FAQ’s on RCM on transportation or Maal Bhada

Introduction:

Dear All,

RCM on transportation FAQ’s. We have compiled the questions asked on our video on freight or maal bhada. All issues including the RCM on agriculture produce, of exempted items, is included in it.

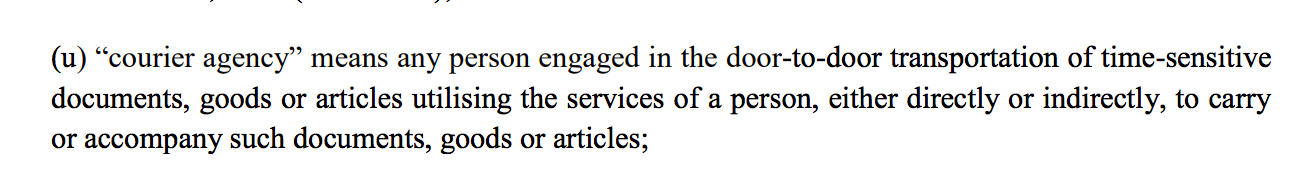

- If a courier and cargo firm hire vehicle on contract bases from individual unregistered person Then courier industry liable for RCM ?

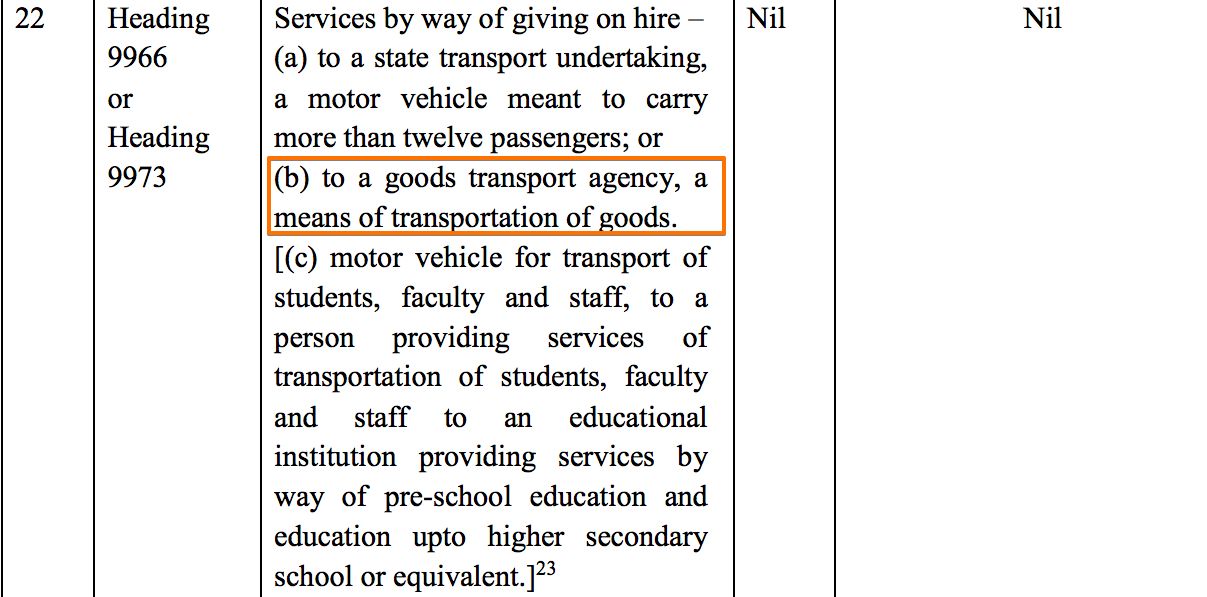

Entry no. 22(b) of 12/2017 exempts the giving a vehicle on hire to a GTA. If the vehicle is given to a courier agency it is not covered by that entry. In that case, it will be taxable.

- Madam my client is supplying goods through his relative truck n his relative does not provide service to any other person and also no consignment note is issued. My question is whether reverse charge is applicable????

- If branch pays freight on inward supply from HO… And get freight reimbursed…will branch liable for RCM… AS act say who pays the freight

RCM on transportation of agriculture produce

Agriculture produce are exempt from RCM. Why separate mentioned of pulses and grain in the list are they are not agriculture produce. Agriculture produce means every item will cover which grow in field please clarify.

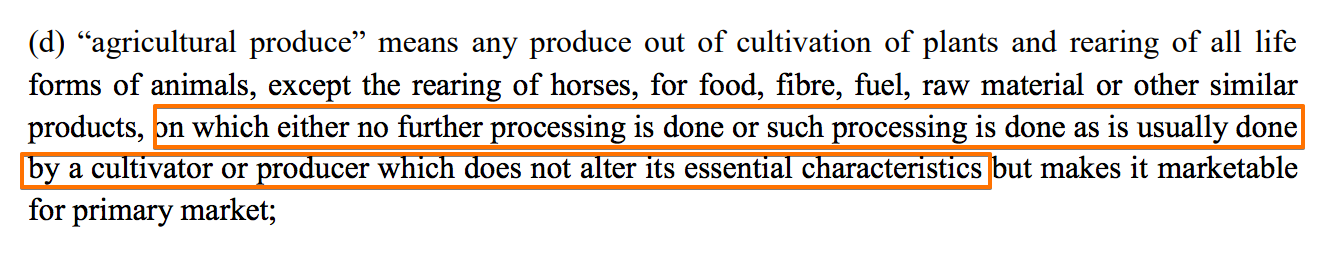

We need to know what is agriculture produce. It is defined in notification no. 12/2017 itself.

CBIC also clarified it via there circular no. 16/16/2017 dated 15th Nov 2017.

Some of the items are specifically clarified by that circular.

- Tea: Tea leaves are agriculture produce but processed tea is not agriculture produce.

- Jaggery: It is processed from sugarcane. This is not agriculture produce.

- Daal/pulses: Daal or pulses are processed by pulse millers. Farmers don’t do the husking. Daal is not agriculture produce. Although whole pulses like, Chana, rajma is agriculture produce.

I rcvd COCONUT by road transport and that is TAX-Free, so I need to pay RCM on that transport exp. ?

Coconut is agriculture produce. In this case, freight is exempted. You don’t need to pay for it.

I have one question nobody is covered this. If I am a registered GTA and billing in FCM for corporates. I am transporting goods thru my own vehicle as well as from another vehicle who is not registered under GST. a consignment note is given by me. My quarry is should I have to pay RCM under the trucks hired from me from the market.

Giving vehicle on rent is not exempted. You dont need to pay RCM in this case.

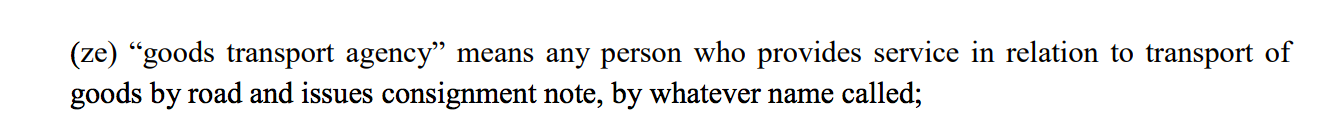

Madam well explain.But I have some doubt Q.1 Madam please explain the difference between courier & GTA .

Both terms are defined in Notification no. 12/2017.

Exampt goods pe GTA pay krna padega. Or kiya uski ITC ka benefit milega

Yes, you will have to pay. If your output is exempted ITC is not allowed.

Questions – if a registered transporter giving GTA services transportation and not charging any tax . Is RCM applicable on freight services received from registered transporter?

Yes , it is applicable.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.