Whether Online Coaching Outside India is Liable for GST?

Case Covered:

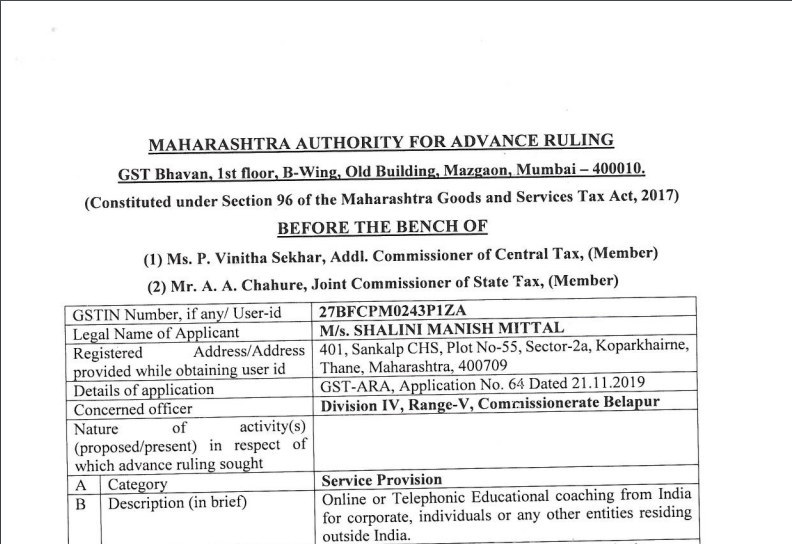

M/s. Shalini Manish Mittal

Facts of the case:

The present application has been filed under Section 97 of the Central Goods and Services Tax Act, 2017, and Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Act” ] by M/s. Shalini Manish Mittal, the applicant, seeking an advance ruling in respect of the following question.

“Whether online or telephonic educational coaching from India for corporate, individuals, or any other entities residing required outside India is subject to GST, and if so under which category is it taxed and section/notification covered for the same?

The submissions made by the applicant is as under:

M/s. Shalini Manish Mittal, the applicant, is rendering online or telephonic IT coaching services to corporates, individuals, or any other entities who are outside India and since the services are provided to clients outside India and amount realized in foreign exchange the said services will be considered as export of service and hence it is a zero-rated service under GST.

Observations:

We have gone through the facts of the case and the written submissions made by both, the applicant and the departmental authority. The issue put before us in respect of the taxability of online or telephonic educational coaching rendered from India by the applicant to corporates, individuals, or any other entities residing outside India. is subject to GST and if so under which category is it taxed and sections/notifications covered for the same?

We find that Applicant is registered under the GST Act and engaged in the supply of Online or Telephonic IT Coaching services to the corporates, individuals, or any other entities situated abroad. For such supply, the consideration is received by them in Foreign Exchange.

The first part of the question raised by them is whether Online or Telephonic IT Coaching from India for corporates, individuals or any other entities residing abroad is subject to GST. The second part of the question arises only if the answer to the first part is in the affirmative.

Ruling:

“The present application filed for advance ruling is rejected, as being non-maintainable as per the provisions of law.”

Read & Download the full Ruling in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.