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha or the Union territories of Jammu and Kashmir, Ladakh, Chandigarh, and Delhi) |

GSTR 3B | 15.09.2020 |

| Jun 2020 | 25.09.2020 | |||

| Jul 2020 | 29.09.2020 | |||

| 5. | FY 18-19 | Regular Taxpayer | GSTR 9 & 9C | 30.09.2020 |

| 6. | Jul 2017 to Jul 2020 | Waiver of late fees in excess of Rs. 250 each in CGST and SGST (Complete waiver for Nil returns) on delay in filing of GSTR 3B can be availed if filed within – | 30.09.2020 | |

Related Topic:

Due Date Compliance Calendar JULY 2021

Read the Copy:

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

Matrix Law Offices

Matrix Law Offices