Annual return for FY 2018-19

Annual return for FY 2018-19 – Quick recap and important points

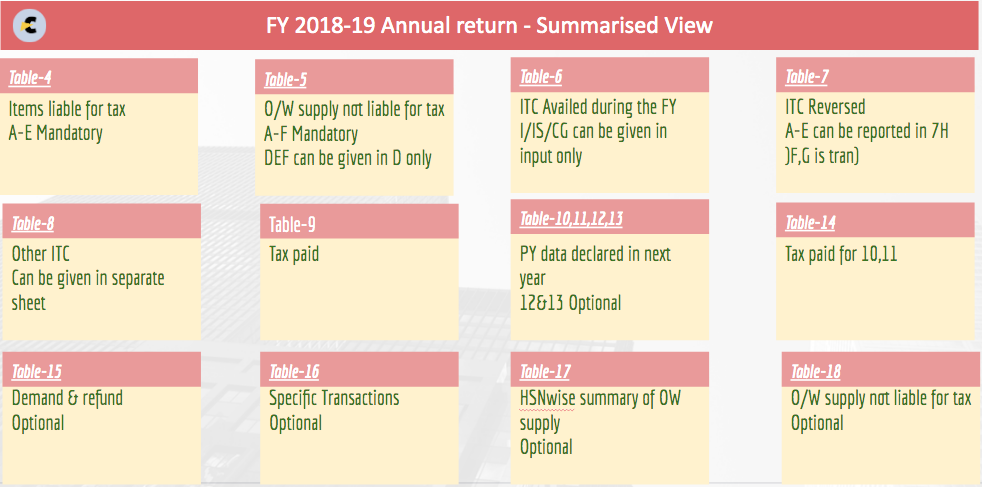

It is time to move on from the blues of Covid and lockdown. Annual return for FY 2018-19 is due for filing. You may have lost all the memory due to lockdown. Here we have planned a quick recap and then important things to take care of this year. So first have a look at the summary of all tables of Annual return for FY 2018-19.

Some of the tables are mandatory. Table no. 12,13,15 to 18 are optional. But if you have the data you can fill. In some tables, all data is not mandatory. Many Raws are optional. That I have included in the image above for quick reference.

Related Topic:

Download PPT on GST Annual Return

What is the last date to file an Annual return for FY 2018-19?

It is the 30th of September 2020.

Important points to take care in Annual return for FY 2018-19

Annual return for FY 2018-19 is not the same as 2017-18. It was our first year and many provisions were inoperative.

E-way bill provisions

The E-way bill was not applicable in the first year. But in AR of 2018-19, we need to consider it. A reconciliation of invoices with the liability of generating an e-way bill is required. Also, the reposting of non-compliance is also required.

Sales of last year reported in FY 2018-19

Turnover of last year which was under-reported. We had an option to show it in the current year. In this case, its treatment in the annual return is different. It is part of GSTR 3b and tax is paid on it in the current year.

Sales of last year reduced in FY 2018-19

It is just the reverse of the preceding case. The actual turnover is reported in Table 4. Now where to show the reduction of last year’s Turnover? We can ignore it. As it is already mentioned in last year’s annual return.

ITC of last year claimed in FY 2018-19

The ITC last year was missed. So it was taken in GSTR 3b of Current FY. It can be reduced from amount in table 6.

ITC of last year reversed in FY 2018-19

This ITC is reversed for last financial year. It should be added back in current years ITC. As it relates to the previous FY.

Related Topic:

Annual Return: Section 92 of Companies Act, 2013

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.