Maharashtra AAR in the case of Lear India Engineering LLP

Case Covered:

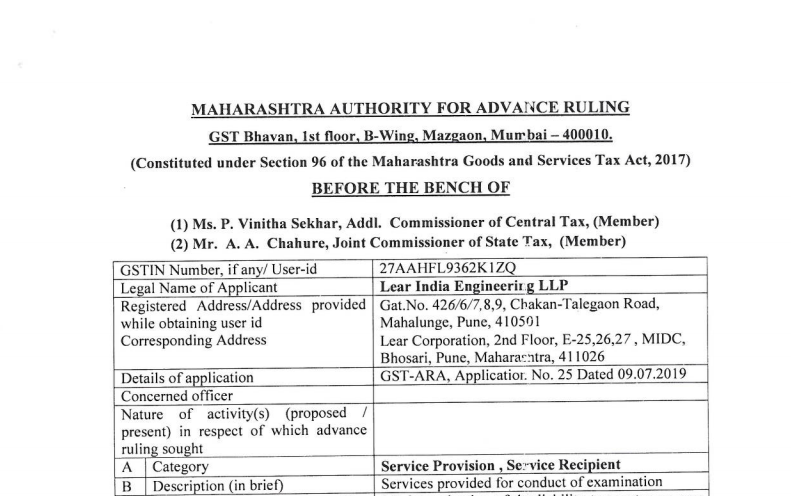

Lear India Engineering LLP

Facts of the case:

The present application has been filed under Section 97 of the Central Goods and Services Tax Act, 2017, and Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and the MGST Act” respectively] by M/s. Lear India Engineering LLP, the applicant, seeking an advance ruling in respect of the following questions.

- Whether the design & Development services provided by Lear India to Lear entities situated aboard would amount to Export of service.

- Whether the design & Development services provided by Lear India to Lear entities situated aboard would fall under the category of OIDAR services.

Observations:

We find, form the submissions made by the applicant, that the subject services are presently being classified by them as ‘Consulting Engineering Services’. However, the GST department has issued them a show-cause Notice 27.08.2018 proposing to classify the services of the Applicant under “on-line database access services” wherein the SCN has alleged that the services provided by the Applicant are bundled services of design, prototype, testing in the virtual world through the computer network and online database access gives the essential characteristic of OIDAR to the said bundled services.

In view of the provisions of Section 98(2) of the CGST Act, 2017, we find that this authority cannot admit the application in respect of this question because the questions raised in the application is already pending before the department under the provisions of this Act as is seen from SCN issued to the applicant on 27.08.2018.

Related Topic:

Maharashtra AAR in the case of M/s. Tata Motors Limited

Order:

For reasons as discussed in the body of the order, the questions are answered thus-

Question 1- Whether the design & Development services provided by Lear India to Lear entities situated aboard would amount to Export of service.

Answer:- This question has been voluntarily withdrawn by the applicant.

Question 2- Whether the design & Development services provided by Lear India to Lear entities situated aboard would fall under the category of OIDAR services.

Answer:- This question is not admitted in view of the provisions of Section 98(2) of the GST Act.

Read & Download full decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.