GST on Printing services and printed books- All updated rates, HSN, issues

Categorisation of various supplies related to Printing, selling of printed books, brochures and others-

A lot of confusion is running in printing industry. The main reason for this Frequently change in provisions, ambiguity in classification and clarifications from CBIC adding into the confusion.

In this article we will have a look at all these aspects and will try to simplify these.

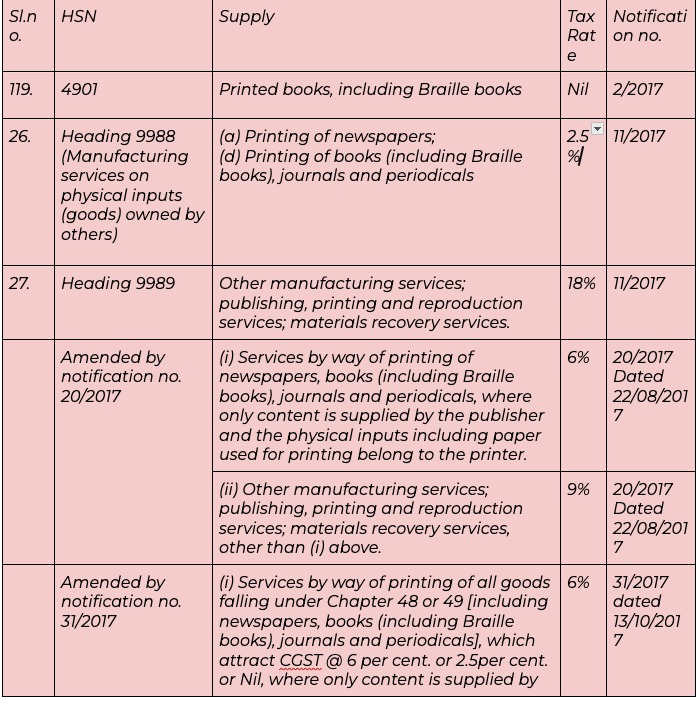

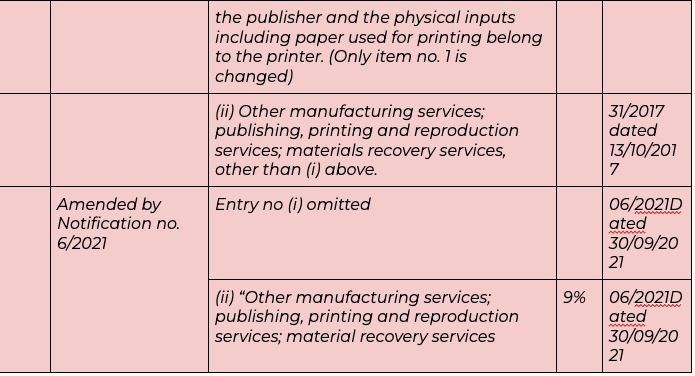

Various notifications related to the printing tax rates

GST rates on printing of books

On a close perusal of the above tax rates we can understand the structure of supplies covered in this industry.

- Entry no. (i) with 12% rate was ommitted by notification no. 6/2021. From that date the tax rate for printing under entry no. 26 become relevant, it was 5%.

- Sale of printed books is completely exempted.

- Where the printing is done on the paper provided by the supplier it is covered under the job work and the tax rate will be 5%.

- Where the books are printed as per the content and specification provided by the supplier , will it still be a supply of books or it is a printing service? what will be the determining factor? Let us have some light over this issue.

Classification in case of books printed as per the specification of the supplier-

This is one of the most confusing part of this whole arena. Let us analyse this part.

When the books are printed as per the specification of the supplier, whether it will per-take the character of a service or is it still a sale of books, i.e. Goods.

As per the scheme of GST the goods and services are defined in section 2 of CGST Act. The supply of books will definitely fall in the definition of goods.

“(52) “goods” means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply;”

If I check my supply in light of this definition-

- The books are movable property

- They are not money or securities

Thus they fall in Goods.

Now the question is that if any process is done on any product, will it change its character?

The answer is no. In that scenario all manufacturing done as per specification of customer will become a service. This will kill the intention of law and will fail its scheme.

CBIC issues a circular and made it even more complex. The Circular No. 11/11/2017-GST dated 20th October 2017. It provided some criteria to ascertain the nature of tax in these cases.

“In the case of printing of books, pamphlets, brochures, annual reports, and the like, where only content is supplied by the publisher or the person who owns the usage rights to the intangible inputs while the physical inputs including paper used for printing belong to the printer, supply of printing [of the content supplied by the recipient of supply] is the principal supply and therefore such supplies would constitute supply of service falling under heading 9989 of the scheme of classification of services.”

“In case of supply of printed envelopes, letter cards, printed boxes, tissues, napkins, wall paper etc. falling under Chapter 48 or 49, printed with design, logo etc. supplied by the recipient of goods but made using physical inputs including paper belonging to the printer, predominant supply is that of goods and the supply of printing of the content [supplied by the recipient of supply] is ancillary to the principal supply of goods and therefore such supplies would constitute supply of goods falling under respective headings of Chapter 48 or 49 of the Customs Tariff.”

Above two criteria’s are fixed. In case the matter required to be printed is not of any significance , It will be a supply of Goods. In case the matter to be printed is owned by supplier it will be a service.

But how the nature of material can change the nature of service? In both cases the printer is selling the books. Just because the content printed by him is owned by the customer will change it?

Many questions will be answered by the litigation in future.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.