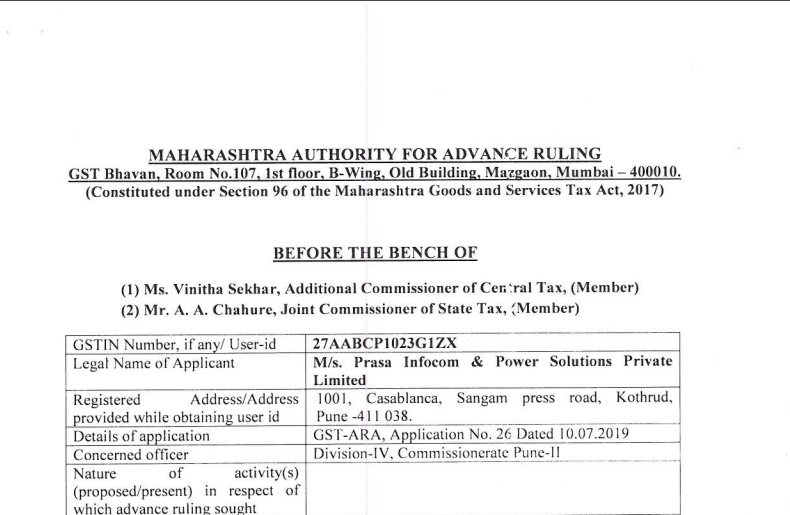

Maharashtra AAR in the case of M/s. Prasa Infocom & Power Solutions Private Limited

Case Covered:

M/s. Prasa Infocom & Power Solutions Private Limited

Facts of the Case:

The present application has been filed under Section 97 of the Central Goods and Services Tax Act, 2017, and Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and the MGST Act” respectively] by M/s. Prasa Infocom & Power Solutions Private Limited, the applicant, seeking an advance ruling in respect of the following questions.

Whether the supply of goods and services by Prasa Infocom & Power Solutions Private Limited to Cray Inc. (Cray) qualify as ‘works contract’ as defined under Section 2(19) of the Central Goods and Services Tax Act, 2017 (CGST Act)?

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the MGST Act.

Observations:

We have gone through the facts of the case, documents on record, and submissions made by both, the applicant as well as the jurisdictional officer. The question before us is Whether the supply of goods and services by the applicant to Cray Inc. (Cray) qualify as ‘works contract’ as defined under Section 2(19) of the Central Goods and Services Tax Act, 2017 (CGST Act)?

M/s. Cray Inc. (Cray) has entered into a ‘Services and Development Agreement’ with the applicant on 04.04.2017 wherein the applicant, acting as an independent contractor, and not as an agent of Cray, shall furnish personnel and services pursuant to the terms and conditions mentioned under Article Nos. I to XXX of the said agreement.

Order:

For reasons as discussed in the body of the order, the questions are answered thus-

Question:- Whether the supply of goods and services by Prasa Infocom & Power Solutions Private Limited to Cray Inc. (Cray) qualify as ‘works contract’ as defined under Section 2(19) of the Central Goods and Services Tax Act, 2017 (CGST Act)?

Answer:- Answered in the negative.

Read & Download the Full Order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.