Basic Scheme of Revised Draft Model GST Law

There were some posts on web about the new Model GST law and experts were expecting new law on public domain very soon. Two days back this new Model GST law alongwith two other laws was posted on the website of cbec. Many changes have been bough into with this Revised Draft Model GST Law. Sequence of sections has also been changed. Some of the key definitions have been changed to make them more clear and simplify. Key definition of Levy itself, definition of “supply” which is the taxable event for GST have been changed. Now there will be no gap in threshold limit for registration and for chargeability. This Revised Draft Model GST Law is expected to be passed by the parliament in winter session.

- Revised Draft Model GST Law, November 2016

- Draft IGST Law

- Draft GST Compensation Law.

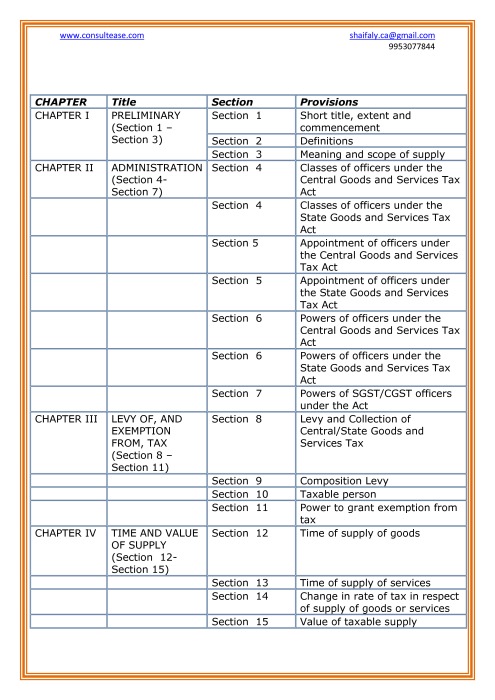

In this article we have compiled the scheme of sections and chapters for the revised draft Model GST Law. The new law have 197 sections, XXVII chapters and V schedules. Earlier law was having III schedules only. Two new schedules have been added into the law. These two new schedules are Schedule III and Schedule IV.

|

SCHEDULE III |

ACTIVITIES OR TRANSACTIONS WHICH SHALL BE TREATED NEITHER A SUPPLY OF GOODS NOR A SUPPLY OF SERVICES |

|

SCHEDULE IV |

ACTIVITIES OR TRANSACTIONS UNDERTAKEN BY THE CENTRAL GOVERNMENT,A STATE GOVERNMENT OR ANY LOCAL AUTHORITY WHICH SHALL BE TREATED NEITHER AS SUPPLY OF GOODS NOR A SUPPLY OF SERVICES |

Apart from these two schedules some other major changes are also there in Revised Draft Model GST Law. The compensation law will provide for the loss of revenue for states due to applicability of GST. Revised Draft Model GST Law also have anti profiteering measures in section 163. Here we will have the section and chapterwise details of the Revised Draft Model GST Law.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.